Capital One 1997 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

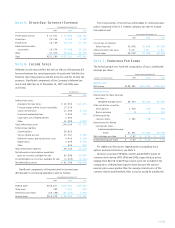

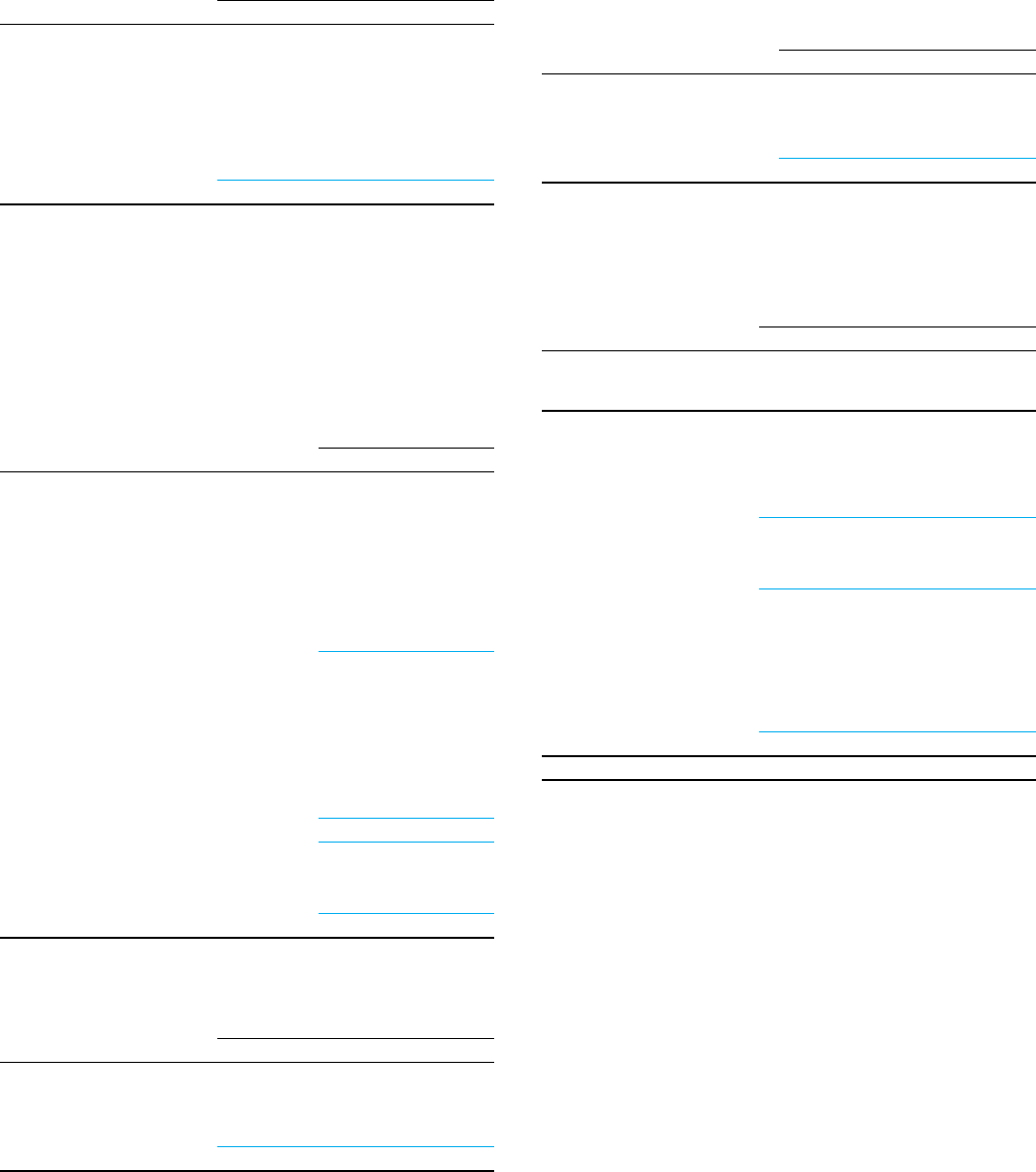

Note G: Other Non-Interest Expense

Year Ended December 31

1997 1996 1995

Professional services $ 47,671 $ 43,968 $28,787

Collections 23,216 9,783 7,193

Fraud losses 16,749 26,773 27,721

Bankcard association

assessments 16,074 15,045 13,116

Other 47,570 36,614 20,726

Total $151,280 $132,183 $97,543

Note H: Income Taxes

Deferred income taxes reflect the net tax effects of temporary dif-

ferences between the carrying amounts of assets and liabilities for

financial reporting purposes and the amounts used for income tax

purposes. Significant components of the Company’s deferred tax

assets and liabilities as of December 31, 1997 and 1996 were

as follows:

December 31

1997 1996

Deferred tax assets:

Allowance for loan losses $ 60,900 $41,475

Finance charge and fee income receivables 17,570

Stock incentive plan 11,466 2,758

Unearned membership fees 5,600 310

State taxes, net of federal benefit 2,694

Other 11,290 7,232

Total deferred tax assets 109,520 51,775

Deferred tax liabilities:

Securitizations 26,822

Service charge accrual 10,167 5,368

Deferred issuance and replacement costs 4,442 3,119

Depreciation 4,235 2,546

Other 456 542

Total deferred tax liabilities 46,122 11,575

Net deferred tax assets before unrealized

gains on securities available for sale 63,398 40,200

Unrealized gains on securities available for sale (1,602) (1,121)

Net deferred tax assets $ 61,796 $39,079

Significant components of the provision for income taxes

attributable to continuing operations were as follows:

Year Ended December 31

1997 1996 1995

Federal taxes $138,877 $119,027 $63,162

State taxes 393 1,715 600

Deferred income taxes (23,198) (27,529) 7,458

Income taxes $116,072 $ 93,213 $71,220

The reconciliation of income tax attributable to continuing oper-

ations computed at the U.S. federal statutory tax rate to income

tax expense was:

Year Ended December 31

1997 1996 1995

Income tax at statutory

federal tax rate 35.00% 35.00% 35.00%

Other, primarily state taxes 3.00 2.50 1.00

Income taxes 38.00% 37.50% 36.00%

Note I: Earnings Per Share

The following table sets forth the computation of basic and diluted

earnings per share:

Year Ended December 31

(Shares in Thousands) 1997 1996 1995

Numerator:

Net income $189,381 $155,267 $126,511

Denominator:

Denominator for basic earnings

per share—

Weighted-average shares 66,070 66,228 65,691

Effect of dilutive securities:

Stock options 1,578 790 391

Restricted stock 38 310

Dilutive potential

common shares 1,581 798 701

Denominator for diluted

earnings per share—

Adjusted weighted-average

shares 67,651 67,026 66,392

Basic earnings per share $ 2.87 $ 2.34 $ 1.93

Diluted earnings per share $ 2.80 $ 2.32 $ 1.91

For additional disclosures regarding the outstanding stock

options and restricted stock, see Note F.

Options to purchase 949,484; 20,725 and 829,855 shares of

common stock during 1997, 1996 and 1995, respectively, at prices

ranging from $23.38 to $47.94 per share, were not included in the

computation of diluted earnings per share because the options’

exercise prices were greater than the average market price of the

common shares and, therefore, their inclusion would be antidilutive.

PAGE 51