Capital One 1997 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

(Currencies in Thousands, Except Per Share Data)

In October 1997, the Bank established a program for the

issuance of debt instruments to be offered outside of the United

States. Under this program, the Bank from time to time may issue

instruments in the aggregate principal amount of $1,000,000 equiv-

alent outstanding at any one time (none issued as of December 31,

1997). Instruments under this program may be denominated in any

currency or currencies.

In September 1996, the Corporation filed a $200,000 shelf regis-

tration statement ($125,000 of senior debt securities issued as of

December 31, 1997) with the Securities and Exchange Commission

under which the Corporation from time to time may offer and sell

(i) senior or subordinated debt securities, consisting of debentures,

notes and/or other unsecured evidences, (ii) preferred stock, which

may be issued in the form of depository shares evidenced by deposi-

tory receipts and (iii) common stock.The securities will be limited

to a $200,000 aggregate public offering price or its equivalent

(based on the applicable exchange rate at the time of sale) in one or

more foreign currencies, currency units or composite currencies as

shall be designated by the Corporation.

In April 1996, the Bank established a deposit note program

under which the Bank from time to time may issue up to

$2,000,000 of deposit notes with maturities from thirty days to

thirty years.

In January 1997, Capital One Capital I, a subsidiary of the Bank

created as a Delaware statutory business trust, issued $100,000

aggregate amount of Floating Rate Junior Subordinated Capital

Income Securities that mature on February 1, 2027.The securities

represent a preferred beneficial interest in the assets of the trust.

The net proceeds of the offering of $97,428 were lent to the Bank

for general corporate purposes. As of December 31, 1997, the inter-

est rate on these securities was 7.30%.

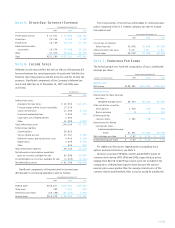

The Company has entered into swaps to effectively convert cer-

tain interest rates on bank notes from fixed to variable.The swaps,

which had a notional amount totaling $450,000 as of December 31,

1997, will mature in 1998 and 2000 to coincide with maturities of

fixed bank notes. In 1997, the Company entered into swaps with

notional amounts totaling $450,000 to effectively offset the swaps

described above with matching maturities and terms which pay

fixed and receive variable rates. As of December 31, 1997, the vari-

able rate payments on the original and offsetting swaps were

matched and will continue to offset each other through maturity.

As of December 31, 1997, the weighted average fixed rate payment

received on the original swaps was 7.39%, and the weighted aver-

age fixed rate payment paid on the offsetting swaps was 6.50%.

As of December 31, 1996, swaps with a notional amount totaling

$974,000, with maturity dates from 1997 through 2000, paid three-

month LIBOR at a weighted average contractual rate of 5.59%

and received a weighted average fixed rate of 7.71%. In 1995,

the Bank entered into basis swaps (notional amounts totaling

$260,000) to effectively convert bank notes, with a variable rate

based on six-month LIBOR to a variable rate based on three-month

LIBOR.These swaps and bank notes matured in 1996.

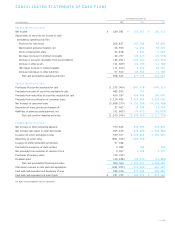

Interest-bearing deposits, senior notes and deposit notes as of

December 31, 1997, mature as follows (all other borrowings mature

in 1998):

Interest-Bearing

Deposits Senior Notes Deposit Notes Total

199 8 $1,129,742 $ 918,166 $299,996 $2,347,904

1999 95,901 789,978 885,879

2000 48,979 649,614 698,593

2001 4,898 523,114 528,012

2002 34,134 112,000 146,134

Thereafter 339,906 339,906

Total $1,313,654 $3,332,778 $299,996 $4,946,428

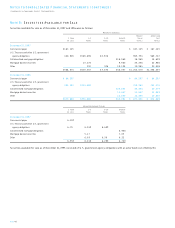

Note E: Associate Benefit Plans

The Company sponsors a contributory Associate Savings Plan in

which substantially all full-time and certain part-time associates

are eligible to participate.The Company matches a portion of asso-

ciate contributions and makes discretionary contributions based

upon the Company meeting a certain earnings per share target.The

Company’s contributions to this plan were $10,264, $9,048 and

$2,701 for the years ended December 31, 1997, 1996 and 1995,

respectively. Effective January 1, 1996, the Company is required to

make additional contributions for pay-based credits for eligible

associates which were previously provided under the Cash Balance

Pension Plan.

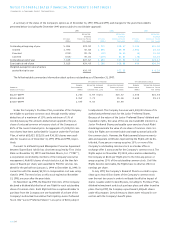

Through December 31, 1995, the Company provided its associate

pension benefits through the Cash Balance Pension Plan and

postretirement medical coverage and life insurance benefits through

the Associate Welfare Benefits Plan. Effective December 31, 1995,

the Company amended the Cash Balance Pension Plan so that no

future pay-based credits will accrue. Future pay-based credits will

accrue to the Associate Savings Plan discussed above. Neither the

remaining obligations under the Cash Balance Pension Plan nor the

obligations under the unfunded Associate Welfare Benefits Plan

were material to the Company’s financial statements.

Note F: Stock Plans

The Company has three stock-based compensation plans which are

described below.The Company applies Accounting Principles Board

Opinion No. 25, “Accounting for Stock Issued to Employees”

(“APB 25”) and related Interpretations in accounting for its stock-

based compensation plans. In accordance with APB 25, no compen-

sation cost has been recognized for the Company’s fixed stock

options, since the exercise price equals the market price of the

underlying stock on the measurement date of grant, nor for the

stock purchase plan, which is considered to be noncompensatory.

PAGE 48