Capital One 1997 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 49

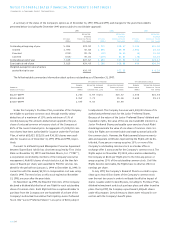

For the performance-based option plans discussed below, compensa-

tion cost is measured as the difference between the exercise price

and the target stock price required for vesting and is recognized

over the estimated vesting period.

SFAS No. 123,“Accounting for Stock-Based Compensation”

(“SFAS 123”) requires, for companies electing to continue to fol-

low the recognition provisions of APB 25, pro forma information

regarding net income and earnings per share, as if the recognition

provisions of SFAS 123 were adopted for stock options granted

subsequent to December 31, 1994. For purposes of pro forma disclo-

sure, the fair value of the options was estimated at the date of grant

using a Black-Scholes option-pricing model with the following

weighted-average assumptions and is amortized to expense over the

options’ vesting period.

For the Years Ended December 31

Assumptions 1997 1996 1995

Dividend yield .82% .90% .90%

Volatility factors of expected

market price of stock 40% 32% 33%

Risk-free interest rate 6.27% 5.90% 6.30%

Expected option lives (in years) 4.5 6.0 4.0

Pro Forma Information

Net income $186,003 $151,853 $125,296

Basic earnings per share $ 2.82 $ 2.29 $ 1.91

Diluted earnings per share $ 2.74 $ 2.27 $ 1.89

Under the 1994 Stock Incentive Plan, the Company has reserved

7,370,880 common shares as of December 31, 1997 and 1996

(5,370,880 as of December 31, 1995) for issuance in the form of

incentive stock options, nonstatutory stock options, stock apprecia-

tion rights, restricted stock and incentive stock.The exercise price

of each stock option issued to date equals the market price of the

Company’s stock on the date of grant.The option’s maximum term

is ten years.The number of shares available for future grants was

97,814; 1,508,352 and 2,061,640 as of December 31, 1997, 1996

and 1995, respectively. Other than the performance-based options

discussed below, options generally vest annually over three to five

years and expire beginning November 2004 and all options vest

immediately upon a change in control.The restrictions on restricted

stock (of which 23,215 shares were issued in 1995 at the then fair

value of $16.75 per share) expire annually over three years.

In December 1997, the Company’s Board of Directors approved

a compensation program under which senior management was

given the opportunity to forego future cash compensation in

exchange for stock options. Under this program, the Company’s

Chairman and Chief Executive Officer and its President and Chief

Operating Officer have agreed to forego all salary and any benefits

under the Associate Stock Purchase Plan (the “Purchase Plan”),

Associate Savings Plan, and the Company’s unfunded excess sav-

ings plan benefits from 1998 through 2000 in exchange for a one-

time option grant.The options granted to these top two executives

are target stock price performance-based options to purchase a

total of 685,755 shares.These options will vest if the fair market

value of the common stock remains at or above $84.00 for at least

ten trading days in any thirty consecutive calendar day period by

the third anniversary of the grant date (December 18, 2000). In the

event that these options do not meet this vesting criteria on or

before December 18, 2000, the options will terminate. In addition,

substantially all of the Company’s top managers elected to forego a

portion of their annual cash bonuses and Associate Savings Plan

benefits for the next three years in exchange for options. Under this

program, certain key managers received target stock price perfor-

mance-based options to purchase 457,466 shares with the same

vesting provisions as the grant to the Company’s top two executives.

In addition, other senior managers received fixed options to pur-

chase 223,900 shares, which vest in full on the third anniversary of

the date of grant.The above option grants provide for the purchase

of common shares at the December 18, 1997 market price of $48.75

per share. All of these awards are subject to stockholder approval

at the Company’s next annual meeting of an increase in shares

available for issuance under the 1994 Stock Incentive Plan in suffi-

cient number to accommodate these awards.

In April 1996, stockholders approved an increase of 2,000,000 in

shares available for issuance under the 1994 Stock Incentive Plan.

With this approval, a September 15, 1995 grant to the Company’s

Chairman and Chief Executive Officer and its President and Chief

Operating Officer became effective.This grant was for target stock

price performance-based options to purchase 2,500,000 common

shares at the September 15, 1995 market price of $29.19 per share.

Vesting of the options was dependent on the fair market value of

the common stock remaining at or above specified levels for at least

ten trading days in any thirty consecutive calendar day period. Fifty

percent of the options vested in January 1997 when the Company’s

stock reached $37.50 per share; 25% vested in October 1997 when

the stock reached $43.75 per share; the remaining 25% vested

in January 1998 when the stock reached $50.00 per share.The

Company recognized $24,772 and $7,728 of compensation cost

for these options for the years ended December 31, 1997 and 1996,

respectively.

In April 1995, the Company adopted the 1995 Non-associate

Directors Stock Incentive Plan.This plan authorizes a maximum of

500,000 shares of the Company’s common stock for the automatic

grant of restricted stock and stock options to eligible members of

the Company’s Board of Directors. As of December 31, 1997, 1996

and 1995, 382,500; 417,500 and 452,500 shares were available for

grant under this plan, respectively.The options vest after one year

and their maximum term is ten years. Restrictions on the restricted

stock (of which 12,500 shares were issued in 1995 at the then fair

value of $19.88 per share) expired in 1996.The exercise price of

each option equals the market price of the Company’s stock on the

date of grant.