Capital One 1997 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 28

Provision and Allowance for

Loan Losses

The provision for loan losses is the periodic expense of maintaining

an adequate allowance at the amount estimated to be sufficient to

absorb possible future losses, net of recoveries (including recovery

of collateral), inherent in the existing on-balance sheet loan portfo-

lio. In evaluating the adequacy of the allowance for loan losses, the

Company takes into consideration several factors including eco-

nomic trends and conditions, overall asset quality, loan seasoning

and trends in delinquencies and expected charge-offs.The Com-

pany’s primary guideline is a calculation which uses current delin-

quency levels and other measures of asset quality to estimate net

charge-offs. Consumer loans are typically charged off (net of any

collateral) at 180 days past-due, although earlier charge-offs may

occur on accounts of bankrupt or deceased consumers. Bankrupt

consumers’ accounts are generally charged off within 30 days after

receipt of the bankruptcy petition. Once a loan is charged off, it

is the Company’s policy to continue to pursue the collection of

principal, interest and fees for non-bankrupt accounts.

Management believes that the allowance for loan losses is ade-

quate to cover anticipated losses in the on-balance sheet consumer

loan portfolio under current conditions.There can be no assurance

as to future credit losses that may be incurred in connection with

the Company’s consumer loan portfolio, nor can there be any assur-

ance that the loan loss allowance that has been established by the

Company will be sufficient to absorb such future credit losses.

The allowance is a general allowance applicable to the on-balance

sheet consumer loan portfolio.Table 8 sets forth the activity in

the allowance for loan losses for the periods indicated. See “Asset

Quality,” “Delinquencies” and “Net Charge-Offs” for a more

complete analysis of asset quality.

For the year ended December 31, 1997, the provision for loan

losses increased to $262.8 million, or 57%, from the 1996 provision

for loan losses of $167.2 million.The allowance for loan losses as a

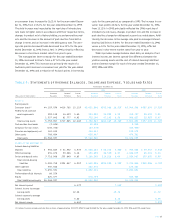

Table 7: Net Charge-Offs(1)

Year Ended December 31

(Dollars in Thousands) 1997 1996 1995 1994 1993

Reported:

Average loans outstanding $ 4,103,036 $ 3,651,908 $2,940,208 $2,286,684 $2,213,378

Net charge-offs 198,192 132,590 59,618 25,727 26,307

Net charge-offs as a percentage of average loans outstanding 4.83% 3.63% 2.03% 1.13% 1.19%

Managed:

Average loans outstanding $13,007,182 $11,268,461 $9,089,278 $6,197,423 $3,265,565

Net charge-offs 856,704 477,732 204,828 91,648 68,332

Net charge-offs as a percentage of average loans outstanding 6.59% 4.24% 2.25% 1.48% 2.09%

(1) Includes consumer loans held for securitization.

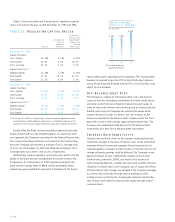

Table 8: Summary of Allowance for Loan Losses

Year Ended December 31

(Dollars in Thousands) 1997 1996 1995 1994 1993

Balance at beginning of year $(118,500 $(72,000 $(68,516 $(63,516 $(55,993

Provision for loan losses 262,837 167,246 65,895 30,727 34,030

Transfer to loans held for securitization (2,770) (27,887) (11,504) (4,869) (2,902)

Increase from consumer loan purchase 9,000

Charge-offs (223,029) (115,159) (64,260) (31,948) (39,625)

Recoveries 27,462 13,300 13,353 11,090 16,020

Net charge-offs (1) (195,567) (101,859) (50,907) (20,858) (23,605)

Balance at end of year $(183,000 $(118,500 $(72,000 $(68,516 $(63,516

Allowance for loan losses to loans at end of year(1) 3.76% 2.73% 2.85% 3.07% 3.41%

(1) Excludes consumer loans held for securitization.