Capital One 1997 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 31

The Company’s primary source of funding, securitization of

consumer loans, increased to $9.4 billion as of December 31, 1997

from $8.5 billion as of December 31, 1996. In 1997, the Company

securitized $2.1 billion of consumer loans, consisting predomi-

nantly of LIBOR-based, variable-rate deals maturing from 2001

through 2004.

In January 1996, the Company implemented a dividend reinvest-

ment and stock purchase plan (the “DRIP”) to provide existing

stockholders with the opportunity to purchase additional shares of

the Company’s common stock by reinvesting quarterly dividends or

making optional cash investments.The Company uses proceeds

from the DRIP for general corporate purposes.

In July 1997, the Company’s Board of Directors voted to repur-

chase up to two million shares of the Company’s common stock over

the next two years in order to mitigate the dilutive impact of shares

issuable under its benefit plans, including its dividend reinvestment

and stock purchase plans, associate stock purchase plan and incen-

tive plans. During 1997, the Company repurchased 1,318,641 shares

under this program. Certain treasury shares were reissued in con-

nection with the Company’s benefit plans.

Although the Company expects to reinvest a substantial portion

of its earnings in its business, the Company intends to continue to

pay regular quarterly cash dividends on the Common Stock.The

declaration and payment of dividends, as well as the amount

thereof, is subject to the discretion of the Board of Directors of the

Company and will depend upon the Company’s results of opera-

tions, financial condition, cash requirements, future prospects and

other factors deemed relevant by the Board of Directors. Accord-

ingly, there can be no assurance that the Company will declare and

pay any dividends. As a holding company, the ability of the Company

to pay dividends is dependent upon the receipt of dividends or other

payments from its subsidiaries. Banking regulations applicable to

the Bank and the Savings Bank and provisions that may be con-

tained in borrowing agreements of the Company or its subsidiaries

may restrict the ability of the Company’s subsidiaries to pay divi-

dends to the Company or the ability of the Company to pay divi-

dends to its stockholders.

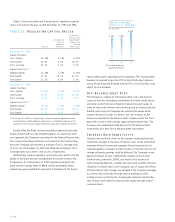

Capital Adequacy

The Bank and the Savings Bank are subject to capital adequacy

guidelines adopted by the Federal Reserve Board (the “Federal

Reserve”) and the Office of Thrift Supervision (the “OTS”) (collec-

tively, the “regulators”), respectively.The capital adequacy guide-

lines and the regulatory framework for prompt corrective action

require the Bank and the Savings Bank to maintain specific capital

levels based upon quantitative measures of their assets, liabilities

and off-balance sheet items as calculated under Regulatory

Accounting Principles.The inability to meet and maintain minimum

capital adequacy levels could result in regulators taking actions

that could have a material effect on the Company’s consolidated

financial statements. Additionally, the regulators have broad discre-

tion in applying higher capital requirements. Regulators consider a

range of factors in determining capital adequacy, such as an institu-

tion’s size, quality and stability of earnings, interest rate risk expo-

sure, risk diversification, management expertise, asset quality,

liquidity and internal controls.

As of December 31, 1997 and 1996, notifications from the

regulators categorized the Bank and the Savings Bank as “well-

capitalized.”To be categorized as “well-capitalized,” the Bank and

the Savings Bank must maintain minimum capital ratios as set

forth in the table below. As of December 31, 1997, there are no con-

ditions or events since the notifications discussed above that man-

agement believes have changed either the Bank or the Savings

Bank’s capital category. As of December 31, 1997, the Bank and the

Savings Bank’s ratios of capital to managed assets were 5.10% and

8.67%, respectively.

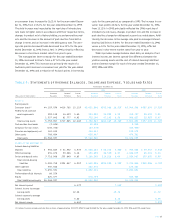

Funding

(in millions)

$796

$98

$1,313

$975

$2,658

$5,840

December 31, 1997

$1,378

$943

$531

$2,616

$5,468

December 31, 1996

● Interest-bearing Deposits

● Other Borrowings

● Senior Deposit Notes < 3 years

● Senior Deposit Notes > 3 years

● Preferred Beneficial Interests