Capital One 1997 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PAGE 26

The Company could also be affected to the extent that other

entities not affiliated with the Company are impacted by the Year

2000 issue.The Company has initiated formal communications with

its critical third party service providers to determine the extent to

which the Company is vulnerable to those third parties’ failure to

remediate their own Year 2000 issues.There is no guarantee that

these other companies will be successful in addressing their Year

2000 issues.

The Company has incurred expenses throughout 1997 and 1996

related to this project and will continue to incur expenses over the

next year. Costs to modify computer systems have been, and will

continue to be, expensed as incurred and are not expected to have

a material impact on the Company’s future financial results or

condition.

Income Taxes

The Company’s income tax rate was 38% for the year ended

December 31, 1997 as compared to 37.5% for 1996 and includes

both state and federal income tax components.

Asset Quality

The asset quality of a portfolio is generally a function of the initial

underwriting criteria used, seasoning of the accounts, levels of com-

petition, account management activities and demographic concen-

tration, as well as general economic conditions.The average age of

the accounts is also an important indicator of the delinquency and

loss levels of the portfolio. Accounts tend to exhibit a rising trend of

delinquency and credit losses as they season. As of December 31,

1997, 53% of managed accounts, representing 43% of the total

managed loan balance, were less than 18 months old. Accordingly, it

is likely that the Company’s managed loan portfolio will experience

increased levels of delinquency and credit losses as the average age

of the Company’s accounts increases.

Another factor contributing to the expectation of a rising rate of

delinquency and credit losses is a shift in the product mix. As dis-

cussed in “Risk Adjusted Revenue and Margin,” certain second gen-

eration products have, in some cases, higher delinquency and higher

charge-off rates. In the case of secured card loans, collateral, in the

form of cash deposits, reduces any ultimate charge-offs.The costs

associated with higher delinquency and charge-off rates are consid-

ered in the pricing of individual products.

During 1997, general economic conditions for consumer credit

continued to worsen as industry levels of charge-offs (including

bankruptcies) and delinquencies both increased. These trends have

impacted the Company’s 1997 results.

Delinquencies

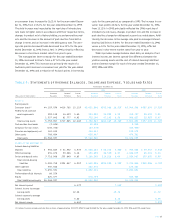

Table 6 shows the Company’s consumer loan delinquency trends for

the years presented as reported for financial statement purposes

and on a managed basis.The entire balance of an account is con-

tractually delinquent if the minimum payment is not received by the

payment due date. However, the Company generally continues to

accrue interest considered to be collectible until the loan is charged

off. Delinquencies not only have the potential to impact earnings if

the account charges off, they also are costly in terms of the person-

nel and other resources dedicated to resolving the delinquencies.

The 30-plus day delinquency rate for the reported consumer loan

portfolio decreased to 5.51% as of December 31, 1997, from 6.08%

as of December 31, 1996.The decrease in 1997 reported delinquency

reflects the modification in the Company’s methodology for charg-

ing off credit card loans (net of any collateral) to 180 days past-due

from the prior practice of charging off loans during the next billing

cycle after becoming 180 days past-due. In addition, in the fourth

quarter of 1997, the Company recognized the estimated uncol-

lectible portion of finance charge and fee income receivables. As of

December 31, 1997, the reported consumer loan portfolio’s delin-

quency rate without these modifications would have been 6.28%.

The 30-plus day delinquency rate for the managed consumer

loan portfolio was 6.20% as of December 31, 1997, down from

6.24% as of December 31, 1996, while the dollar amount of delin-

quent managed consumer loans increased approximately $82.9 mil-

lion. As of December 31, 1997, the managed consumer loan portfolio’s

delinquency rate, without the modifications in charge-off policy

and finance charge and fee income recognition, would have been

6.97%.The managed consumer loan portfolio’s delinquency rate as

of December 31, 1997 principally reflected the continued seasoning

of accounts and consumer loan balances, the increased presence

of second generation products, general economic trends in

consumer credit performance and the modifications in charge-off

policy and finance charge and fee income recognition.

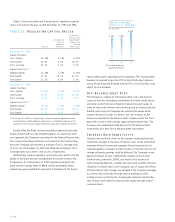

Net Charge-Offs

Net charge-offs include the principal amount of losses (excluding

accrued and unpaid finance charges, fees and fraud losses) less cur-

rent period recoveries. In the fourth quarter of 1997, the Company