Capital One 1997 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 23

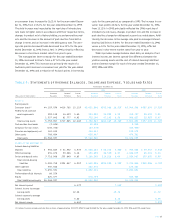

Table 4: Statements of Average Balances, Income and Expense, Yields and Rates

Year Ended December 31

1997 1996 1995

Average Income/ Yield/ Average Income/ Yield/ Average Income/ Yield/

(Dollars in Thousands) Balance Expense Rate Balance Expense Rate Balance Expense Rate

Assets:

Earning assets

Consumer loans(1) $4,103,036 $619,785 15.11% $3,651,908 $592,088 16.21% $2,940,208 $397,654 13.52%

Federal funds sold and

resale agreements 293,119 16,423 5.60 394,939 21,293 5.39 453,797 26,832 5.91

Other 1,357,842 81,777 6.02 752,140 47,102 6.26 508,827 32,923 6.47

Total earning assets 5,753,997 $717,985 12.48% 4,798,987 $660,483 13.76% 3,902,832 $457,409 11.72%

Cash and due from banks (2,636) 40,698 9,309

Allowance for loan losses (132,728) (83,573) (69,939)

Premises and equipment, net 181,610 156,441 123,472

Other assets 768,694 656,407 470,381

Total assets $6,568,937 $5,568,960 $4,436,055

Liabilities and Equity:

Interest-bearing liabilities

Deposits $ 958,885 $ 41,932 4.37% $1,046,122 $ 56,272 5.38% $ 769,688 $ 49,547 6.44%

Other borrowings 631,876 39,066 6.18 454,899 28,509 6.27 1,028,075 66,214 6.44

Senior and deposit notes 3,718,988 253,849 6.83 3,168,205 210,218 6.64 1,924,087 133,635 6.95

Total interest-bearing

liabilities 5,309,749 $334,847 6.31% 4,669,226 $294,999 6.32% 3,721,850 $249,396 6.70%

Other liabilities 345,582 222,975 170,841

Total liabilities 5,655,331 4,892,201 3,892,691

Preferred beneficial interests 89,529

Equity 824,077 676,759 543,364

Total liabilities and equity $6,568,937 $5,568,960 $4,436,055

Net interest spread 6.17% 7.44% 5.02%

Interest income to average

earning assets 12.48 13.76 11.72

Interest expense to average

earning assets 5.82 6.14 6.39

Net interest margin 6.66% 7.62% 5.33%

(1) Interest income includes past-due fees on loans of approximately $132,297, $94,393 and $50,384 for the years ended December 31, 1997, 1996 and 1995, respectively.

on consumer loans increased to 16.21% for the year ended Decem-

ber 31, 1996 from 13.52% for the year ended December 31, 1995.

The yield increase was impacted by the repricing of introductory

rate loans to higher rates in accordance with their respective terms,

changes in product mix to higher yielding, second generation prod-

ucts and the increase in the amount of past-due fees from both a

change in terms and an increase in the delinquency rate.The aver-

age rate paid on borrowed funds decreased to 6.32% for the year

ended December 31, 1996 from 6.70% in 1995 primarily reflecting

decreases in short-term market rates from year to year.

The managed net interest margin for the year ended December

31, 1996 increased to 8.16% from 6.27% for the year ended

December 31, 1995.This increase was primarily the result of a

164 basis point increase in consumer loan yield for the year ended

December 31, 1996 and a reduction of 46 basis points in borrowing

costs for the same period, as compared to 1995.The increase in con-

sumer loan yield to 14.76% for the year ended December 31, 1996

from 13.12% in 1995 principally reflected the 1996 repricing of

introductory rate loans, changes in product mix and the increase in

past-due fees charged on delinquent accounts as noted above. Addi-

tionally, the decrease in the average rate paid on managed interest-

bearing liabilities to 5.84% for the year ended December 31, 1996

versus 6.30% for the year ended December 31, 1995, reflected

decreases in short-term market rates from year to year.

Table 4 provides average balance sheet data, an analysis of net

interest income, net interest spread (the difference between the

yield on earning assets and the cost of interest-bearing liabilities)

and net interest margin for each of the years ended December 31,

1997, 1996 and 1995.