Capital One 1997 Annual Report Download - page 32

Download and view the complete annual report

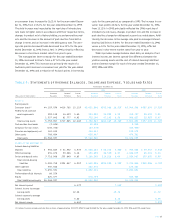

Please find page 32 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In November 1996, the Company entered into a four-year,

$1.7 billion unsecured revolving credit arrangement (the “Credit

Facility”).The Credit Facility is comprised of two tranches: a

$1.375 billion Tranche A facility available to the Bank and the Sav-

ings Bank, including an option for up to $225 million in multi-cur-

rency availability, and a $325 million Tranche B facility available to

the Corporation, the Bank and the Savings Bank, including an

option for up to $100 million in multi-currency availability. Each

tranche under the facility is structured as a four-year commitment

and is available for general corporate purposes.The borrowings of

the Savings Bank are limited to $750 million. All borrowings under

the Credit Facility are based on varying terms of LIBOR.The Bank

has irrevocably undertaken to honor any demand by the lenders to

repay any borrowings which are due and payable by the Savings

Bank but which have not been paid. Any borrowings under the

Credit Facility will mature on November 24, 2000; however, the final

maturity of each tranche may be extended for three additional one-

year periods. As of December 31, 1997 and 1996, the Company had

no outstandings under the Credit Facility.The unused commitment is

available as funding needs arise.

In August 1997, the Company entered into a three-year, $350

million equivalent unsecured revolving credit arrangement (the

“UK/Canada Facility”), which will be used to finance the Com-

pany’s expansion in the United Kingdom and Canada.The

UK/Canada Facility is comprised of two tranches: a Tranche A

facility in the amount of £156.5 million ($249.8 million equivalent

based on the exchange rate at closing) and a Tranche B facility

in the amount of C$139.6 million ($100.2 million equivalent based

on the exchange rate at closing). An amount of £34.6 million or

C$76.9 million ($55.2 million equivalent based on the exchange

rates at closing) may be transferred between the Tranche A facility

and the Tranche B facility, respectively, upon the request of the

Company. All borrowings under the UK/Canada Facility are based

on varying terms of LIBOR. Each tranche under the facility is struc-

tured as a three-year commitment and will be available for general

corporate purposes.The Corporation serves as the guarantor of all

borrowings under the UK/Canada Facility. As of December 31, 1997,

the Company had no outstandings under the UK/Canada Facility.

In April 1997, the Bank increased the aggregate amount of bank

notes available under its bank note program. Under the program,

the Bank from time to time may issue up to $7.8 billion of senior

bank notes with maturities from thirty days to thirty years and up

to $200 million of subordinated bank notes (none issued as of

December 31, 1997) with maturities from five to thirty years. As of

December 31, 1997, the Company had $3.2 billion in senior bank

notes outstanding, a 10% decrease from $3.6 billion outstanding as

of December 31, 1996. As of December 31, 1997, bank notes issued

totaling $2.1 billion have fixed interest rates and mature from one

to five years.The Company has entered into interest rate swap

agreements (“swaps”) to effectively convert fixed rates on senior

notes to variable rates which match the variable rates earned on

consumer loans (see “Interest Rate Sensitivity”).

In October 1997, the Bank established a program for the

issuance of debt instruments to be offered outside of the United

States. Under this program, the Bank from time to time may issue

instruments in the aggregate principal amount of $1.0 billion equiv-

alent outstanding at any one time (none issued as of December 31,

1997). Instruments under this program may be denominated in any

currency or currencies.

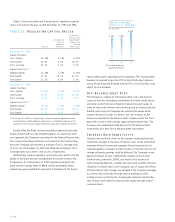

In September 1996, the Corporation filed a $200 million shelf

registration statement ($125 million of senior debt securities issued

as of December 31, 1997) with the Securities and Exchange Com-

mission (the “SEC”) under which the Corporation from time to

time may offer and sell (i) senior or subordinated debt securities

consisting of debentures, notes and/or other unsecured evidences,

(ii) preferred stock, which may be issued in the form of depository

shares evidenced by depository receipts and (iii) common stock.The

securities will be limited to $200 million aggregate public offering

price or its equivalent (based on the applicable exchange rate at the

time of sale) in one or more foreign currencies, currency units or

composite currencies as shall be designated by the Corporation.

In April 1996, the Bank established a deposit note program

under which the Bank from time to time may issue up to $2.0 billion

of deposit notes with maturities from thirty days to thirty years. As

of December 31, 1997, the Company had $300 million in deposit

notes outstanding.

In January 1997, Capital One Capital I, a subsidiary of the Bank

created as a Delaware statutory business trust, issued $100 million

aggregate amount of Floating Rate Junior Subordinated Capital

Income Securities that mature on February 1, 2027.The securities

represent a preferred beneficial interest in the assets of the trust

and qualify as Tier 1 capital at the Corporation and Tier 2 capital at

the Bank.The net proceeds of the offering of $97.4 million were lent

to the Bank for general corporate purposes. As of December 31,

1997, the interest rate on these securities was 7.30%.

PAGE 30