Capital One 1997 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

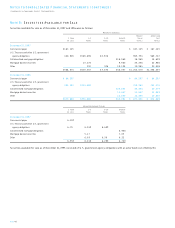

Note C: Allowance for Loan Losses

The following is a summary of changes in the allowance for

loan losses:

Year Ended December 31

1997 1996 1995

Balance at beginning of year $(118,500 $(72,000 $(68,516

Provision for loan losses 262,837 167,246 65,895

Transfer to loans held for

securitization (2,770) (27,887) (11,504)

Increase from consumer

loan purchase 9,000

Charge-offs (223,029) (115,159) (64,260)

Recoveries 27,462 13,300 13,353

Net charge-offs (195,567) (101,859) (50,907)

Balance at end of year $(183,000 $(118,500 $(72,000

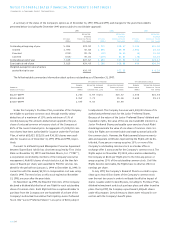

Note D: Borrowings

Borrowings as of December 31, 1997 and 1996 were as follows:

1997 1996

Weighted Weighted

Average Average

Outstanding Rate Outstanding Rate

Interest-

bearing

deposits $1,313,654 4.49% $ 943,022 4.31%

Other

borrowings

Federal funds

purchased and

resale agreements $ 705,863 5.75% $ 445,600 6.26%

Other 90,249 7.09 85,383 6.43

Total $ 796,112 $ 530,983

Senior notes

Bank—fixed rate $2,793,778 7.03% $3,140,237 7.31%

Bank—variable rate 414,000 6.19 429,000 5.99

Corporation 125,000 7.25 125,000 7.25

Total $3,332,778 $3,694,237

Deposit notes

Fixed rate $ 224,996 6.71% $ 224,996 6.71%

Variable rate 75,000 6.15 75,000 5.86

Total $ 299,996 $ 299,996

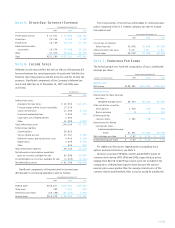

As of December 31, 1997, the aggregate amount of interest-

bearing deposits with accounts exceeding $100 was $228,428. In

September 1997, the Savings Bank completed the purchase of the

national retail deposit franchise of JCPenney National Bank. Retail

deposit balances acquired under the agreement were approximately

$421,000.

In November 1996, the Company entered into a four-year,

$1,700,000 unsecured revolving credit arrangement (the “Credit

Facility”).The Credit Facility is comprised of two tranches: a

$1,375,000 Tranche A facility available to the Bank and the Savings

Bank, including an option for up to $225,000 in multi-currency

availability, and a $325,000 Tranche B facility available to the Cor-

poration, the Bank and the Savings Bank, including an option for up

to $100,000 in multi-currency availability. Each tranche under the

facility is structured as a four-year commitment and is available for

general corporate purposes.The borrowings of the Savings Bank

are limited to $750,000. All borrowings under the Credit Facility are

based on varying terms of the London InterBank Offered Rate

(“LIBOR”).The Bank has irrevocably undertaken to honor any

demand by the lenders to repay any borrowings which are due and

payable by the Savings Bank but which have not been paid. Any

borrowings under the Credit Facility will mature on November 24,

2000; however, the final maturity of each tranche may be extended

for three additional one-year periods. As of December 31, 1997 and

1996, the Company had no outstandings under the Credit Facility.

In August 1997, the Company entered into a three-year,

$350,000 equivalent unsecured revolving credit arrangement

(the “UK/Canada Facility”), which will be used to finance the

Company’s expansion in the United Kingdom and Canada.The

UK/Canada Facility is comprised of two tranches: a Tranche A facil-

ity in the amount of £156,458 ($249,800 equivalent based on the

exchange rate at closing) and a Tranche B facility in the amount of

C$139,609 ($100,200 equivalent based on the exchange rate at

closing). An amount of £34,574 or C$76,910 ($55,200 equivalent

based on the exchange rates at closing) may be transferred between

the Tranche A facility and the Tranche B facility, respectively, upon

the request of the Company. Each tranche under the facility is struc-

tured as a three-year commitment and will be available for general

corporate purposes. All borrowings under the UK/Canada Facility

are based on varying terms of LIBOR.The Corporation serves as

the guarantor of all borrowings under the UK/Canada Facility. As

of December 31, 1997, the Company had no outstandings under the

UK/Canada Facility.

In April 1997, the Bank increased the aggregate amount of bank

notes available under its bank note program. Under the program,

the Bank from time to time may issue up to $7,800,000 of senior

bank notes with maturities from thirty days to thirty years and up

to $200,000 of subordinated bank notes (none issued as of Decem-

ber 31, 1997 and 1996) with maturities from five to thirty years.

PAGE 47