Capital One 1997 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

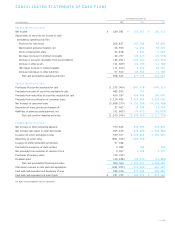

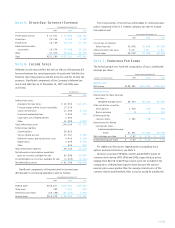

Notes to Consolidated Financial Statements (continued)

(Currencies in Thousands, Except Per Share Data)

Under the Company’s Purchase Plan, associates of the Company

are eligible to purchase common stock through monthly salary

deductions of a maximum of 15% and a minimum of 1% of

monthly base pay.The amounts deducted are applied to the pur-

chase of unissued common or treasury stock of the Company at

85% of the current market price. An aggregate of 1,000,000 com-

mon shares have been authorized for issuance under the Purchase

Plan, of which 682,427; 822,001 and 934,355 shares were avail-

able for issuance as of December 31, 1997, 1996 and 1995, respec-

tively.

Pursuant to a Marketing and Management Services Agreement

between Signet Bank (which has since been acquired by First Union

Bank on November 30, 1997) and Fairbank Morris, Inc. (“FMI”),

a corporation controlled by members of the Company’s executive

management, 464,400 shares of restricted stock, at the then fair

value of $16.00 per share, were awarded to FMI for services ren-

dered for the period from January 1, 1994 to December 31, 1995. In

connection with this award, $3,715 in compensation cost was recog-

nized in 1995.The restrictions on this stock expired on November

15, 1995, one year after the grant date.

On November 16, 1995, the Board of Directors of the Company

declared a dividend distribution of one Right for each outstanding

share of common stock. Each Right entitles a registered holder to

purchase from the Company one one-hundredth of a share of the

Company’s authorized Cumulative Participating Junior Preferred

Stock (the “Junior Preferred Shares”) at a price of $150, subject

to adjustment.The Company has reserved 1,000,000 shares of its

authorized preferred stock for the Junior Preferred Shares.

Because of the nature of the Junior Preferred Shares’ dividend and

liquidation rights, the value of the one one-hundredth interest in a

Junior Preferred Share purchasable upon exercise of each Right

should approximate the value of one share of common stock. Ini-

tially, the Rights are not exercisable and trade automatically with

the common stock. However, the Rights generally become exercis-

able and separate certificates representing the Rights will be dis-

tributed, if any person or group acquires 15% or more of the

Company’s outstanding common stock or a tender offer or

exchange offer is announced for the Company’s common stock.The

Rights expire on November 29, 2005, unless earlier redeemed by

the Company at $0.01 per Right prior to the time any person or

group acquires 15% of the outstanding common stock. Until the

Rights become exercisable, the Rights have no dilutive effect on

earnings per share.

In July 1997, the Company’s Board of Directors voted to repur-

chase up to two million shares of the Company’s common stock

over the next two years in order to mitigate the dilutive impact of

shares issuable under its benefit plans, including its Purchase Plan,

dividend reinvestment and stock purchase plans and other incentive

plans. During 1997, the Company repurchased 1,318,641 shares

under this program. Certain treasury shares were reissued in con-

nection with the Company’s benefit plans.

PAGE 50

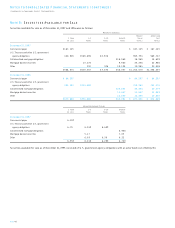

A summary of the status of the Company’s options as of December 31, 1997, 1996 and 1995, and changes for the years then ended is

presented below (excluding the December 1997 grants subject to stockholder approval):

1997 1996 1995

Weighted- Weighted- Weighted-

Average Average Average

Options Exercise Price Options Exercise Price Options Exercise Price

(000s) Per Share (000s) Per Share (000s) Per Share

Outstanding at beginning of year 5,894 $23.92 3,315 $19.67 2,036 $16.00

Granted 1,590 40.88 2,694 29.04 1,361 25.08

Exercised (215) 20.76 (12) 16.40 (6) 16.00

Canceled (144) 30.16 (103) 21.82 (76) 18.25

Outstanding at end of year 7,125 $27.67 5,894 $23.92 3,315 $19.67

Exercisable at end of year 3,815 $24.43 1,196 $18.98 454 $16.00

Weighted-average fair value of options

granted during the year $16.03 $11.22 $ 8.19

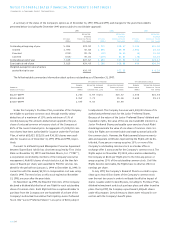

The following table summarizes information about options outstanding as of December 31, 1997:

Options Outstanding Options Exercisable

Number Weighted-Average Weighted-Average Number Weighted-Average

Range of Outstanding Remaining Exercise Price Exercisable Exercise Price

Exercise Prices (000s) Contractual Life Per Share (000s) Per Share

$16.00–$24.99 2,240 6.93 years $16.52 1,406 $16.38

$25.00–$33.99 3,352 7.73 29.08 2,409 29.13

$34.00–$47.99 1,533 9.52 40.90