Capital One 1997 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

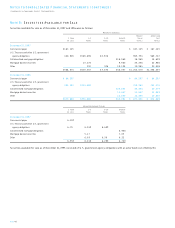

Note P: Capital One Financial

Corporation (Parent Company Only)

Condensed Financial Information

December 31

Balance Sheets 1997 1996

Assets:

Cash and cash equivalents $ 203 $ 16,073

Investment in subsidiaries 818,518 748,365

Loans to subsidiaries 207,507(1) 105,000

Other 5,001 2,333

Total assets $1,031,229 $871,771

Liabilities:

Senior notes $ 125,000 $125,000

Other 12,970 6,380

Total liabilities 137,970 131,380

Stockholders’ Equity: 893,259 740,391

Total liabilities and stockholders’ equity $1,031,229 $871,771

(1) As of December 31, 1997, includes $143,500 of cash invested at the Bank instead of

the open market.

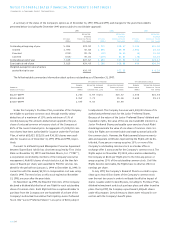

Year Ended December 31

Statements of Income 1997 1996 1995

Interest from temporary

investments $ 11,352 $ 2,296 $ 560

Interest expense 11,067 3,013

Dividends, principally from

bank subsidiaries 228,000 117,400 11,000

Non-interest income 56

Non-interest expense 409 571 456

Income before income taxes

and equity in undistributed

earnings of subsidiaries 227,932 116,112 11,104

Income taxes (25) (490) 37

227,957 116,602 11,067

Equity in undistributed

earnings of subsidiaries (38,576) 38,665 115,444

Net income $189,381 $155,267 $126,511

Year Ended December 31

Statements of Cash Flows 1997 1996 1995

Operating Activities:

Net income $(189,381 $(155,267 $(126,511

Adjustments to reconcile net

income to net cash provided

by operating activities:

Equity in undistributed

earnings of subsidiaries 38,576 (38,665) (115,444)

Amortization of deferred

compensation 62 4,020

(Increase) decrease in

other assets (2,183) 2,017 (3,161)

Increase (decrease) in

other liabilities 6,590 6,380 (1,054)

Net cash provided by

operating activities 232,364 125,061 10,872

Investing Activities:

Increase in investment in

subsidiaries (83,366) (119,502) (2,470)

Increase in loans to

subsidiaries (102,507) (105,000)

Net cash used for investing

activities (185,873) (224,502) (2,470)

Financing Activities:

Proceeds from issuances of

common stock 4,957 3,109 1,257

Proceeds from exercise of

stock options 4,082 186 132

Issuance of senior notes 125,000

Purchases of treasury stock (50,762)

Dividends paid (20,638) (20,573) (15,883)

Net cash (used for) provided

by financing activities (62,361) 107,722 (14,494)

(Decrease) increase in cash

and cash equivalents (15,870) 8,281 (6,092)

Cash and cash equivalents

at beginning of year 16,073 7,792 13,884

Cash and cash equivalents

at end of year $(203 $(16,073 $(7,792

PAGE 55