Capital One 1997 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company has entered into swaps to effectively convert

certain of the interest rates on bank notes from fixed to variable.

The swaps, which had a notional amount totaling $450 million as of

December 31, 1997, will mature in 1998 and 2000 to coincide with

maturities of fixed bank notes. In 1997, the Company entered into

swaps with notional amounts totaling $450 million to effectively

offset the swaps described above with matching maturities and terms

which pay fixed and receive variable rates. As of December 31, 1997,

the variable rate payments on the original and offsetting swaps

were matched and will continue to offset each other through matu-

rity. As of December 31, 1997, the weighted average fixed rate

payment received on the original swaps was 7.39%, and the

weighted average fixed rate payment paid on the offsetting swaps

was 6.50%.

The Company has also entered into swaps to reduce the interest

rate sensitivity associated with securitizations.The swaps, which

had a notional amount totaling $591 million as of December 31,

1997, will mature in 1998 and 1999 to coincide with the final pay-

ments of a 1995 securitization. In 1997, the Company entered into

swaps with notional amounts totaling $591 million to effectively

offset the swaps described above with matching maturities and

terms which pay fixed and receive variable rates. As of December 31,

1997, the variable rate payments on the original and offsetting

swaps were matched and will continue to offset each other through

maturity. As of December 31, 1997, the weighted average fixed rate

payment received on the original swaps was 7.68%, and the

weighted average fixed rate payment paid on the offsetting swaps

was 6.52%.

Liquidity

Liquidity refers to the Company’s ability to meet its cash needs.The

Company meets its cash requirements by securitizing assets and

through issuing debt. As discussed in “Managed Consumer Loan

Portfolio,” a significant source of liquidity for the Company has

been the securitization of consumer loans. Maturity terms of the

existing securitizations vary from 1998 to 2004 and typically have

accumulation periods during which principal payments are aggre-

gated to make payments to investors. As payments on the loans are

accumulated for the participants in the securitization and are no

longer reinvested in new loans, the Company’s funding requirements

for such new loans increase accordingly.The occurrence of certain

events may cause the securitization transactions to amortize earlier

than scheduled which would accelerate the need for funding.

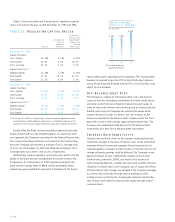

Table 13 shows the amounts of investor principal from securi-

tized consumer loans that will amortize or be otherwise paid over

the periods indicated based on outstanding securitized consumer

loans as of January 1, 1998. As of December 31, 1997 and 1996,

66% of the Company’s total managed loans were securitized.

As such loans amortize or are otherwise paid, the Company

believes that it can securitize consumer loans, purchase federal

funds and establish other funding sources to fund the amortization

or other payment of the securitizations in the future, although no

assurance can be given to that effect. Additionally, the Company

maintains a portfolio of high-quality securities such as U.S.Trea-

suries and other U.S. government obligations, commercial paper,

interest-bearing deposits with other banks, federal funds and other

cash equivalents in order to provide adequate liquidity and to meet

its ongoing cash needs. As of December 31, 1997, the Company had

$1.5 billion of such securities.

Liability liquidity is measured by the Company’s ability to obtain

borrowed funds in the financial markets in adequate amounts and at

favorable rates. As of December 31, 1997, the Company, the Bank

and the Savings Bank collectively had over $2.0 billion in unused

commitments under its credit facilities available for liquidity needs.

PAGE 34

Table 13: Securitizations—Scheduled Amortization Table

(Dollars in Thousands) 1998 1999 2000 2001 2002-2004

Balance at beginning of year $(9,369,328 $7,202,549 $(6,471,428 $(4,412,078 $ 872,790

Less repayment amounts (2,166,779) (731,121) (2,059,350) (3,539,288) (872,790)

Balance at end of year $(7,202,549 $6,471,428 $ 4,412,078 $(872,790 $ —