Capital One 1997 Annual Report Download

Download and view the complete annual report

Please find the complete 1997 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Wired for

Innovation

Capital One Financial Corporation

1997 Annual Report

Table of contents

-

Page 1

Wired for Innovation Capital One Financial Corporation 1997 Annual Report -

Page 2

..., and Falls Church, Virginia; Tampa, Florida; Dallas/Fort Worth, Texas; and London and Nottingham, England. Capital One has grown dramatically due to the success of our proprietary information-based strategy and sophisticated analytical techniques to identify, manage and rapidly exploit business... -

Page 3

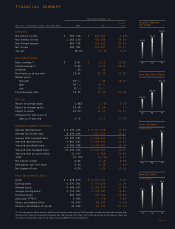

... income Tax rate Per Common Share: Basic earnings (1) Diluted earnings (1) Dividends Book value as of year-end Market prices Year-end High Low Price /Earnings ratio Ratios: Return on average assets Return on average equity Capital to assets Allowance for loan losses to loans as of year-end Managed... -

Page 4

... our credit card portfolio. In 1997, our mance: total revenue, net interest income and margin, risk adjusted revenue and margin, non-interest income, net income, earnings per share, return on assets, return on equity, accounts, managed loans and marketing investment. We added 3.2 million customers... -

Page 5

...-products, prices, credit lines, account management, retention and collections. Through mass customization-which we view as the ultimate power tool of marketing-we can deliver the right product to the right customer at the right time and at the right price. Mass customization gives Capital One... -

Page 6

... opportunity for growth. In the United States, credit cards are increasingly the preferred form of consumer payment, and they are steadily winning market share from other types of consumer borrowing. Capital One now serves nearly one in ten U.S. households, and our customers are using their cards... -

Page 7

... into markets outside the United States . The World Beyond Financial Services We think of Capital One not as a credit card company or even as only a financial services company but as an information-based marketing company. Although we are still in the early stages of applying our strategy outside... -

Page 8

... to believe that Capital One will continue to be one of the nation's outstanding growth companies. Sincerely, Richard D. Fairbank Fredericksburg, Tampa and Dallas / Fort Worth. Sponsored by the Second Harvest National Food Bank Network, Kids Cafes give school-age children a safe place to go after... -

Page 9

Wired for Innovation PAGE 7 -

Page 10

They say information is power. PAGE 8 -

Page 11

... new products well before the crowd moves in. The vast quantities of data we process daily in servicing our accounts give us an ability to manage credit risk analytically; when conditions change, we can respond quickly. â- Highly ï¬,exible, IBS can be applied to numerous industries and many markets... -

Page 12

The innovation imperative: PAGE 10 -

Page 13

... large and growing database is a mine of ideas for new products, new services, new markets. â- Capital One associates are agents of change - empowered to act, rewarded for initiative and skilled at the teamwork that drives rapid, successful innovation. tion's only sustainable competitive advantage... -

Page 14

... marketing endgame of the Information Age. Instead of offering a single product that ï¬ts some of the needs of some of the people some of the time, mass customization packages product attributes in thousands of combinations, creating something for everyone. Capital One's ability to mass customize... -

Page 15

Our way: tailor-made PAGE 13 -

Page 16

...And it's working. We're one of the nation's fastest- growing companies, adding customers at a current rate of 10,000 a day. And we are winning a high percentage of the head-to-head recruiting battles for top talent against the leading consulting ï¬rms, investment banks, blue-chip corporations and... -

Page 17

World-class growth machine PAGE 15 -

Page 18

1997 Financial Presentation Page 17 Selected Financial & Operating Data Page 18 Management ' s Discussion and Analysis of Financial Condition and Results of Operations Page 37 Selected Quarterly Financial Data Page 38 Management ' s Report on Consolidated Financial Statements and Internal ... -

Page 19

... Financial Statements. (5) Division equity reflects an allocation of capital to Capital One Bank as a division for purposes of preparation of the financial statements of the Company. Such allocation is not subject to regulatory minimums. (6) Excludes consumer loans held for securitization. PAGE... -

Page 20

... which offers credit card products, and Capital One, F.S.B. (the "Savings Bank"), which provides certain consumer lending and deposit services.The Corporation and its subsidiaries are collectively referred to as the "Company." As of December 31, 1997, the Company had 11.7 million customers and $14... -

Page 21

...be recognized in accordance with SFAS 125 will be dependent on the timing and amount of future securitizations.The Company will continuously assess the performance of new and existing securitization transactions as estimates of future cash ï¬,ows change. Managed Loans (in billions) $14.2 $12.8 $10... -

Page 22

...the rate of interest are used to pay the credit enhancement fee and servicing fee and are available to absorb the investors' share of credit losses. Certiï¬cateholders in the Company's securitization program are generally entitled to receive principal payments either through monthly payments during... -

Page 23

... immediate impact on managed loan balances of the ï¬rst generation products but typically consist of lower credit limit accounts and balances that build over time.The terms of the second generation products tend to include annual membership fees and higher annual ï¬nance charge rates.The proï¬le... -

Page 24

... loans, changes in product mix and the increase in past-due fees charged on delinquent accounts noted above.The average rate paid on borrowed funds increased slightly to 5.95% for the year ended December 31, 1997 from 5.84% in 1996 primarily reï¬,ecting a relatively steady short-term interest rate... -

Page 25

... past-due fees from both a change in terms and an increase in the delinquency rate.The average rate paid on borrowed funds decreased to 6.32% for the year ended December 31, 1996 from 6.70% in 1995 primarily reï¬,ecting decreases in short-term market rates from year to year. The managed net interest... -

Page 26

... 125, increased $199.8 million, or 127%, for the year ended December 31, 1997 from 1996, as a result of loan and account growth, the securitization of second generation products and changes in the terms of overlimit fees charged. Charge-offs of securitized loans for the year ended December 31, 1997... -

Page 27

... the impact resulting from the implementation of SFAS 125, for the year ended December 31, 1997, primarily due to loan and account growth of second generation products and changes in the terms of overlimit fees charged. Other reported non-interest income increased to $303.6 million, or 112%, for the... -

Page 28

... rates. In the case of secured card loans, collateral, in the form of cash deposits, reduces any ultimate charge-offs.The costs associated with higher delinquency and charge-off rates are considered in the pricing of individual products. During 1997, general economic conditions for consumer credit... -

Page 29

...ï¬ed its methodology for charging off credit card loans (net of any collateral) to 180 days past-due from the prior practice of charging off loans during the next billing cycle after becoming 180 days past-due.The impact of this modiï¬cation was to increase reported and managed charge-offs by $11... -

Page 30

...-offs.The Company's primary guideline is a calculation which uses current delinquency levels and other measures of asset quality to estimate net charge-offs. Consumer loans are typically charged off (net of any collateral) at 180 days past-due, although earlier charge-offs may occur on accounts of... -

Page 31

... products, which in some cases have modestly higher charge-off rates than ï¬rst generation products, increased the amount of provision necessary to absorb credit losses. In consideration of these factors, the Company increased the allowance for loan losses by $46.5 million during 1996. Funding... -

Page 32

... evidences, (ii) preferred stock, which may be issued in the form of depository shares evidenced by depository receipts and (iii) common stock.The securities will be limited to $200 million aggregate public offering price or its equivalent (based on the applicable exchange rate at the time of sale... -

Page 33

... stockholders with the opportunity to purchase additional shares of the Company's common stock by reinvesting quarterly dividends or making optional cash investments.The Company uses proceeds from the DRIP for general corporate purposes. In July 1997, the Company's Board of Directors voted to... -

Page 34

... limit the ability of the Bank and the Savings Bank to transfer funds to the Corporation. As of December 31, 1997, retained earnings of the Bank and the Savings Bank of $99.6 million and $24.8 million, respectively, were available for payment of dividends to the Corpo- Interest Rate Sensitivity... -

Page 35

... certain states to reject such repricing by giving timely written notice to the Company and thereby relinquishing charging privileges. However, the repricing of credit card loans may be limited by competitive factors as well as certain legal constraints. Interest rate sensitivity at a point in time... -

Page 36

...cash needs. As of December 31, 1997, the Company had $1.5 billion of such securities. Liability liquidity is measured by the Company's ability to obtain borrowed funds in the ï¬nancial markets in adequate amounts and at favorable rates. As of December 31, 1997, the Company, the Bank and the Savings... -

Page 37

... existing credit card operations outside of the United States, with an initial focus on the United Kingdom and Canada.These second and third generation products are subject to competitive pressures, which management anticipates will increase as these markets mature. The Company continues to apply... -

Page 38

... personnel to assist in the management and operations of new products and services; and other factors listed from time to time in the Company's SEC reports, including, but not limited to, the Annual Report on Form 10-K for the year ended December 31, 1997 (Part I, Item 1, Cautionary Statements... -

Page 39

... is a tabulation of the Company's unaudited quarterly results for the years ended December 31, 1997 and 1996.The Company's common shares are traded on the New York Stock Exchange under the symbol COF. In addition, shares may be traded in the over-the-counter stock market. There were 10,585 and... -

Page 40

... of December 31, 1997, in all material respects, the Company maintained effective internal controls over ï¬nancial reporting. Richard D.Fairbank Chairman and Chief Executive Ofï¬cer Nigel W. Morris President and Chief Operating Ofï¬cer James M.Zinn Senior Vice President and Chief Financial Of... -

Page 41

... consolidated balance sheets of Capital One Financial Corporation as of December 31, 1997 and 1996, and the related consolidated statements of income, changes in stockholders' equity, and cash ï¬,ows for each of the three years in the period ended December 31, 1997.These ï¬nancial statements are... -

Page 42

... Senior notes Deposit notes Interest payable Other liabilities Total liabilities Commitments and Contingencies Guaranteed Preferred Beneficial Interests In Capital One Bank's Floating Rate Junior Subordinated Capital Income Securities: Stockholders' Equity: Preferred stock, par value $.01 per share... -

Page 43

...Service charges Interchange Other Total non-interest income Non-Interest Expense: Salaries and associate benefits Marketing Communications and data processing Supplies and equipment Occupancy Other Total non-interest expense Income before income taxes Income taxes Net income Basic earnings per share... -

Page 44

...' Equity Paid-In Capital, Net Retained Earnings Treasury Stock Balance, December 31, 1994 Net income Cash dividends-$.24 per share Issuances of common stock Exercise of stock options Tax benefit from stock awards Restricted stock, net Change in unrealized gains on securities available for sale... -

Page 45

... of securities available for sale Proceeds from securitization of consumer loans Net increase in consumer loans Recoveries of loans previously charged off Additions of premises and equipment, net Net cash used for investing activities Financing Activities: Net increase in interest-bearing deposits... -

Page 46

...provide a variety of products and services to consumers.The principal subsidiaries are Capital One Bank (the "Bank"), which offers credit card products, and Capital One, F.S.B. (the "Savings Bank"), which provides certain consumer lending and deposit services.The Corporation and its subsidiaries are... -

Page 47

... could materially change in the near term. Prior to 1997, no gains were recorded due to the relatively short average life of the consumer loans securitized. Excess servicing fee income was recorded over the life of each sale transaction. Premises and Equipment Premises and equipment are stated at... -

Page 48

...Consolidated Financial Statements (continued) (Currencies in Thousands, Except Per Share Data) Note B: Securities Available for Sale Securities available for sale as of December 31, 1997 and 1996 were as follows: Maturity Schedule Market Value Totals Amortized Cost Totals 1 Year or Less 1-5 Years... -

Page 49

... the Company had no outstandings under the UK/Canada Facility. In April 1997, the Bank increased the aggregate amount of bank notes available under its bank note program. Under the program, the Bank from time to time may issue up to $7,800,000 of senior bank notes with maturities from thirty days to... -

Page 50

... evidences, (ii) preferred stock, which may be issued in the form of depository shares evidenced by depository receipts and (iii) common stock.The securities will be limited to a $200,000 aggregate public offering price or its equivalent (based on the applicable exchange rate at the time of sale... -

Page 51

... cash compensation in exchange for stock options. Under this program, the Company's Chairman and Chief Executive Ofï¬cer and its President and Chief Operating Ofï¬cer have agreed to forego all salary and any beneï¬ts under the Associate Stock Purchase Plan (the "Purchase Plan"), Associate Savings... -

Page 52

...summarizes information about options outstanding as of December 31, 1997: Options Outstanding Number Outstanding (000s) Weighted-Average Remaining Contractual Life Weighted-Average Exercise Price Per Share Options Exercisable Number Exercisable (000s) Weighted-Average Exercise Price Per Share Range... -

Page 53

...per share: Year Ended December 31 (Shares in Thousands) 1997 1996 1995 Numerator: Net income $189,381 $155,267 $126,511 Deferred tax assets: Allowance for loan losses $ 60,900 Finance charge and fee income receivables 17,570 Stock incentive plan 11,466 Unearned membership fees 5,600 State taxes... -

Page 54

...terms of these available lines of credit at any time. Certain premises and equipment are leased under agreements that expire at various dates through 2006, without taking into consideration available renewal options. Many of these leases provide for payment by the lessee of property taxes, insurance... -

Page 55

... 1995, the Company and the Bank became involved in a purported class action suit relating to certain collection practices engaged in by Signet Bank and, subsequently, by the Bank.The complaint in this case alleges that Signet Bank and/or the Bank violated a variety of California state statutes and... -

Page 56

... of securities available for sale was determined using current market prices. See Note B. Consumer Loans The net carrying amount of consumer loans, including the Company's seller's interest in securitized consumer loan receivables, approximated fair value due to the relatively short average life and... -

Page 57

...Net cash provided by operating activities 232,364 125,061 10,872 Investing Activities: Increase in investment in subsidiaries Increase in loans to subsidiaries Net cash used for investing activities Financing Activities: Proceeds from issuances of common stock Proceeds from exercise of stock options... -

Page 58

... Falls Church, VA 22042 Principal Financial Contact Paul Paquin Vice President, Investor Relations Capital One Financial Corporation 2980 Fairview Park Drive, Suite 1300 Falls Church, VA 22042-4525 (703) 205-1039 Copies of Form 10-K filed with the Securities and Exchange Commission are available...