BP 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Form 20-F 2011 95

Business review: BP in more depth

Business review

balance of participation and capital employed from established to growth

regions.

In March 2010, we set a target to shareholders to deliver a

performance improvement of at least $2 billion by 2012 relative to a 2009

baseline and we believe we are on track to deliver this by the end of 2012a.

In addition, post-2012, we plan to grow our margin further through our

focus on growth markets and expansion of our margin capture capability,

which we expect to achieve through projects such as those described

below.

In our fuels business, as previously announced, we are planning

to dispose of our Texas City refinery and the southern part of the

US West Coast FVC before the end of 2012. We are investing in our

existing operations to sustain safe, compliant standards and selectively

investing in cash margin capture projects. The largest of these projects

is the repositioning of the Whiting refinery towards heavy feedstock

advantage, which is already under way and scheduled to come onstream

in the second half of 2013. In addition to the repositioning of the Whiting

refinery, margin capture projects include the Cherry Point refinery clean

diesel project, Toledo refinery continuous catalytic reforming project,

Gelsenkirchen refinery margin improvement programme and the recently

announced Brazil aviation acquisition (see Acquisitions and disposals

section on page 97).

We are also well positioned for growth in our lubricants and

petrochemicals businesses. In our lubricants business, around half of our

profit growth in recent years has come from the emerging economies in

non-OECD countries as we have expanded in these markets. We have

a material presence in the Indian automotive lubricant market. These

positions provide a strong base to capture further long-term growth. In

petrochemicals around 45% of our capacity is in the demand centre of

Asia. Growth options are enabled by our distinctive technology, operational

capability and access through key strategic relationships. During 2011

the latest example of our strategy deployment was the signing of a

memorandum of understanding with IndianOil Corp (IOC) to explore the

potential for establishing a 50:50 joint venture to invest in a 1 million tonne

per annum (mtpa) acetic acid plant in Gujarat, India. The joint venture will

use BP’s latest Cativa® catalyst and technology, while the associated

gasification facilities would utilize petroleum coke feedstock from IOC.

Additionally, in 2011 BP received local government approval for a 1.25mtpa

PTA plant in Zhuhai, China, and is now seeking final central governmental

approval.

From 2012 we plan to create a new revenue stream in

petrochemicals through licencing our technology, beginning with our

aromatics products of PX and PTA.

As part of our drive towards more efficient operations, we have

been transforming our back office. In 2011, we made further progress on

our global SAP implementation within the fuels and lubricants businesses.

We also continued to expand the scale of our business service centres

(BSCs). BSCs are regional centres for certain finance, operational

procurement and IT services for the BP group.

a This performance improvement will be measured by comparing Refining and Marketing’s

replacement cost profit before interest and tax for 2009 with that of 2012, after adjusting for

non-operating items, fair value accounting effects and the impact of changes in the refining margin

and petrochemicals environment (including energy costs), foreign exchange impacts and price-lag

effects for crude and product purchases. This adjusted measure of replacement cost profit before

interest and tax is non-GAAP. We believe the measure is useful to investors because it is one that

is viewed and closely tracked by management as an important indicator of segment performance.

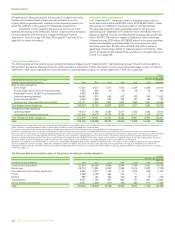

Our performance

2011 performance

Safety and operational risk

Safety remains the top priority across BP, and we are committed to

leadership in process safety and to ensuring that our operations are safe,

compliant and reliable with regard to both personal and process safety.

Refining and Marketing utilizes the group’s operating management

system (OMS). OMS provides a set of group-wide requirements and a

systematic way of working to continuously improve the way we operate.

(OMS is explained in more detail on page 65). While all Refining and

Marketing entities have transitioned on to OMS, we continue to work to

enhance local systems and processes at all our sites.

All our major manufacturing entities (refineries and petrochemicals

sites) have been through two performance improvement cycles (PIC) of

OMS, and all other entities across our FVCs will have completed their

second PIC by the end of 2012. The PIC is a management review carried

out within each entity of their local operating management system, which

identifies areas where further actions can be taken to enhance our systems

and processes. These actions are risk-prioritized and form an integral part

of each entity’s annual and longer-term planning. Where appropriate,

actions are aggregated to provide common solutions.

Direction and oversight of safety in Refining and Marketing is

provided by the segment operating risk committee (SORC) chaired by the

chief executive officer of Refining and Marketing. Monitoring of safety and

compliance in our operations is conducted by the newly-formed safety

and operational risk function, for which there is a Refining and Marketing

segment team independent of the segment CEO.

As outlined on page 65, BP has further strengthened its risk review

process, and this process was applied to Refining and Marketing to ensure

that appropriate risk management and mitigating actions were prioritized

throughout the segment.

We measure our personal safety performance through the

employment of a recordable injury frequency (RIF) rate and a days away

from work case frequency (DAFWCF) rate, as well as a severe vehicle

accident rate.

In 2011, our RIF (measured by the number of recordable injuries

to the BP workforce per 200,000 hours worked) was 0.37, slightly higher

than the 2010 rate of 0.35. The 2011 DAFWCF (a subset of the RIF that

measures the number of cases where an employee misses one or more

days from work) was 0.108, compared with 0.114 in 2010. There was a

significant improvement in the severe vehicle accident rate (SVAR) in 2011

with 61 severe vehicle accidents compared with 77 in 2010.

While progress has been made in the area of personal safety, there

were two workplace fatalities in 2011. These tragic events have been fully

investigated, and the learnings shared and actioned.

Process safety is measured by the process safety incident index

(PSII), a weighted index which reflects both the number and severity of

events per 200,000 hours worked. The PSII for 2011 was 0.36, equal to

the 2010 rate, and better than the 2009 rate of 0.48. While the number of

PSII events has increased from 2010, the overall severity of the events has

reduced.

In terms of operational integrity, the number of losses of primary

containment (LOPC), a measure of unplanned or uncontrolled releases of

material from primary containment, was 5% lower in 2011 than in 2010.

The number of oil spills greater than one barrel was slightly higher in 2011

(145) than 2010 (132) however the volumes of oil spills were significantly

lower in 2011 than in 2010 at 0.4 million litres compared with 1.3 million

litres respectively.

In our US refineries, we continue to implement the

recommendations of the BP US Refineries Independent Safety Review

Panel and regulatory bodies. See the Safety section on page 67 for further

information on progress.