BP 2011 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ remuneration report

142 BP Annual Report and Form 20-F 2011

Executive directors’ remuneration

Remuneration committee

During the year the committee met seven times, and was made up of the

following independent non-executive directors:

Mr Antony Burgmans (chairman from 2011 Annual General Meeting (AGM))

Mr George David

Mr Ian Davis

Dr DeAnne Julius was chairman of the committee until her retirement at

the 2011 AGM. Mr Svanberg has attended all meetings.

The group chief executive is consulted on matters relating to the other

executive directors and senior executives who report to him and on

matters relating to the performance of the company; neither he nor the

chairman of the board participate in decisions on their own remuneration.

The committee’s tasks are set out in the board governance principles:

• To determine, on behalf of the board, the terms of engagement and

remuneration of the group chief executive and the executive directors

and to report on these to the shareholders.

• To determine, on behalf of the board, matters of policy over which the

company has authority regarding the establishment or operation of

the company’s pension schemes of which the executive directors are

members.

• To nominate, on behalf of the board, any trustees (or directors of

corporate trustees) of such schemes.

• To review and approve the policies and actions being applied by the

group chief executive in remunerating senior executives other than

executive directors to ensure alignment and proportionality.

• To recommend to the board the quantum and structure of remuneration

for the chairman of the board.

The committee operates with a high level of independence. The board

considers all committee members to be independent (see page 121). They

have no personal financial interest, other than as shareholders, in the

committee’s decisions. Each member of the remuneration committee is

subject to annual re-election as a director of the company.

Gerrit Aronson, an independent consultant, is the committee’s

independent adviser as well as secretary. He is engaged directly by the

committee and not by executive management. Advice is also received

from David Jackson, the company secretary, and from the company

secretary’s office, which is independent of executive management and

reports to the chairman of the board.

The committee also appoints external advisers to provide specialist advice

and services on particular remuneration matters. The independence of

the advice is subject to periodic review. In 2011, the committee continued

to engage Towers Watson as its principal external adviser, primarily for

market information. Towers Watson also provided other remuneration and

benefits advice to parts of the group. Freshfields Bruckhaus Deringer LLP

provided legal advice on specific matters to the committee, as well as

providing some legal advice to the group.

The committee values its dialogue with major shareholders

on remuneration matters. The committee is accountable to shareholders

through its annual report on executive directors’ remuneration. It will

consider the outcome of the vote at the AGM on the directors’

remuneration report and take into account the views of shareholders in its

future decisions.

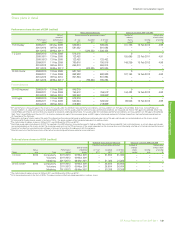

Executive directors’ remuneration 2011

This section contains detail on executive directors’ remuneration including

salary, annual bonus and deferred bonus relating to 2011 and the share

element for the performance period 2009-2011.

Salary

Mr Dudley’s current salary of $1,700,000 was unchanged during 2011.

As reported in last year’s remuneration report, Mr Conn’s and Dr Grote’s

salaries were increased in April 2011 to £730,000 and $1,442,000

respectively, their first increase since 2008.

Annual bonus

Framework

All executive directors were eligible for an overall annual bonus, including

deferral, of 150% of salary at target and a maximum of 225% of salary.

Mr Dudley’s annual bonus was based entirely on group results and

Mr Conn’s and Dr Grote’s based 70% on group results and 30% on their

respective segment and function.

Measures and targets for the annual bonus were set at the start of

the year and were derived from the company’s annual plan which, in turn,

reflected its strategic priorities of reinforcing safety and risk management,

rebuilding trust and reinforcing value creation. Targets are set so that

meeting plan equates to on-target bonus.

At group level, the safety and risk management component

included targets for recordable injury frequency, loss of primary

containment and implementation of change programmes. Rebuilding trust

was focused on external reputation as measured by external surveys and

internal morale as measured by surveys. Finally, the value component

included measures for underlying replacement cost profit, total cash

costs, upstream operating cash and downstream profitability.

Mr Conn’s Refining and Marketing segment similarly included

targets for various safety measures, onstream availability, cost efficiency

and profitability. Dr Grote’s functional segment included measures for IST

compliance, succession and divestments.

Apart from the specific measures set out, the committee may

consider any other results that it deems relevant and apply its judgement

in determining final bonus scores.

Results

Outcomes for the year are summarized in the table below, with a more

detailed explanation following.

2011 bonus measures and outcomes

Key measures for 2011 bonus

Safety and risk management

Below target On target Better than

target

Recordable injury frequency

Loss of primary containment

Implementation of change

programmes

Retaining and building capability

Rebuilding trust

External reputation

Internal alignment and morale

Restoring value

Underlying replacement cost profit

Total cash costs

Upstream operating cash

Refining and Marketing profitability