BP 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 BP Annual Report and Form 20-F 2011

Business review

Exploration and Production

At the end of 2010, as part of our response to the Deepwater Horizon

oil spill, we announced the decision to reorganize the Exploration and

Production segment to create three separate divisions: Exploration,

Developments and Production, integrated through a Strategy and

Integration organization. This structure was established in March 2011

and each of the four parts is led by an executive vice president reporting

directly to the group chief executive. The new organization is designed

to change the way we operate, with a particular focus on managing

risk, delivering common standards and processes and building technical

capability. The new organization has not changed the way we report our

operating segments under IFRS.

The Exploration division is accountable for renewing our resource

base through access, exploration and appraisal. The Developments

division is accountable for the safe and compliant execution of wells

(drilling and completions) and major projects and comprises the global

wells organization and the global projects organization, which were

established in 2011. The Production division is accountable for safe and

compliant operations, including upstream production assets, midstream

transportation and processing activities, and the development of our

resource base. Divisional activities are integrated on a regional basis by a

regional president reporting to the Production division. The Strategy and

Integration organization is accountable for optimization and integration

across the divisions, including the delivery of support from the group’s

finance, procurement and supply chain, human resources, technology and

information technology functions.

From 1 January 2012, the group’s investment in TNK-BP will

be reported as a separate operating segment, rather than within the

Exploration and Production segment, reflecting the way in which the

investment is now managed.

The group safety and operational risk (S&OR) function maintains

our global safety standards. S&OR staff are deployed at the operating level

within the Exploration and Production segment to support the systematic

and disciplined application of those standards. This creates an independent

reporting line, working alongside line management while having the power

to intervene.

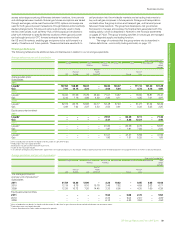

Our Exploration and Production segment included upstream

and midstream activities in 30 countries in 2011, including Angola,

Azerbaijan, Brazil, Canada, Egypt, India, Iraq, Norway, Russia, Trinidad &

Tobago (Trinidad), the UK, the US and other locations within Africa, Asia,

Australasia and South America, as well as gas marketing and trading

activities, primarily in Canada, Europe and the US. Upstream activities

involve oil and natural gas exploration, field development and production.

Our exploration and appraisal programme is currently focused on Angola,

Australia, Azerbaijan, Brazil, Canada, Egypt, the deepwater Gulf of Mexico,

the UK North Sea, Oman and onshore US. Major development areas

include Angola, Australia, Azerbaijan, Canada, Egypt, the deepwater Gulf of

Mexico, North Africa, and the UK North Sea. During 2011, production came

from 24 countries. The principal areas of production are Angola, Argentina,

Azerbaijan, Egypt, Russia, Trinidad, the UAE, the UK and the US.

Midstream activities involve the ownership and management

of crude oil and natural gas pipelines, processing facilities and export

terminals, LNG processing facilities and transportation, and our NGL

extraction businesses in Canada, Indonesia, the US and the UK. Our most

significant midstream pipeline interests are the Trans-Alaska Pipeline

System in the US; the Forties Pipeline System and the Central Area

Transmission System pipeline, both in the UK sector of the North Sea;

the South Caucasus Pipeline, which runs from Azerbaijan through Georgia

to the Turkish border; and the Baku-Tbilisi-Ceyhan pipeline, which runs

through Azerbaijan, Georgia and Turkey. Major LNG activities are located in

Australia, Indonesia and Trinidad. BP is also investing in the LNG business

in Angola.

Additionally, our activities include the marketing and trading of natural gas,

power and natural gas liquids. These activities provide routes into liquid

markets for BP’s produced gas, and generate margins and fees associated

with the provision of physical products and derivatives to third parties and

income from asset optimization and trading.

Our oil and natural gas production assets are located onshore and

offshore and include wells, gathering centres, in-field flow lines, processing

facilities, storage facilities, offshore platforms, export systems (e.g. transit

lines), pipelines and LNG plant facilities.

Upstream operations in Abu Dhabi, Argentina, Bolivia, Chile, Russia,

Venezuela and Vietnam as well as some of our operations in Angola,

Canada, Indonesia and Trinidad are conducted through equity-accounted

entities.

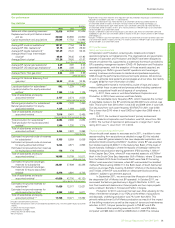

Our market

Energy demand, and in particular oil demand, has followed overall

economic trends in recent years, recovering strongly in 2010 but facing

more challenging conditions in 2011.

Dated Brent for the year averaged $111.26 per barrel, 40%

above 2010’s average of $79.50 per barrel. In 2012, we expect oil price

movements to continue to be driven by the pace of global economic

growth and its resulting implications for oil consumption, and by OPEC

production decisions.

Natural gas prices diverged globally in 2011, reflecting different

regional dynamics. The average US Henry Hub First of Month Index fell

to $4.04/mmBtu, an 8% decrease from 2010, while in Europe prices

increased. Spot gas prices at the UK National Balancing Point increased by

33% to an average of $56.33 pence per therm for 2011.

After a record increase in 2010, global gas consumption growth

moderated in 2011. In the US, economic momentum supported gas use

in the first half of the year and a hot summer raised demand. Yet domestic

production outpaced consumption growth due to further increases in the

availability of shale gas.

In 2012, we expect gas markets to continue to be driven by the

economy, weather, domestic production, LNG supply and reductions in

nuclear power generation following the Fukushima disaster in Japan in

March 2011.

Our strategy

In Exploration and Production, our highest priority is to ensure safe, reliable

and compliant operations worldwide. Our strategy is to invest to grow long-

term value by continuing to build a portfolio of material, enduring positions

in the world’s key hydrocarbon basins with a focus on deepwater, gas

value chains and giant fields. Our strategy is enabled by:

• A continued focus on safety and managing risk.

• Strong relationships built on mutual advantage, deep knowledge of the

basins in which we operate, and technology.

• Building capability along the value chain in Exploration, Developments

and Production.

• Actively managing our portfolio.

We intend to increase investment with a focus on Exploration, a key

source of value creation, and evolve the nature of our relationships,

particularly with national oil companies.