BP 2011 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ remuneration report

146 BP Annual Report and Form 20-F 2011

Remuneration policy for 2012 in more depth

This section contains a more detailed explanation of the components of

total remuneration for executive directors and how they will be

implemented in 2012.

Salary

The committee normally reviews salaries annually, taking into account

other large Europe-based global companies, other oil majors, and relevant

US companies. It also considers salary treatment throughout the company

when determining appropriate increases for executive directors.

Annual bonus

The group strategy provides the context for the company’s annual plan,

from which measures and targets are derived at the start of the year for

senior managers including executive directors. Measures typically include

a range of financial and operating metrics as well as those relating to

safety and environment, and people.

At the end of each year, performance is assessed relative to the

measures and targets established at the start of the year, adjusted for any

material changes in the market environment (predominantly oil prices).

Assessment includes both quantitative and qualitative views as well as

input from the other committees on relevant aspects. The committee

considers that this informed judgement is important to establishing a fair

overall assessment.

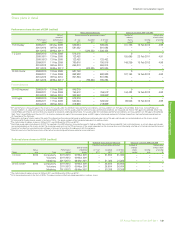

The chart below shows the average annual bonus result (before

any deferral) and relative to an on-target level for executive directors for

the current year and previous five.

200

150

100

50

History of annual bonus results

20072006 2008 200

92

0112010

on-target

average actual result

% of target

For 2012, all executive directors will again be eligible for a total bonus

(including deferral) of 150% of salary at target and 225% at maximum.

Mr Dudley’s bonus will be based entirely on group measures. Mr Conn,

Dr Gilvary and Dr Grote will have 70% of their bonus based on group

results and 30% on their respective segment or function.

The measures used to determine bonus results flow directly from

the group’s annual plan which reflects the strategic priorities of reinforcing

safety and risk management, rebuilding trust, and reinforcing value

creation.

At group level, safety and risk management measures include

recordable injury frequency, loss of primary containment and process

related major incident announcements and high potential incidents.

Rebuilding trust will be measured via surveys to assess both external

reputation and internal staff alignment and morale. Restoring value will

provide the dominant set of measures and include operating cash flow,

underlying replacement cost profit, total cash costs, gearing, divestments,

upstream production efficiency, major project delivery and Refining and

Marketing profitability.

The Refining and Marketing segment will include specific safety

metrics for the segment. Value metrics will include availability, efficiency,

and profitability metrics, as well as divestments and major project

delivery. Finance function measures will include divestments, gearing

and major project delivery. The corporate business function will include

profitability and compliance measures for IST and Alternative Energy.

In all cases, targets for each measure are set so that achieving plan

levels of performance equates to an on-target bonus. As in past years,

in addition to the specific bonus metrics, the committee will also review

the underlying performance of the group in light of competitors’ results,

analysts’ reports and the views of the chairmen of the other committees.

Based on this broader view, the committee can decide to adjust bonuses

where it is warranted and, in exceptional circumstances, to pay no

bonuses.

Deferred bonus

The structure of deferred bonus, paid in shares, places increased focus

on long-term alignment with shareholders, and reinforces the critical

importance of maintaining high safety and environmental standards. It

effectively translates the outcome of a portion of the annual performance

bonus into a long-term plan with additional performance hurdles. As

shown below, the results of 2012 will form the basis for determining the

deferred bonus in 2013.

Timeline for 2012 deferred bonus

2013 20142012 2015 2016

DeferralDeferral

Result of

annual

performance

Result of

annual

performance Vesting

Vesting

Performance period

For 2012, as last year, one-third of the annual bonus will be deferred

into shares for three years and matched by the company on a one-for-

one basis. Under the rules of the plan, the average share price over

the three days following announcement of full-year results is used to

determine the number of shares. Both deferred and matched shares

will vest in February 2016 contingent on an assessment of safety and

environmental sustainability over the three-year deferral period. If the

committee assesses that there has been a material deterioration in safety

and environmental metrics, or there have been major incidents revealing

underlying weaknesses in safety and environmental management, then it

may conclude that shares should vest in part, or not at all. In reaching its

conclusion, the committee will obtain advice from the safety, ethics and

environment assurance committee (SEEAC).

Executive directors may voluntarily defer a further one-third of their

annual bonus into shares, which will be capable of vesting, and will qualify

for matching, on the same basis as set out above. Where shares vest,

the executive director will also receive additional shares representing the

value of the re-invested dividends.

Performance shares

The performance share element reflects the committee’s policy that a

large proportion of total remuneration is tied to long-term performance.

Performance shares are awarded at the start of each year and vesting,

after three years, is based on performance relative to measures and

targets derived from the company’s strategic priorities. Those shares

that vest are then held for a further three-year retention period before

being released to the executive after payment of tax on vesting.

This gives executive directors a six-year incentive structure, which is

designed to ensure their interests are aligned with those of shareholders.

Where shares vest, the executive director will receive additional shares

representing the value of the re-invested dividends.

Timeline for 2012-2014 share element

2012 2013 2014 2015 2016 2017 2018

AwardAward VestingVesting ReleaseRelease

Retention periodPerformance period