BP 2011 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Additional information for shareholders

BP Annual Report and Form 20-F 2011 157

Additional information for shareholders

Contingent liabilities relating to the Gulf of Mexico oil spill

BP has provided for its best estimate of certain claims under the Oil

Pollution Act 1990 (OPA 90) that will be paid through the $20-billion

trust fund, including the increased estimate of the cost of individual and

business claims as a result of the proposed settlement announced on

3 March 2012 as described in Note 2 and Note 36. It is not possible, at

this time, to measure reliably any other items that will be paid from the

trust fund, namely any obligation in relation to Natural Resource Damages

claims (except for the estimated costs of the assessment phase and the

costs relating to emergency and early restoration agreements) and claims

asserted in civil litigation, including any further litigation through potential

opt-outs from the proposed settlement agreement with the Plaintiffs’

Steering Committee announced on 3 March 2012 (see page 76 for further

information), nor is it practicable to estimate their magnitude or possible

timing of payment. Although these items, which will be paid through the

trust fund, have not been provided for at this time, BP’s full obligation

under the $20-billion trust fund was expensed in the income statement in

2010, taking account of the time value of money.

For those items not covered by the trust fund it is not possible to

measure reliably any obligation in relation to other litigation or potential

fines and penalties except, subject to certain assumptions, for those

relating to the Clean Water Act. Therefore no amounts have been provided

for these items as at 31 December 2011. There are a number of federal

and state environmental and other provisions of law, other than the Clean

Water Act, under which one or more governmental agencies could seek

civil fines and penalties from BP. Given the large number of claims that

may be asserted, it is not possible at this time to determine whether and

to what extent any such claims would be successful or what penalties or

fines would be assessed.

Pensions and other post-retirement benefits

Accounting for pensions and other post-retirement benefits involves

judgement about uncertain events, including estimated retirement

dates, salary levels at retirement, mortality rates, rates of return on plan

assets, determination of discount rates for measuring plan obligations,

assumptions for inflation rates, US healthcare cost trend rates and rates of

utilization of healthcare services by US retirees.

These assumptions are based on the environment in each country.

Determination of the projected benefit obligations for the group’s defined

benefit pension and post-retirement plans is important to the recorded

amounts for such obligations on the balance sheet and to the amount of

benefit expense in the income statement. The assumptions used may

vary from year to year, which will affect future results of operations. Any

differences between these assumptions and the actual outcome also

affect future results of operations.

Pension and other post-retirement benefit assumptions are

reviewed by management at the end of each year. These assumptions

are used to determine the projected benefit obligation at the year-end and

hence the surpluses and deficits recorded on the group’s balance sheet,

and pension and other post-retirement benefit expense for the following

year.

The pension and other post-retirement benefit assumptions at

December 2011, 2010 and 2009 are provided in Financial statements –

Note 37 on page 234.

The assumed rate of investment return, discount rate, inflation

rate and the US healthcare cost trend rate have a significant effect on the

amounts reported. A sensitivity analysis of the impact of changes in these

assumptions on the benefit expense and obligation is provided in Financial

statements – Note 37 on page 234.

In addition to the financial assumptions, we regularly review the

demographic and mortality assumptions. Mortality assumptions reflect

best practice in the countries in which we provide pensions and have been

chosen with regard to the latest available published tables adjusted where

appropriate to reflect the experience of the group and an extrapolation of

past longevity improvements into the future. A sensitivity analysis of the

impact of changes in the mortality assumptions on the benefit expense

and obligation is provided in Financial statements – Note 37 on page 234.

Actuarial gains and losses are recognized in full within other

comprehensive income in the year in which they occur.

Property, plant and equipment

BP has freehold and leasehold interests in real estate in numerous

countries, but no individual property is significant to the group as a whole.

See Exploration and Production on page 80 for a description of the group’s

significant reserves and sources of crude oil and natural gas. Significant

plans to construct, expand or improve specific facilities are described under

each of the business headings within this section.

Share ownership

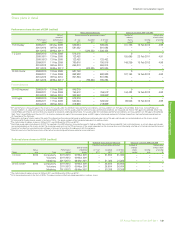

Directors and senior management

As at 1 March 2012, the following directors of BP p.l.c. held interests in BP

ordinary shares of 25 cents each or their calculated equivalent as set out

below:

Director

Ordinary

shares

Performance

sharesaRestricted

sharesb

C-H Svanberg 933,971 – –

R W Dudley 337,301c1,911,414c–

P M Anderson 6,000c– –

F L Bowman 12,720c– –

A Burgmans 10,156 – –

C B Carroll 10,500c– –

Sir William Castell 82,500 – –

I C Conn 497,501d1,322,606 133,452b

G David 579,000c– –

I E L Davis 10,391 – –

Professor Dame Ann Dowling – – –

Dr B Gilvary 331,088 45,000 269,145e

Dr B E Grote 1,484,603f1,693,704c–

B R Nelson 11,040 – –

F P Nhleko – – –

A Shilston – – –

a

Performance shares awarded under the BP Executive Directors’ Incentive Plan. These figures

represent the maximum possible vesting levels. The actual number of shares/ADSs that vest

will depend on the extent to which performance conditions have been satisfied over a three-year

period.

b Restricted share award under the BP Executive Directors’ Incentive Plan. These shares will vest in

2013, subject to the director’s continued service and satisfactory performance.

c

Held as ADSs.

d

Includes 48,024 shares held as ADSs.

e

Held as restricted share units under the BP Deferred Annual Bonus Plan and the BP Executive

Performance Plan.

f

Held as ADSs, except for 94 shares held as ordinary shares.

As at 1 March 2012, the following directors of BP p.l.c. held options under

the BP group share option schemes for ordinary shares or their calculated

equivalent as set out below:

Director Options

R W Dudleya107,010

I C Conn 3,622

Dr B Gilvary 504,191

Dr B E Grotea–

a Held as ADSs.

There are no directors or members of senior management who own more

than 1% of the ordinary shares outstanding. At 1 March 2012, all directors

and senior management as a group held interests in 10,760,373 ordinary

shares or their calculated equivalent, 5,536,676 performance shares or

their calculated equivalent and 7,575,135 options for ordinary shares or

their calculated equivalent under the BP group share options schemes.

Additional details regarding the options granted and performance

shares awarded can be found in the Directors’ remuneration report on

pages 139-151.