BP 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94 BP Annual Report and Form 20-F 2011

Business review

Refining and Marketing

Our Refining and Marketing segment is responsible for the refining,

manufacturing, marketing, transportation, and supply and trading of crude

oil, petroleum, petrochemicals products and related services to wholesale

and retail customers. We have significant operations in Europe, North

America and Asia, and we also manufacture and market our products

across Australasia, southern Africa and Central and South America; in total

we market our products in more than 70 countries.

The segment operates hydrocarbon value chains covering three

main businesses: fuels, lubricants and petrochemicals. Previously we

referred to lubricants and petrochemicals as international businesses, but

to provide greater transparency of the performance of these businesses

we are now providing our financial information separately for fuels,

lubricants and petrochemicals.

The fuels businesses sell refined petroleum products including

gasoline, diesel, aviation fuel and liquefied petroleum gas (LPG). Within

this, the fuels value chains (FVCs) integrate the activities of refining,

logistics, marketing, and supply and trading on a regional basis. This

recognizes the geographic nature of the markets in which we compete,

providing the opportunity to optimize our activities from crude oil purchases

to end-consumer sales through our physical assets (refineries, terminals,

pipelines and retail stations). In addition, we operate a global aviation fuels

marketing business and an LPG marketing business.

Our lubricants business is involved in manufacturing and marketing

lubricants and related services to markets around the world. We market

lubricants to the automotive, industrial, marine, aviation and energy

markets through our key brands of Castrol, BP and Aral. Our Castrol brand

is a highly recognized and popular lubricant brand worldwide. Distinctive

brands, cutting-edge technology and building and sustaining customer

relationships are cornerstones to our approach to market and underpin our

success. We are particularly strong in Europe and key Asia Pacific markets

including India.

Our petrochemicals business operates on a global basis and

includes the manufacture and marketing of petrochemicals that are

used in many everyday products, such as plastic bottles and textiles for

clothing. Technology is at the heart of our business and we own proprietary

world class technology for each of our main products. Our technological

advantage, operational experience and project execution track record

has made us an attractive partner which leads to material and distinctive

growth opportunities. Petrochemicals growth is focused on the demand

centre of Asia.

Our market

Overall world economic growth slowed in 2011, as did growth in world

oil consumption. Global oil demand grew by 0.7 million b/d, but in the

OECD, demand contracted again after growing for the first time in five

years in 2010. By contrast, there was demand growth in Australia and

Japan, where oil partially replaced nuclear power after the earthquake and

tsunami. Aggregate OECD oil demand in 2011 was 4.3 million b/d below

the 2005 peak.

The annual average BP refining marker margin (RMM) in 2011 was

16% higher than in 2010, averaging $11.64 per barrel. Margins followed

a typical seasonal pattern, with a peak in the second quarter in the run-up

to the summer driving season. The RMM is an environmental indicator,

similar to those used by many of our competitors, and is weighted

regionally based on our refining capacity in that part of the world. Each

regional marker margin is based upon product yields and a marker crude oil

deemed appropriate for the region.

The RMM uses regional crack spreads to calculate the margin

indicator, and does not include estimates of fuel costs and other variable

costs. The RMMs may not be representative of the margins achieved by

BP in any period because of BP’s particular refinery configurations and

crude and product slate. However, the RMM is useful for understanding

the indicative refining margin environment that is available to refiners in

each region.

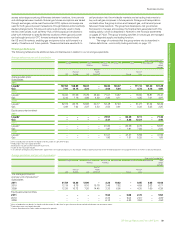

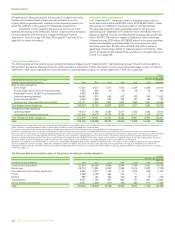

$ per barrel

Crude marker 2011 2010 2009

Refining marker margin (RMM)

US West Coast ANS 13.63 13.09 13.40

US Gulf Coast Mars 11.87 10.17 9.16

US Midwest LLS 7.46 6.00 6.02

Northwest Europe Brent 11.85 10.36 8.95

Mediterranean Azeri Light 9.03 8.82 7.93

Singapore Dubai/Tapis blend 14.57 10.69 8.51

BP Average RMM 11.64 10.02 9.19

In 2011, refining margins increased in all the main US regions, despite a

contraction in domestic gasoline demand, with reduced gasoline import

volumes compensated for by higher domestic crude runs.

In Europe, where diesel accounts for a large proportion of regional

consumption, refining margins increased for a second year running despite

the loss of Libyan sweet crude supplies for much of the year, as demand

for commercial transport improved.

Refining margins also improved in Asia Pacific, averaging

$14.57 per barrel due to continuing oil demand growth and the disruption

to Japanese refining operations caused by the earthquake and tsunami.

US mid-continent crude oils (including West Texas Intermediate

(WTI)) were heavily discounted throughout the year because of increasing

production in the US mid-continent and Canada, coupled with constrained

infrastructure for crude transportation. This particularly benefited BP’s

location-advantaged refineries of Toledo and Whiting in the US Midwest.

In addition, fuel oil price discounts versus crude oil widened in 2011,

benefiting our highly upgraded refineries that produce relatively little

fuel oil.

In oil markets in 2011, supply was hampered by geo-political

issues and a series of technical problems in non-OPEC crude production.

This supply deficit brought OECD stocks down from historical highs to

near-average levels within the first nine months of the year. After very low

volatility levels in the second half of 2009 and in 2010, 2011 saw a return

towards more average volatility.

In lubricants, we saw modest improvement in demand for the

automotive and industrial sectors early in the year, but this came under

increasing pressure as the year progressed and by the fourth quarter

demand was declining in many geographies. Base oil prices rose markedly

in the first half of the year, increasing our input costs. We continued to

see a gradual shift towards higher-quality and higher-margin premium and

synthetic lubricants.

In the first half of 2011, the petrochemicals margin environment

was markedly different from the second half, due to strong demand

for purified terephthalic acid (PTA) coupled with supply interruptions in

both PTA and paraxylene (PX) leading to robust margins. In contrast the

second half of the year saw the installed capacity run normally along with

significant new capacity coming onstream. In addition concerns over the

global economy affected demand, leading to a rapid reduction in margins.

Acetic acid had a similar margin profile to PTA with supply interruptions in

the first half leading to higher margins followed by weaker margins in the

second half of the year as additional capacity came onstream.

Our strategy

Refining and Marketing is the product and service-led arm of BP, focused

on fuels, lubricants and petrochemicals products and related services. We

aim to be excellent in the markets in which we choose to participate –

those that allow BP to serve the major energy markets of the world. We

pursue competitive returns and sustainable growth, underpinned by safe

manufacturing operations and technology, as we serve customers and

promote BP and our brands through high-quality products.

We are focused on a consistent set of priorities executed in a

systematic and disciplined way. These priorities begin with safety and

include excellence of execution, portfolio quality and integration and

growing margin share via exposure to growth. This is all underpinned by a

disciplined financial framework. We believe that we now have a platform

to sustain a world-class downstream business, which will enable us to be

a leader in each of our chosen markets. Over time, we expect to shift the