BP 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ remuneration report

Directors’ remuneration report

BP Annual Report and Form 20-F 2011 143

Safety and risk management performance was strong with most targets

exceeded. Loss of primary containment showed a 14% reduction on

the number of incidents that occurred in the previous year and process

safety related high potential incidents dropped 26% – both metrics

are important indicators of process safety performance. Recordable

injury frequency was better than target. A major change programme

related to safety and risk management progressed very well. A central

part of this was the completed implementation of the safety and

operational risk function as a group-wide organization independent of line

management. The change programme also included a major upstream

reorganization, the introduction of a contractor management process,

global rollout of a values and behaviours charter, implementation of a new

individual performance and reward framework and completion of a risk

management review.

Rebuilding trust showed some early signs of improvement but

with clear work remaining to be done related to the long-term impact

of the Deepwater Horizon oil spill. Independent external surveys

reflect some recovery of trust and reputation in key markets as the

year progressed. Internal employee alignment and morale remained

encouragingly strong through a difficult period for the company. Employee

satisfaction, as measured by survey, was near pre-Deepwater Horizon

levels and a new ‘progress index’ was implemented to track specific

employee alignment related to the company’s strategic priorities.

Rebuilding value measures were at or near target. Relative to

target, underlying replacement cost profit was around 90% and total cash

costs were 7% above. Upstream operating cash was some 3% better

than target and Refining and Marketing profitability met its plan level.

Refining and Marketing had a strong year overall with record earnings,

good safety, and high utilization availability.

Based on these results, the committee assessed group

performance to be on-target. Mr Dudley therefore received a total bonus

of 150% of salary including deferral, reflecting on-target performance.

Mr Conn’s total bonus of 165% of salary reflected achievements above

target for the Refining and Marketing segment. Dr Grote’s total bonus of

150% of salary reflects on-target results at both group and function level.

Of the total bonuses referred to above, one-third is paid in cash,

one-third is deferred on a mandatory basis and one-third is paid either

in cash or voluntarily deferred at the individual’s discretion. Amounts, as

received by the individuals, are shown in the table on page 141.

Deferred bonus

One-third of the total bonus awarded to the executive directors is deferred

into shares on a mandatory basis under the terms of the deferred bonus

element. Their deferred shares are matched on a one-for-one basis

and will vest in three years contingent on an assessment of safety and

environmental sustainability over the three-year deferral period.

Individuals may elect to defer an additional one-third into shares

on the same basis as the mandatory deferral. All three executive directors

chose to participate in the voluntary deferral. Again this is reflected in the

table on page 141.

All deferred bonuses will be converted to shares based on the

average price of BP shares over the three days following the company’s

announcement of 2011 results (£4.91/share, $46.70/ADS).

2009-2011 share element

Framework

Performance shares were awarded to each executive director in early

2009 with vesting after three years dependent on performance relative

to measures reflecting the company’s strategic priorities at the time. For

the 2009 plan, vesting was based 50% on total shareholder return (TSR)

versus the oil majors, and 50% on a balanced scorecard of underlying

performance factors versus the same peers. The underlying performance

factors were production growth, Refining and Marketing profitability, and

underlying net income growth. The peer group included ExxonMobil,

Shell, Total, Chevron and ConocoPhillips. Vesting was set at 100%, 70%

and 35% for performance equivalent to first, second, and third rank

respectively and none for fourth or fifth place.

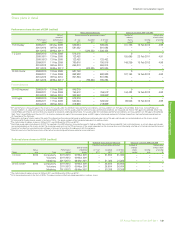

Salary

Cash bonus

Deferred bonus (before match)

Share element vesting

R W Dudley

Salary

Cash bonus

Deferred bonus (before match)

Share element vesting

Salary

Cash bonus

Deferred bonus (before match)

Share element vesting

I C Conn

Dr B E Grote

$1,700

$850

$1,700

$688

£720

£396

£792

£626

$1,427

$713

$1,427

$1,267

thousand

2011 total remuneration outcomes

Results

Reflecting the impact of the Deepwater Horizon oil spill, the TSR,

production growth and net income growth measures for the three-year

period 2009-2011 were all below the third place required for vesting.

Refining and Marketing profitability was strong and based on a first

place ranking achieved full vesting for that portion. Based on the agreed

formula, this resulted in a vesting of 16.67% of the original award.

The committee considered this result was a fair reflection of

overall performance over the period. The resulting shares and value of the

vesting is shown in the table on page 149.

2011 total remuneration outcomes

The charts below summarize the actual total remuneration outcome of

2011 for each of the executive directors.

The salary is the amount actually received during the year and

the cash bonus reflects the portion of total bonus for 2011 that is

received in cash.

The deferred bonus reflects that portion of total bonus for 2011

that is deferred, either on a mandatory or voluntary basis. The value

shown is converted to shares, matched one-for-one and vests after three

years contingent on the review of safety and environmental sustainability

over the three years.

Finally the share element portion reflects the value of the vesting

that occurred for the 2009-2011 plan. These shares now enter a further

three-year retention period before they are released to the individual.