BP 2011 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements

BP Annual Report and Form 20-F 2011 217

Notes on financial statements

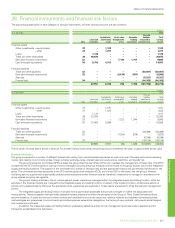

26. Financial instruments and financial risk factors

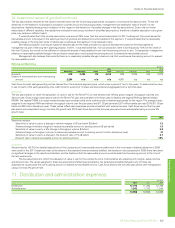

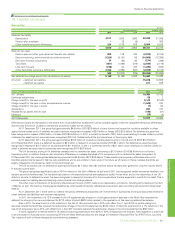

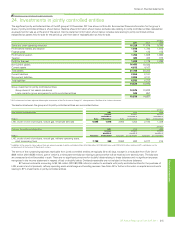

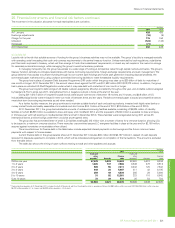

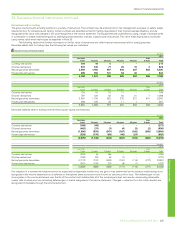

The accounting classification of each category of financial instruments, and their carrying amounts, are set out below.

$ million

At 31 December 2011

Note

Loans and

receivables

Available-for-

sale financial

assets

At fair value

through profit

or loss

Derivative

hedging

instruments

Financial

liabilities

measured at

amortized cost

Total

carrying

amount

Financial assets

Other investments – equity shares 27 – 1,128 –––1,128

– other 27 – 1,277 –––1,277

Loans 1,128 ––––1,128

Trade and other receivables 29 36,879 ––––36,879

Derivative financial instruments 33 – – 7,188 1,707 –8,895

Cash and cash equivalents 30 9,750 4,317 –––14,067

Financial liabilities

Trade and other payables 32 – – – – (50,651) (50,651)

Derivative financial instruments 33 – – (6,436) (557) –(6,993)

Accruals ––––(6,321) (6,321)

Finance debt 34 – – – – (44,183) (44,183)

47,757 6,722 752 1,150 (101,155) (44,774)

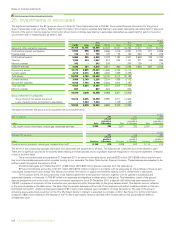

$ million

At 31 December 2010

Note

Loans and

receivables

Available-for-

sale financial

assets

At fair value

through profit

or loss

Derivative

hedging

instruments

Financial

liabilities

measured at

amortized cost

Total

carrying

amount

Financial assets

Other investments – equity shares 27 – 1,191 –––1,191

– other 27 – 1,532 –––1,532

Loans 1,141 ––––1,141

Trade and other receivables 29 32,380 – – – – 32,380

Derivative financial instruments 33 – – 7,222 1,344 –8,566

Cash and cash equivalents 30 13,462 5,094 – – – 18,556

Financial liabilities

Trade and other payables 32 – – – – (56,499) (56,499)

Derivative financial instruments 33 – – (7,254) (279) –(7,533)

Accruals ––––(6,249) (6,249)

Finance debt 34 – – – – (39,139) (39,139)

46,983 7,817 (32) 1,065 (101,887) (46,054)

The fair value of finance debt is shown in Note 34. For all other financial instruments, the carrying amount is either the fair value, or approximates the fair value.

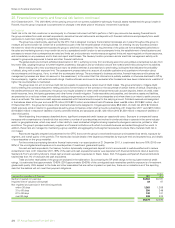

Financial risk factors

The group is exposed to a number of different financial risks arising from natural business exposures as well as its use of financial instruments including:

market risks relating to commodity prices, foreign currency exchange rates, interest rates and equity prices; credit risk; and liquidity risk.

The group financial risk committee (GFRC) advises the group chief financial officer (CFO) who oversees the management of these risks. The GFRC

is chaired by the CFO and consists of a group of senior managers including the group treasurer and the heads of the group finance, tax and the integrated

supply and trading functions. The purpose of the committee is to advise on financial risks and the appropriate financial risk governance framework for the

group. The committee provides assurance to the CFO and the group chief executive (GCE), and via the GCE to the board, that the group’s financial

risk-taking activity is governed by appropriate policies and procedures and that financial risks are identified, measured and managed in accordance with

group policies and group risk appetite.

The group’s trading activities in the oil, natural gas and power markets are managed within the integrated supply and trading function, while the

activities in the financial markets are managed by the integrated supply and trading function, on behalf of the treasury function. All derivative activity is

carried out by specialist teams that have the appropriate skills, experience and supervision. These teams are subject to close financial and management

control.

The integrated supply and trading function maintains formal governance processes that provide oversight of market risk associated with

trading activity. These processes meet generally accepted industry practice and reflect the principles of the Group of Thirty Global Derivatives Study

recommendations. A policy and risk committee monitors and validates limits and risk exposures, reviews incidents and validates risk-related policies,

methodologies and procedures. A commitments committee approves value-at-risk delegations, the trading of new products, instruments and strategies

and material commitments.

In addition, the integrated supply and trading function undertakes derivative activity for risk management purposes under a separate control

framework as described more fully below.