BP 2011 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300

|

|

Financial statements

BP Annual Report and Form 20-F 2011 235

Notes on financial statements

37. Pensions and other post-retirement benefits continued

Our assumptions for the rate of increase in salaries are based on our inflation rate assumption plus an allowance for expected long-term real salary

growth. These include allowance for promotion-related salary growth, of between 0.3% and 0.4% depending on country.

In addition to the financial assumptions, we regularly review the demographic and mortality assumptions. The mortality assumptions reflect best

practice in the countries in which we provide pensions, and have been chosen with regard to the latest available published tables adjusted where appropri-

ate to reflect the experience of the group and an extrapolation of past longevity improvements into the future. BP’s most substantial pension liabilities are

in the UK, the US and Germany where our mortality assumptions are as follows:

Years

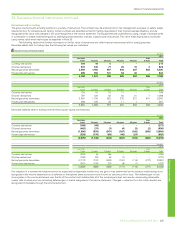

Mortality assumptions UK US Germany

2011 2010 2009 2011 2010 2009 2011 2010 2009

Life expectancy at age 60 for a

male currently aged 60 27.6 26.1 26.0 24.8 24.7 24.6 23.5 23.3 23.2

Life expectancy at age 60 for a

male currently aged 40 30.5 29.1 29.0 26.3 26.2 26.1 26.3 26.2 26.1

Life expectancy at age 60 for a

female currently aged 60 29.3 28.7 28.6 26.4 26.3 26.3 28.0 27.9 27.8

Life expectancy at age 60 for a

female currently aged 40 32.0 31.6 31.5 27.3 27.2 27.2 30.7 30.6 30.4

Our assumption for future US healthcare cost trend rate for the first year after the reporting date reflects the rate of actual cost increases seen in recent

years. The ultimate trend rate reflects our long-term expectations of the level at which cost inflation will stabilize based on past healthcare cost inflation

seen over a longer period of time. The assumed future US healthcare cost trend rate assumptions are as follows:

%

2011 2010 2009

First year’s US healthcare cost trend rate 7.6 7.8 8.0

Ultimate US healthcare cost trend rate 5.0 5.0 5.0

Year in which ultimate trend rate is reached 2020 2018 2016

Pension plan assets are generally held in trusts. The primary objective of the trusts is to accumulate pools of assets sufficient to meet the obligations of

the various plans. The assets of the trusts are invested in a manner consistent with fiduciary obligations and principles that reflect current practices in

portfolio management.

A significant proportion of the assets are held in equities, owing to a higher expected level of return over the long term with an acceptable level of

risk. In order to provide reasonable assurance that no single security or type of security has an unwarranted impact on the total portfolio, the investment

portfolios are highly diversified. The long-term asset allocation policy for the major plans is as follows:

UK US Other

Asset category % % %

Total equity 73 70 17-63

Bonds/cash 20 30 25-75

Property/real estate 7 – 0-10

Some of the group’s pension plans use derivative financial instruments as part of their asset mix and to manage the level of risk. The group’s main pen-

sion plans do not invest directly in either securities or property/real estate of the company or of any subsidiary.

Return on asset assumptions reflect the group’s expectations built up by asset class and by plan. The group’s expectation is derived from

a combination of historical returns over the long term and the forecasts of market professionals. Our assumption for return on equities is based on a

long-term view, and the size of the resulting equity risk premium over government bond yields is reviewed each year for reasonableness. Our assumption

for return on bonds reflects the portfolio mix of government fixed-interest, index-linked and corporate bonds.