BP 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 BP Annual Report and Form 20-F 2011

Business review

BP believes that, taking into account the amounts of undrawn borrowing

facilities and increased levels of cash and cash equivalents, and the

ongoing ability to generate cash, including further disposal proceeds, the

group has sufficient working capital for foreseeable requirements.

Uncertainty remains regarding the amount and timing of future

expenditures relating to the Deepwater Horizon oil spill and the implications

for future activities. See Risk factors on pages 59-63, and Financial

statements – Note 2 on page 190, Note 36 on page 231 and Note 43 on

page 249 for further information.

Off-balance sheet arrangements

At 31 December 2011, the group’s share of third-party finance debt of

equity-accounted entities was $7,003 million (2010 $6,987 million). These

amounts are not reflected in the group’s debt on the balance sheet.

The group has issued third-party guarantees under which amounts

outstanding at 31 December 2011 are $415 million (2010 $404 million) in

respect of liabilities of jointly controlled entities and associates and $1,430

million (2010 $1,339 million) in respect of liabilities of other third parties.

Of these amounts, $220 million (2010 $355 million) of the jointly controlled

entities and associates guarantees relate to borrowings and for other

third-party guarantees, $1,267 million (2010 $1,324 million) relates to

guarantees of borrowings. Details of operating lease commitments, which

are not recognized on the balance sheet, are shown in the table below and

in Note 14 on page 208.

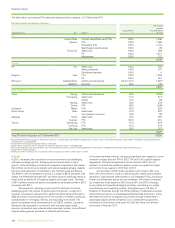

Contractual commitments

The following table summarizes the group’s principal contractual obligations at 31 December 2011, distinguishing between those for which a liability is

recognized on the balance sheet and those for which no liability is recognized. Further information on borrowings and finance leases is given in Financial

statements – Note 34 on page 229 and more information on operating leases is given in Financial statements – Note 14 on page 208.

$ million

Payments due by period

Expected payments by period under contractual

obligations and commercial commitments Total 2012 2013 2014 2015 2016

2017 and

thereafter

Balance sheet obligations

Borrowingsa47,242 9,570 7,812 7,262 5,438 4,586 12,574

Finance lease future minimum lease payments 1,034 454 54 49 49 48 380

Deepwater Horizon Oil Spill Trust funding liability 4,884 4,884 – – – – –

Decommissioning liabilitiesb19,693 610 546 433 305 346 17,453

Environmental liabilitiesb3,646 1,665 588 232 187 192 782

Pensions and other post-retirement benefitsc29,171 1,945 1,933 1,944 1,938 1,921 19,490

Total balance sheet obligations 105,670 19,128 10,933 9,920 7,917 7,093 50,679

Off-balance sheet obligations

Operating leasesd16,072 4,182 3,286 2,207 1,630 1,223 3,544

Unconditional purchase obligationse197,404 115,679 18,155 12,388 8,311 7,168 35,703

Total off-balance sheet obligations 213,476 119,861 21,441 14,595 9,941 8,391 39,247

Total 319,146 138,989 32,374 24,515 17,858 15,484 89,926

a Expected payments include interest payments on borrowings totalling $3,751 million ($896 million in 2012, $746 million in 2013, $582 million in 2014, $443 million in 2015, $333 million in 2016 and $751

million thereafter), and exclude disposal deposits of $30 million included in current finance debt on the balance sheet.

b The amounts are undiscounted. Environmental liabilities include those relating to the Gulf of Mexico oil spill, including liabilities for spill response costs.

c Represents the expected future contributions to funded pension plans and payments by the group for unfunded pension plans and the expected future payments for other post-retirement benefits.

d The future minimum lease payments are before deducting related rental income from operating sub-leases. In the case of an operating lease entered into solely by BP as the operator of a jointly controlled

asset, the amounts shown in the table represent the net future minimum lease payments, after deducting amounts reimbursed, or to be reimbursed, by joint venture partners. Where BP is not the

operator of a jointly controlled asset BP’s share of the future minimum lease payments are included in the amounts shown, whether BP has co-signed the lease or not. Where operating lease costs are

incurred in relation to the hire of equipment used in connection with a capital project, some or all of the cost may be capitalized as part of the capital cost of the project.

e Represents any agreement to purchase goods or services that is enforceable and legally binding and that specifies all significant terms. The amounts shown include arrangements to secure long-term

access to supplies of crude oil, natural gas, feedstocks and pipeline systems. In addition, the amounts shown for 2012 include purchase commitments existing at 31 December 2011 entered into

principally to meet the group’s short-term manufacturing and marketing requirements. The price risk associated with these crude oil, natural gas and power contracts is discussed in Financial statements

– Note 26 on page 217.

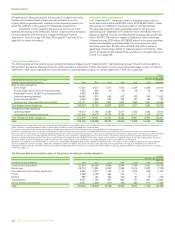

The following table summarizes the nature of the group’s unconditional purchase obligations.

$ million

Payments due by period

Unconditional purchase obligations Total 2012 2013 2014 2015 2016

2017 and

thereafter

Crude oil and oil products 130,824 90,690 9,095 5,684 3,344 2,853 19,158

Natural gas 38,370 17,591 5,258 3,589 2,516 2,087 7,329

Chemicals and other refinery feedstocks 9,962 2,573 1,129 1,115 1,028 979 3,138

Power 3,038 2,169 644 212 11 2 –

Utilities 892 181 154 106 97 75 279

Transportation 8,061 1,183 957 926 731 661 3,603

Use of facilities and services 6,257 1,292 918 756 584 511 2,196

Total 197,404 115,679 18,155 12,388 8,311 7,168 35,703