BP 2011 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements

BP Annual Report and Form 20-F 2011 231

Notes on financial statements

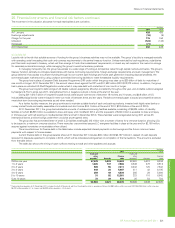

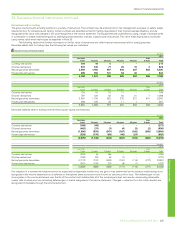

36. Provisions

$ million

Decommissioning Environmental Spill response

Litigation and

claims

Clean Water

Act penalties Other Total

At 1 January 2011 10,544 2,465 1,043 11,967 3,510 2,378 31,907

Exchange adjustments (27) (4) –(13) –(12) (56)

Acquisitions 163 – – 9 – 118 290

New or increased provisions 4,596 1,677 586 3,821 –1,145 11,825

Write-back of unused provisions (1) (140) –(92) –(416) (649)

Unwinding of discount 195 27 –15 – 6 243

Change in discount rate 3,211 90 –45 –10 3,356

Utilization (342) (840) (1,293) (4,715) –(876) (8,066)

Reclassified as liabilities directly associated

with assets held for sale (51) –––––(51)

Deletions (1,048) (11) –(61) –(37) (1,157)

At 31 December 2011 17,240 3,264 336 10,976 3,510 2,316 37,642

Of which – current 596 1,375 282 8,518 –467 11,238

– non-current 16,644 1,889 54 2,458 3,510 1,849 26,404

$ million

Decommissioning Environmental Spill response

Litigation and

claims

Clean Water

Act penalties Other Total

At 1 January 2010 9,020 1,719 –1,076 –2,815 14,630

Exchange adjustments (114) – – (7) –(50) (171)

Acquisitions 188 – – 2 – 15 205

New or increased provisions 1,800 1,290 10,883 15,171 3,510 808 33,462

Write-back of unused provisions (12) (120) –(51) –(466) (649)

Unwinding of discount 168 29 –18 –19 234

Change in discount rate 444 22 – 9 – (6) 469

Utilization (164) (460) (9,840) (4,250) –(755) (15,469)

Reclassified as liabilities directly associated

with assets held for sale (381) (1) –––(1) (383)

Deletions (405) (14) –(1) –(1) (421)

At 31 December 2010 10,544 2,465 1,043 11,967 3,510 2,378 31,907

Of which – current 432 635 982 7,011 –429 9,489

– non-current 10,112 1,830 61 4,956 3,510 1,949 22,418

The group makes full provision for the future cost of decommissioning oil and natural gas wells, facilities and related pipelines on a discounted basis upon

installation. The provision for the costs of decommissioning these wells, production facilities and pipelines at the end of their economic lives has been

estimated using existing technology, at current prices or future assumptions, depending on the expected timing of the activity, and discounted using a real

discount rate of 0.5% (2010 1.5%). These costs are generally expected to be incurred over the next 30 years. While the provision is based on the best

estimate of future costs and the economic lives of the facilities and pipelines, there is uncertainty regarding both the amount and timing of these costs.

Provisions for environmental remediation are made when a clean-up is probable and the amount of the obligation can be estimated reliably.

Generally, this coincides with commitment to a formal plan of action or, if earlier, on divestment or on closure of inactive sites. The provision for

environmental liabilities has been estimated using existing technology, at current prices and discounted using a real discount rate of 0.5% (2010 1.5%).

The majority of these costs are expected to be incurred over the next 10 years. The extent and cost of future remediation programmes are inherently

difficult to estimate. They depend on the scale of any possible contamination, the timing and extent of corrective actions, and also the group’s share of

the liability.

The litigation category includes provisions for matters related to, for example, commercial disputes, product liability, and allegations of exposures

of third parties to toxic substances. Included within the other category at 31 December 2011 are provisions for deferred employee compensation of

$666 million (2010 $728 million). These provisions are discounted using either a nominal discount rate of 2.5% (2010 3.75%) or a real discount rate of

0.5% (2010 1.5%), as appropriate.

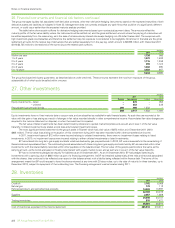

Provisions relating to the Gulf of Mexico oil spill

The Gulf of Mexico oil spill is described on pages 76 to 79 and in Note 2. Provisions relating to the Gulf of Mexico oil spill, included in the table above, are

separately presented below:

$ million

Environmental Spill response

Litigation and

claims

Clean Water

Act penalties Total

At 1 January 2011 809 1,043 10,973 3,510 16,335

New or increased provisions 1,167 586 3,430 –5,183

Unwinding of discount 6 – – – 6

Change in discount rate 17 – – – 17

Utilization (482) (1,293) (4,433) –(6,208)

At 31 December 2011 1,517 336 9,970 3,510 15,333

Of which – current 961 282 8,194 –9,437

– non-current 556 54 1,776 3,510 5,896

Of which – payable from the trust fund 1,066 –8,809 –9,875

http://www.bp.com/downloads/provisions