BP 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Form 20-F 2011 81

Business review: BP in more depth

Business review

Our performance

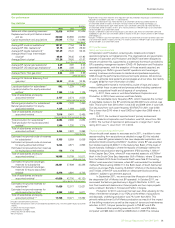

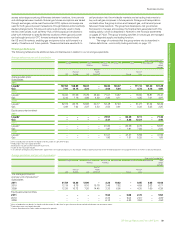

Key statistics

$ million

2011 2010 2009

Sales and other operating revenuesa75,475 66,266 57,626

Replacement cost profit before interest

and tax 30,500 30,886 24,800

Capital expenditure and acquisitions 25,535 17,753 14,896

$ per barrel

Average BP crude oil realizationsb107.91 77.54 59.86

Average BP NGL realizationsb51.18 42.78 29.60

Average BP liquids realizationsb c 101.29 73.41 56.26

Average West Texas Intermediate

oil priced95.04 79.45 61.92

Average Brent oil priced111.26 79.50 61.67

$ per thousand cubic feet

Average BP natural gas realizationsb4.69 3.97 3.25

Average BP US natural gas realizationsb3.34 3.88 3.07

$ per million British thermal units

Average Henry Hub gas pricee4.04 4.39 3.99

pence per therm

Average UK National Balancing Point

gas priced56.33 42.45 30.85

thousand barrels per day

Liquids production for subsidiariesc f 992 1,229 1,400

Liquids production for equity-accounted

entitiesc f 1,165 1,145 1,135

Total of subsidiaries and equity-

accounted entitiesc f 2,157 2,374 2,535

million cubic feet per day

Natural gas production for subsidiariesf6,393 7,332 7,450

Natural gas production for equity-

accounted entitiesf1,125 1,069 1,035

Total of subsidiaries and equity-

accounted entitiesf7,518 8,401 8,485

thousand barrels of oil equivalent per day

Total production for subsidiariesf g 2,094 2,492 2,684

Total production for equity-accounted

entitiesf g 1,360 1,330 1,314

Total of subsidiaries and equity-

accounted entitiesf g 3,454 3,822 3,998

million barrels

Estimated net proved crude oil reserves

for subsidiariesc h 5,153 5,559 5,658

Estimated net proved crude oil reserves

for equity-accounted entitiesc i 5,234 4,971 4,853

Estimated net proved bitumen reserves

for equity-accounted entities 178 179 –

Total of subsidiaries and equity-

accounted entitiesc h i 10,565 10,709 10,511

billion cubic feet

Estimated net proved natural gas

reserves for subsidiariesj36,381 37,809 40,388

Estimated net proved natural gas

reserves for equity-accounted

entitiesk5,278 4,891 4,742

Total of subsidiaries and equity-

accounted entitiesj k 41,659 42,700 45,130

million barrels of oil equivalent

Estimated net proved reserves for

subsidiariesh j 11,426 12,077 12,621

Estimated net proved reserves for

equity-accounted entitiesi k 6,322 5,994 5,671

Total of subsidiaries and equity-

accounted entitiesh i j k 17,748 18,071 18,292

a Includes sales between businesses.

b Realizations are based on sales of consolidated subsidiaries only, which excludes equity-accounted

entities.

c Crude oil and natural gas liquids.

d All traded days average.

e Henry Hub First of Month Index.

f Net of royalties.

g Expressed in thousands of barrels of oil equivalent per day (mboe/d). Natural gas is converted to oil

equivalent at 5.8 billion cubic feet = 1 million barrels.

h Includes 20 million barrels (22 million barrels at 31 December 2010 and 23 million barrels at

31 December 2009) in respect of the 30% minority interest in BP Trinidad and Tobago LLC.

i Includes 310 million barrels (254 million barrels at 31 December 2010 and 243 million barrels at

31 December 2009) in respect of the 7.37% minority interest in TNK-BP (7.03% at 31 December

2010 and 6.86% at 31 December 2009).

j Includes 2,759 billion cubic feet of natural gas (2,921 billion cubic feet at 31 December 2010 and

3,068 billion cubic feet at 31 December 2009) in respect of the 30% minority interest in BP Trinidad

and Tobago LLC.

k Includes 174 billion cubic feet (137 billion cubic feet at 31 December 2010 and 131 billion cubic feet

at 31 December 2009) in respect of the 6.27% minority interest in TNK-BP (7.03% at 31 December

2010 and 6.86% at 31 December 2009).

2011 performance

Safety and operational risk

In Exploration and Production, ensuring safe, reliable and compliant

operations remains our highest priority. The organizational and governance

changes in Exploration and Production and S&OR have been designed to

ensure we achieve this, supported by a systematic framework provided by

BP’s operating management system (OMS). All Exploration and Production

operated businesses, with the exception of those recently acquired, are

now applying our OMS to govern their BP operations and have begun

working to achieve conformance to standards and practices required by

OMS through the performance improvement cycle process. We continue

to work to enhance local systems and processes at all our sites. See Safety

on pages 65-66 for more information on OMS.

Safety performance is monitored by a suite of input and output

metrics which focus on personal and process safety including operational

integrity, occupational health and all aspects of compliance.

In 2011, there were no workforce fatalities in Exploration and

Production. In 2010, there was one workforce fatality.

The recordable injury frequency (RIF), which measures the number

of recordable injuries to the BP workforce per 200,000 hours worked, was

0.30. This is lower than 2010 when it was 0.32 and 2009 when it was 0.39.

Our day away from work case frequency (DAFWCF) in 2011 was 0.060.

This is lower than 2010 when it was 0.063 but higher than 2009 when it

was 0.038.

In 2011, the number of reported loss of primary containment

(LOPC) incidents in Exploration and Production was 152, down from 194

in 2010. The number of reported oil spills equal to or larger than 1 barrel

during 2011 was 71, down from 117 in 2010.

Financial and operating performance

We continually seek access to resources and in 2011, in addition to new

access resulting from acquisitions as detailed on page 83, this included

Angola, where BP gained access to five new deepwater exploration and

production blocks covering 24,200km2; Australia, where BP was awarded

four blocks covering 24,500km2 in the Ceduna Sub Basin off the coast of

South Australia; Azerbaijan, where the republic of Azerbaijan ratified the

Shafag-Asiman production-sharing agreement (PSA) covering 1,100km2

in the Caspian Sea; China, where BP was awarded access to a 9,700km2

block in the South China Sea; deepwater Gulf of Mexico, where 12 leases

from the March 2010 Outer Continental Shelf Lease Sale 213 covering

280km2 were executed; Indonesia, where BP was awarded four coalbed

methane PSAs covering 4,800km2 in the Barito basin of South Kalimantan

and two oil and gas PSAs covering 16,400km2 offshore in the Arafura Sea;

and Trinidad, where BP was awarded two deepwater blocks covering

3,600km2, subject to government approval.

In September 2011, we announced the Moccasin oil discovery in

the deepwater Gulf of Mexico (not BP-operated). In October 2011, we

announced the Salmon gas discovery in Egypt’s Nile Delta. In 2011, we

took final investment decisions on three projects and two major projects

came onstream: Serrette in Trinidad and Pazflor in Angola.

Production for 2011 was lower than last year. After adjusting for the

effect of entitlement changes in our PSAs and the effect of acquisitions

and disposals, underlying production was 7% lower than 2010. This

primarily reflects lower Gulf of Mexico production as a result of the impact

of the drilling moratorium as well as the impact of turnaround maintenance

activities. In 2011, full-year production growth in TNK-BP was 2.8%.

Sales and other operating revenues for 2011 were $75 billion,

compared with $66 billion in 2010 and $58 billion in 2009. The increase