BP 2011 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements

BP Annual Report and Form 20-F 2011 227

Notes on financial statements

33. Derivative financial instruments continued

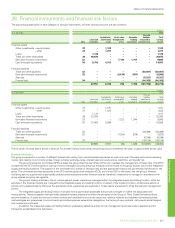

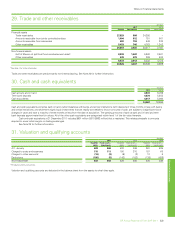

The following table shows the changes during the year in the net fair value of derivatives held for trading purposes within level 3 of the fair value hierarchy.

http://www.bp.com/downloads/dfi

$ million

Oil

price

Natural

gas price

Power

price Total

Net fair value of contracts at 1 January 2011 164 667 (1) 830

Gains (losses) recognized in the income statement 69 129 11 209

Settlements (71) (110) 3(178)

Transfers out of level 3 –(278) –(278)

Net fair value of contracts at 31 December 2011 162 408 13 583

$ million

Oil

price

Natural

gas price

Power

price Total

Net fair value of contracts at 1 January 2010 215 72 (1) 286

Gains (losses) recognized in the income statement 21 637 (1) 657

Settlements (54) (11) 1(64)

Transfers out of level 3 (18) (38) –(56)

Transfers into level 3 – 4 – 4

Exchange adjustments – 3 – 3

Net fair value of contracts at 31 December 2010 164 667 (1) 830

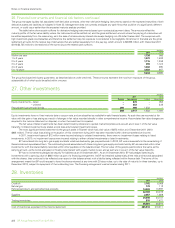

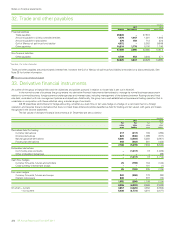

Transfers out of level 3 of the fair value hierarchy in 2011 relate primarily to the delivery dates for a number of natural gas forward contracts moving into a

time period where market observable prices are available, and therefore being reclassified to level 2 of the fair value hierarchy.

The amount recognized in the income statement for the year relating to level 3 held for trading derivatives still held at 31 December 2011 was a

$204 million gain (2010 $651 million gain relating to derivatives still held at 31 December 2010).

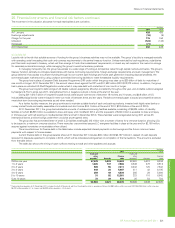

Gains and losses relating to derivative contracts are included either within sales and other operating revenues or within purchases in the income

statement depending upon the nature of the activity and type of contract involved. The contract types treated in this way include futures, options,

swaps and certain forward sales and forward purchases contracts, and relate to both currency and commodity trading activities. Gains or losses arise

on contracts entered into for risk management purposes, optimization activity and entrepreneurial trading. They also arise on certain contracts that are

for normal procurement or sales activity for the group but that are required to be fair valued under accounting standards. Also included within sales and

other operating revenues are gains and losses on inventory held for trading purposes. The total amount relating to all of these items was a net loss of

$934 million (2010 $1,738 million net gain and 2009 $4,046 million net gain).

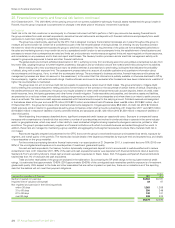

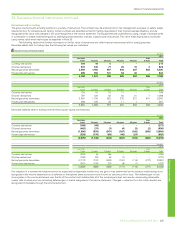

Embedded derivatives

The group has embedded derivatives relating to certain natural gas contracts. Prior to the development of an active gas trading market, UK gas contracts

were priced using a basket of available price indices, primarily relating to oil products, power and inflation. After the development of an active UK gas

market, certain contracts were entered into or renegotiated using pricing formulae not directly related to gas prices, for example, oil product and power

prices. In these circumstances, pricing formulae have been determined to be derivatives, embedded within the overall contractual arrangements that are

not clearly and closely related to the underlying commodity. The resulting fair value relating to these contracts is recognized on the balance sheet with

gains or losses recognized in the income statement.

All the commodity price embedded derivatives relate to natural gas contracts, are categorized in level 3 of the fair value hierarchy and are valued

using inputs that include price curves for each of the different products that are built up from active market pricing data. Where necessary, these are

extrapolated to the expiry of the contracts (the last of which is in 2018) using all available external pricing information. Additionally, where limited data

exists for certain products, prices are interpolated using historic and long-term pricing relationships.

In addition, at 31 December 2010, BP was party to a collar-backed financing arrangement involving an available-for-sale investment held by the

group. This arrangement contained an embedded derivative whose fair value was related to the equity price of the investment and was categorized in

level 2 of the fair value hierarchy. The arrangement was terminated in 2011.