BP 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review: BP in more depth

BP Annual Report and Form 20-F 2011 79

Business review

grants, which were supplemented by a further $3.3 million from other

contributors, were awarded for projects designed to:

• Improve sea turtle hatchling success across 56 miles of priority Florida

beaches.

• Increase the capacity of marine mammal and sea turtle treatment

facilities.

• Restore a combined 3.5 miles of oyster reefs, which in turn protect

sensitive coastal habitat.

• Reduce the incidence of sea turtles being caught in the course of

recreational and commercial fishing.

Commitment to long-term oil spill research

In 2010, BP committed $500 million over 10 years to fund independent

scientific research through the Gulf of Mexico Research Initiative (GoMRI).

The research will improve knowledge of the Gulf ecosystem and help the

industry and others to better understand and mitigate the impact of oil

spills in the region and elsewhere.

In June 2011, the GoMRI Research Board awarded 17 grants

totalling $1.5 million to support scientists as they continue time-sensitive

data collection. In August 2011, the Research Board awarded a total of

$112.5 million over three years to eight consortia comprised of over 70

research institutions. All eight consortia are led by Gulf Coast institutions.

Research recipients will use the grants to investigate the fate of oil

released by the spill, and for the development of new tools and technology

for responding to future spills and improving mitigation and restoration.

In December 2011, the GoMRI Research Board also issued a

request for proposals (RFP) for approximately $7.5 million per year for three

years, in smaller grants to individual or small teams of researchers.

Rebuilding trust through effective communications

During 2011, we worked to engage, inform and communicate with a wide

range of stakeholders throughout the region. We supported community

events and we shared information on a variety of issues and concerns with

individuals, community organizations, business leaders, elected officials,

non-governmental organizations and the news media.

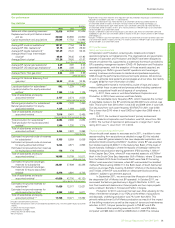

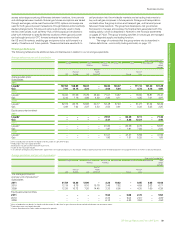

Financial update

Profit before tax for the group includes a pre-tax credit of $3.8 billion

and finance costs of $0.1 billion in relation to the Gulf of Mexico oil spill.

The pre-tax credit reflects $5.5 billion in relation to settlements reached

with MOEX, Weatherford, Anadarko and Cameron, partially offset by

further costs associated with the ongoing spill response, adjustments to

provisions, and an increase in the amount provided for legal fees, as well as

functional expenses of BP’s Gulf Coast Restoration Organization (GCRO).

Provisions were established during 2010 for the environmental

expenditure, spill response costs, litigation and claims, and Clean Water

Act (CWA) penalties. Most of the costs incurred in 2011 were covered

by these existing provisions. Pre-tax charges were recorded in 2011

of $0.4 billion for the functional expenses of the GCRO, $1.1 billion for

increases in the amounts provided, primarily related to spill response costs

and legal fees, a $0.1 billion finance charge for unwinding of discount on

provisions, and $0.1 billion for spill response costs charged directly to the

income statement. These charges partially offset the $5.5 billion credit for

settlements reached during the year.

As at 31 December 2011, the cumulative charges for provisions to

be paid from the Trust and the associated reimbursement asset recognized

amounted to $16.6 billion. This represented an increase of

$4.0 billion in the provisioned amounts during 2011, primarily for the

$2.1-billion expected impact of the proposed settlement announced on

3 March 2012 with the Plaintiffs’ Steering Committee in MDL 2179, the

$1-billion commitment to NRD early restoration and new provisions for

personal injury and death claims and Vessel of Opportunity programme

claims. A further $3.4 billion could be provided in subsequent periods for

items covered by the Trust, with no net impact on the income statement.

BP has provided for all potential liabilities that can be estimated

reliably at this time, including fines and penalties under the CWA. The

total amounts that will ultimately be paid by BP in relation to all obligations

relating to the incident are subject to significant uncertainty.

BP considers that it is not possible to estimate reliably any obligation in

relation to NRD claims under OPA 90 (other than the estimated costs of

the assessment phase and the costs relating to emergency restoration

and the $1 billion agreement for early restoration), any amounts in relation

to fines and penalties except for those relating to the CWA and litigation

arising from alleged violations of OPA 90. These items are therefore

contingent liabilities.

BP holds a 100% interest in the Macondo well, with the lease

interests previously held by MOEX and Anadarko now assigned to BP as

part of the settlement agreements. MOEX paid BP $1.1 billion in cash and

Anadarko paid BP $4 billion in cash to settle all outstanding claims between

the companies related to the incident and to the prospect.

For details regarding the impacts and uncertainties relating to the

Gulf of Mexico oil spill refer to Financial statements – Note 2 on page 190,

Note 36 on page 231 and Note 43 on page 249. See also Risk factors on

page 59 and Proceedings and investigations relating to the Gulf of Mexico

oil spill on pages 160-164.

Legal proceedings and investigations

See Legal proceedings on pages 160-164 for a full discussion of legal

proceedings and investigations relating to the incident.