BP 2011 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2011 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Additional information for shareholders

BP Annual Report and Form 20-F 2011 159

Additional information for shareholders

In accordance with DTR 5, we have received notification that as at

31 December 2011 BlackRock, Inc. held 5.69% and Legal & General

Group Plc held 3.90% of the voting rights of the issued share capital of the

company. As at 17 February 2012 BlackRock, Inc. held 5.37% and Legal

& General Group Plc held 3.99% of the voting rights of the issued share

capital of the company.

Under the US Securities Exchange Act of 1934 we have received

notification of the following interests as at 17 February 2012:

Holder

Holding of

ordinary shares

Percentage

of ordinary

share capital

excluding

shares held

in treasury

JPMorgan Chase Bank, depositary for

ADSs, through its nominee Guaranty

Nominees Limited 5,031,905,448 26.51

BlackRock, Inc. 1,019,731,492 5.37

Legal & General Group plc 758,363,148 4.00

The company’s major shareholders do not have different voting rights.

On 17 May 2011, BP announced that the Rosneft Share Swap

Agreement, originally announced on 14 January 2011, had terminated. For

further information see Legal proceedings on page 166.

The company has also been notified of the following interests in

preference shares as at 17 February 2012:

Holder

Holding of 8%

cumulative first

preference shares

Percentage of

class

The National Farmers Union Mutual

Insurance Society 945,000 13.07

M & G Investment Management Ltd. 528,150 7.30

Duncan Lawrie Ltd. 426,876 5.90

Smith & Williamson Investment

Management Ltd. 407,250 5.63

Barclays Wealth 370,931 5.13

Holder

Holding of 9%

cumulative second

preference shares

Percentage of

class

The National Farmers Union Mutual

Insurance Society 987,000 18.03

M & G Investment Management Ltd. 644,450 11.77

Royal London Asset Management Ltd. 438,000 8.00

Smith & Williamson Investment

Management Ltd. 405,500 7.41

Ruffer LLP 294,000 5.37

Lazard Asset Management Limited disposed of its interests in 374,000

8% cumulative first preference shares and 404,500 9% cumulative second

preference shares during 2011.

Gartmore Investment Management Limited disposed of its interest

in 394,538 8% cumulative first preference shares and 500,000 9%

cumulative second preference shares during 2010.

As at 17 February 2012, the total preference shares in issue

comprised only 0.44% of the company’s total issued nominal share capital

(excluding shares held in treasury), the rest being ordinary shares.

Called-up share capital

Details of the allotted, called-up and fully-paid share capital at 31 December

2011 are set out in Financial statements – Note 38 on page 241.

At the AGM on 14 April 2011, authorization was given to the

directors to allot shares up to an aggregate nominal amount equal to

$3,133 million. Authority was also given to the directors to allot shares for

cash and to dispose of treasury shares, other than by way of rights issue,

up to a maximum of $235 million, without having to offer such shares

to existing shareholders. These authorities are given for the period until

the next AGM in 2012 or 14 July 2012, whichever is the earlier. These

authorities are renewed annually at the AGM.

Dividends

When dividends are paid on its ordinary shares, BP’s policy is to pay

interim dividends on a quarterly basis.

BP policy is also to announce dividends for ordinary shares in US

dollars and state an equivalent sterling dividend. Dividends on BP ordinary

shares will be paid in sterling and on BP ADSs in US dollars. The rate of

exchange used to determine the sterling amount equivalent is the average

of the market exchange rates in London over the four business days prior

to the sterling equivalent announcement date. The directors may choose

to declare dividends in any currency provided that a sterling equivalent

is announced, but it is not the company’s intention to change its current

policy of announcing dividends on ordinary shares in US dollars.

Information regarding dividends announced and paid by the

company on ordinary shares and preference shares is provided in Financial

statements – Note 19 on page 212.

A Scrip Dividend Programme (Programme) was introduced in

2011 which enables BP ordinary shareholders and ADS holders to elect to

receive new fully paid ordinary shares in BP (or ADSs in the case of ADS

holders) instead of cash. The operation of the Programme is always subject

to the directors’ decision to make the scrip offer available in respect of

any particular dividend. Should the directors decide not to offer the scrip in

respect of any particular dividend, cash will automatically be paid instead.

Future dividends will be dependent on future earnings, the financial

condition of the group, the Risk factors set out on pages 59-63 and other

matters that may affect the business of the group set out in Our strategy

on pages 37-41 and in Liquidity and capital resources on page 103.

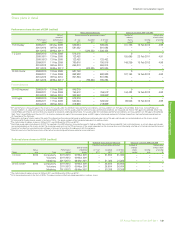

The following table shows dividends announced and paid by the

company per ADS for each of the past five years.

Dividends per ADS March June September December Total

2007 UK pence 31.5 30.9 31.7 31.8 125.9

US cents 61.95 61.95 64.95 64.95 253.8

Canadian

cents 73.3 69.5 67.8 63.6 274.2

2008 UK pence 40.9 41.0 42.2 52.2 176.3

US cents 81.15 81.15 84.0 84.0 330.3

Canadian

centsa80.8 82.5 85.8 108.6 357.7

2009 UK pence 58.91 57.50 51.02 51.07 218.5

US cents 84 84 84 84 336

2010 UK pence 52.07 –––52.07

US cents 84 –––84

2011 UK pence 26.02 25.68 25.90 26.82 104.42

US cents 42 42 42 42 168

a BP shares were de-listed from the Toronto Stock Exchange on 15 August 2008 and the last

dividend payment in Canadian dollars was made on 8 December 2008.