BP 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance review

BP Annual Report and Accounts 2008

Performance review

value accounting effects had a favourable impact of $211 million relative

to management’s measure of performance (see page 56).

During 2008, significant performance improvements in both our

Fuels Value Chains and International Businesses mitigated cost inflation

and, to a large extent, the much weaker environment. The main sources

of improvement were from restoring the revenues of our refining

operations; improved supply and trading performance; improved

marketing performance, particularly from the International Businesses,

and reduced costs. The cost reductions have been driven by the

simplification of our business structure through the establishment of

Fuels Value Chains and a reduction in our geographical footprint, as well

as by strong cost management. The most significant environmental factor

was the weaker refining environment, particularly due to lower refining

margins in the US and the adverse impact in the second half of 2008 of

prior-month pricing of domestic pipeline barrels for our US refining

system, but there were also adverse foreign exchange effects.

During 2007, the segment continued to focus on the restoration

of operations at the Texas City refinery and on investments in integrity

management throughout our refining portfolio. We have also focused on

the repair and recommissioning of the Whiting refinery following the

operational issues in March 2007. In many parts of the refining portfolio

and the other market-facing businesses, we delivered high reliability and

improved results compared with 2006. However, for the full year,

compared with 2006, the impact of the outages and recommissioning

costs at the Texas City and Whiting refineries, as well as investments in

integrity management and scheduled turnarounds throughout our refining

portfolio, cost inflation and lower results from supply optimization

decreased our result. These factors more than offset increased margins

in both refining and marketing.

The average refining Global Indicator Margin (GIM) in 2008 was

lower than in 2007.

Refining throughputs in 2008 were 2,155mb/d, 28mb/d higher

than in 2007. Refining availability was 88.8%, six percentage points

higher than in 2007, the increase being driven primarily by improvement

at the Texas City and Whiting refineries. Marketing volumes at 3,711mb/d

were around 2.5% lower than in 2007.

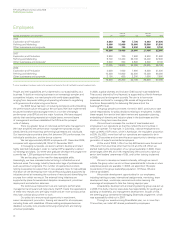

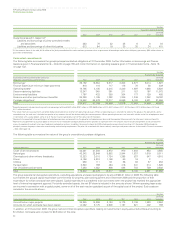

Other businesses and corporate

$ million

2008 2007 2006

Total revenuesa 5,040 3,972 3,703

Profit (loss) before interest and tax

from continuing operationsb (1,258) (1,233) (779)

aIncludes sales between businesses.

bIncludes profit after interest and tax of equity-accounted entities.

Other businesses and corporate comprises the Alternative Energy

business, Shipping, the group’s aluminium asset, Treasury (which includes

all the group’s cash, cash equivalents), and corporate activities worldwide.

The loss before interest and tax for the year ended 31 December

2008 was $1,258 million and included inventory holding losses of

$35 million and a net charge for non-operating items of $633 million

(see page 56).

The loss before interest and tax for the year ended 31 December

2007 was $1,233 million and included inventory holding losses of

$24 million and a net charge for non-operating items of $262 million

(see page 56).

The loss before interest and tax for the year ended 31 December

2006 was $779 million and included inventory holding gains of

$62 million and a net charge for non-operating items of $72 million

(see page 56).

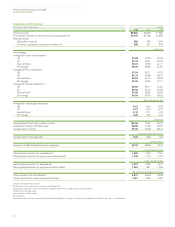

Non-operating items

Non-operating items are charges and credits that BP discloses separately

because it considers such disclosures to be meaningful and relevant to

investors. The main categories of non-operating items in the periods

presented are: impairments; gains or losses on sale of fixed assets and

the sale of businesses; environmental remediation; restructuring,

integration and rationalization costs; and changes in the fair value of

embedded derivatives. These disclosures are provided in order to enable

investors better to understand and evaluate the group’s financial

performance. An analysis of non-operating items is shown on page 56.

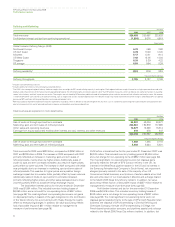

Non-GAAP information on fair value accounting effects

BP uses derivative instruments to manage the economic exposure

relating to inventories above normal operating requirements of crude oil,

natural gas and petroleum products as well as certain contracts to supply

physical volumes at future dates. Under IFRS, these inventories and

contracts are recorded at historic cost and on an accruals basis

respectively. The related derivative instruments, however, are required

to be recorded at fair value with gains and losses recognized in income

because hedge accounting is either not permitted or not followed,

principally due to the impracticality of effectiveness testing requirements.

Therefore, measurement differences in relation to recognition of gains

and losses occur. Gains and losses on these inventories and contracts

are not recognized until the commodity is sold in a subsequent

accounting period. Gains and losses on the related derivative commodity

contracts are recognized in the income statement from the time the

derivative commodity contract is entered into on a fair value basis using

forward prices consistent with the contract maturity.

IFRS requires that inventory held for trading be recorded at its

fair value using period end spot prices whereas any related derivative

commodity instruments are required to be recorded at values based on

forward prices consistent with the contract maturity. Depending on

market conditions, these forward prices can be either higher or lower

than spot prices resulting in measurement differences.

BP enters into contracts for pipelines and storage capacity that,

under IFRS, are recorded on an accruals basis. These contracts are risk-

managed using a variety of derivative instruments that are fair valued

under IFRS. This results in measurement differences in relation to

recognition of gains and losses.

The way that BP manages the economic exposures described

above, and measures performance internally, differs from the way these

activities are measured under IFRS. BP calculates this difference by

comparing the IFRS result with management’s internal measure of

performance, under which the inventory and the supply and capacity

contracts in question are valued based on fair value using relevant

forward prices prevailing at the end of the period. We believe that

disclosing management’s estimate of this difference provides useful

information for investors because it enables investors to see the

economic effect of these activities as a whole. The impacts of fair value

accounting effects, relative to management’s internal measure of

performance, are shown in the table below and on the following page.

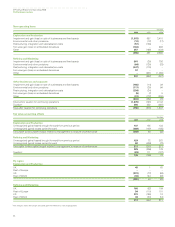

Reconciliation of non-GAAP information

Exploration and Production

$ million

2008 2007 2006

Profit before interest and tax adjusted

for fair value accounting effects 38,197 27,681 39,985

Impact of fair value accounting effects (282) 48 (32)

Profit before interest and tax 37,915 27,729 39,953

Refining and Marketing

Profit before interest and tax adjusted

for fair value accounting effects (2,395) 6,433 4,708

Impact of fair value accounting effects 511 (357) 211

Profit before interest and tax (1,884) 6,076 4,919

55