BP 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

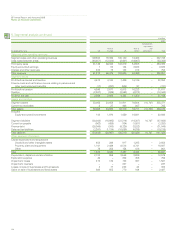

Financial statements

BP Annual Report and Accounts 2008

Notes on financial statements

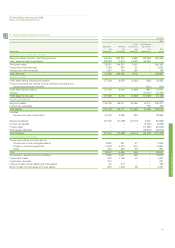

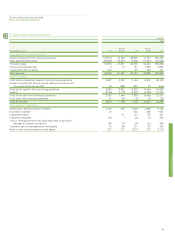

3. Acquisitions

Acquisitions in 2008

BP made a number of acquisitions in 2008 for a total consideration of $403 million. These business combinations were in the Exploration and

Production segment and Other businesses and corporate and the most significant was the acquisition of Whiting Clean Energy, a cogeneration power

plant. Fair value adjustments have been made on a provisional basis to the acquired assets and liabilities. Goodwill of $1 million has been recognized

on these acquisitions.

Acquisitions in 2007

BP made a number of acquisitions in 2007 for a total consideration of $1,200 million. These business combinations were predominantly in the Refining

and Marketing segment, the most significant of which was the acquisition of Chevron’s Netherlands manufacturing company, Texaco Raffiniderij Pernis

B.V. The acquisition included Chevron’s 31% minority shareholding in Nerefco, its 31% shareholding in the 22.5 MW wind farm co-located at the

refinery as well as a 22.8% shareholding in the TEAM joint venture terminal and shareholdings in two local pipelines linking the TEAM terminal to the

refinery. Fair value adjustments were made to the acquired assets and liabilities. Goodwill of $270 million arose on these acquisitions.

Acquisitions in 2006

BP made a number of acquisitions in 2006 for a total consideration of $256 million. All these business combinations were in Other businesses and

corporate. Fair value adjustments were made to the acquired assets and liabilities and goodwill of $64 million arose on these acquisitions.

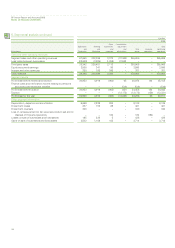

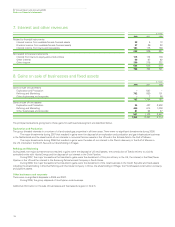

Non-current assets held for sale

In December 2007, BP signed a memorandum of understanding with Husky Energy Inc. to form an integrated North American oil sands business.

The transaction was completed on 31 March 2008, with BP contributing its Toledo refinery to a US jointly controlled entity to which Husky contributed

$250 million cash and a payable of $2,588 million. The Toledo refinery assets and associated liabilities were classified as a disposal group held for sale

at 31 December 2007. No impairment loss was recognized at the time of reclassification of the Toledo disposal group as held for sale nor

at 31 December 2007. For further information see Notes 5 and 26.

The major classes of assets and liabilities of the Toledo disposal group, reported within the Refining and Marketing segment, classified as held

for sale at 31 December 2007, are set out below.

$ million

2007

Assets

Property, plant and equipment 635

Goodwill 90

Inventories 561

Assets classified as held for sale 1,286

Liabilities

Current liabilities 163

Liabilities directly associated with assets classified as held for sale 163

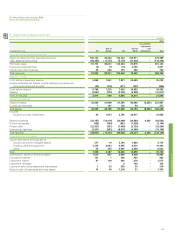

Discontinued operations

The sale of Innovene, BP’s olefins, derivatives and refining group, to INEOS was completed on 16 December 2005. In 2006 a loss before taxation of

$184 million was incurred which related to post-closing adjustments. These adjustments also reduced disposal proceeds by $34 million.

Financial information for the Innovene operations after group eliminations is presented below.

$ million

2006

Loss recognized on the remeasurement to fair value less costs to sell and on disposal (184)

Loss before taxation from Innovene operations (184)

Tax (charge) credit

on loss before loss recognized on remeasurement to fair value less costs to sell and on disposal 166

on loss recognized on the remeasurement to fair value less costs to sell and on disposal (7)

Loss from Innovene operations (25)

Loss per share from Innovene operations – cents

Basic (0.13)

Diluted (0.12)

Further information is contained in Note 5.

4. Non-current assets held for sale and discontinued operations

117