BP 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance review

BP Annual Report and Accounts 2008

Performance review

Exploration and Production

Our Exploration and Production segment includes upstream and

midstream activities in 29 countries, including Angola, Azerbaijan,

Canada, Egypt, Russia, Trinidad & Tobago (Trinidad), the UK, the US and

locations within Asia Pacific, Latin America, North Africa and the Middle

East, as well as gas marketing and trading activities, primarily in Canada,

Europe, the UK and the US. Upstream activities involve oil and natural

gas exploration and field development and production. Our exploration

programme is currently focused around Algeria, Angola, Azerbaijan,

Canada, Egypt, the deepwater Gulf of Mexico, Libya, the North Sea and

onshore US. Major development areas include Algeria, Angola, Asia

Pacific, Azerbaijan, Egypt and the deepwater Gulf of Mexico. During

2008, production came from 21 countries. The principal areas of

production are Angola, Asia Pacific, Azerbaijan, Egypt, Latin America,

the Middle East, Russia, Trinidad, the UK and the US.

Midstream activities involve the ownership and management

of crude oil and natural gas pipelines, processing facilities and export

terminals, LNG processing facilities and transportation, and our NGL

extraction businesses in the US and UK. Our most significant midstream

pipeline interests are the Trans-Alaska Pipeline System in the US, the

Forties Pipeline System and the Central Area Transmission System

pipeline, both in the UK sector of the North Sea, and the Baku-Tbilisi-

Ceyhan pipeline, running through Azerbaijan, Georgia and Turkey. Major

LNG activities are located in Trinidad, Indonesia and Australia. BP is also

investing in the LNG business in Angola.

Additionally, our activities include the marketing and trading of

natural gas, power and natural gas liquids in the US, Canada, UK and

Europe. These activities provide routes into liquid markets for BP's gas

and power, and generate margins and fees associated with the provision

of physical and financial products to third parties and additional income

from asset optimization and trading.

Our oil and natural gas production assets are located onshore and

offshore and include wells, gathering centres, in-field flow lines,

processing facilities, storage facilities, offshore platforms, export

systems (e.g. transit lines), pipelines and LNG plant facilities.

Upstream operations in Argentina, Bolivia, Abu Dhabi, Kazakhstan

and TNK-BP and some of the Sakhalin operations in Russia, as well as

some of our operations in Canada, Indonesia and Venezuela, are

conducted through equity-accounted entities.

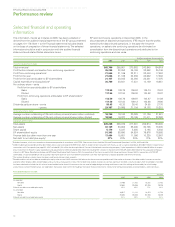

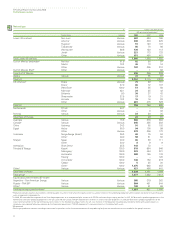

Our performance in 2008

Profit before interest and tax for 2008 was $37.9 billion, an increase of

37% compared with 2007. The increase was primarily driven by higher oil

and gas realizations. Our financial results are discussed in more detail on

pages 52-53.

In 2008, nine major projects came onstream. Production

commenced at the Thunder Horse field, with four wells in operation by

the end of the year, producing around 200,000boe/d (gross) making us

the largest producer in the Gulf of Mexico. We also started oil production

on our Deepwater Gunashli platform in the Azerbaijan sector of the

Caspian Sea. Other significant successes included the start of oil and gas

production at the Saqqara and Taurt fields in Egypt. Production from our

established centres including the North Sea, Alaska, North America Gas

and Trinidad & Tobago, was on plan. We are also increasing our ability to

get more from fields by improving our overall recovery rates through

developing and applying new technology.

In terms of the continued renewal of our oil and natural gas resource

base, 2008 was one of our best years this decade for new discoveries.

Total capital expenditure including acquisitions in 2008 was

$22.2 billion (2007 $14.2 billion and 2006 $13.3 billion). In 2008, there

were no significant acquisitions. Capital expenditure included $2.8 billion

relating to the formation of an integrated North American oil sands

business with Husky Energy Inc. It also included $3.7 billion relating to

the purchase of all Chesapeake Energy Corporation’s interest in the

Woodford Shale assets in the Arkoma basin, and the purchase of a 25%

interest in Chesapeake’s Fayetteville Shale assets, enabling further

growth of our North American gas business.

There were no significant acquisitions in 2006 and 2007. Capital

expenditure in 2006 included our investment of $1 billion in Rosneft.

Development expenditure incurred in 2008, excluding midstream

activities, was $11,767 million, compared with $10,153 million in 2007

and $9,109 million in 2006.

Looking ahead, our priorities remain the same: safety, people

and performance. We will continue to strive to deliver safe, reliable and

efficient operations while maintaining our flexibility so we can respond

to oil price volatility.

In 2009, oil and gas prices are expected to be significantly lower

than 2008. In response we will aim to use the operational momentum

generated in 2008 to continue to increase the efficiency of our cost

base and to build capability for the future. We intend to retain our rigour

around capital investment, in particular pacing our development to take

advantage of any cost reductions in a deflationary environment, and

supporting our strategy of growing the upstream business. We believe

that our portfolio of assets is strong and is well positioned to compete

and grow in a range of external conditions.

Comparative information presented in the table on the following

page has been restated, where appropriate, to reflect the

resegmentation, following transfers of certain businesses between

segments, that was effective from 1 January 2008. See page 16 for more

details.

Performance review

17