BP 2008 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2008

Performance review

Petrochemicals

Our petrochemicals operations are comprised of the global Aromatics &

Acetyls businesses (A&A) and the Olefins & Derivatives (O&D)

businesses, predominantly in Asia. New investments are targeted

principally in the higher growth Asian markets.

In A&A, we manufacture and market three main product lines:

purified terephthalic acid (PTA), paraxylene (PX) and acetic acid. Our A&A

strategy is to leverage our industry-leading technology in selected

markets, to grow the business and to deliver industry-leading returns.

PTA is a raw material used in the manufacture of polyesters used in

fibres, textiles and film, and PET bottles. Acetic acid is a versatile

intermediate chemical used in a variety of products such as paints,

adhesives and solvents, as well as its use in the production of PTA.

We have a strong global market share in the PTA and acetic markets

with a major manufacturing presence in Asia, particularly China. PX

is a feedstock for PTA production.

In O&D, we manufacture ethylene and propylene from naphtha

and also produce a number of downstream derivative products.

Our O&D business has operations in both China and Malaysia. In

China, our SECCO joint venture between BP, Sinopec and its subsidiary,

Shanghai Petrochemical Company is the largest foreign-invested olefins

cracker in China. SECCO is BP’s single largest investment in China. This

naphtha cracker produces ethylene and propylene plus derivatives

acrylonitrile, polyethylene, polypropylene, styrene, polystyrene, and other

products. In Malaysia, BP participates in two joint-ventures: Ethylene

Malaysia Sdn. Bhd. (EMSB), which produces ethylene from gas feedstock

in a joint venture between BP, Petronas and Idemitsu; while Polyethylene

Malaysia Sdn. Bhd. (PEMSB) produces polyethylene in a joint venture

between BP and Petronas. Each of these ventures has demonstrated a

strong track record of project delivery and performance. BP also owns

one other naphtha cracker outside Asia, which is integrated with our

Gelsenkirchen refinery in Germany.

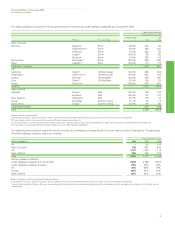

The following table shows BP’s petrochemicals production

capacity at 31 December 2008. This production capacity is based on the

original design capacity of the plants plus expansions.

BP share of capacity

thousand tonnes per year

Acetic

Geographic area PTA PX acid Other O&D Total

US 2,385 2,373 546 151 – 5,455

Europe 1,075 622 544 158 1,629 4,028

Asia (excluding China) 2,209 – 815 56 257 3,337

China 1,554 – 215 51 2,290 4,110

7,223 2,995 2,120 416 4,176 16,930

During 2008, the environment in which our petrochemicals businesses

operate became more challenging as deterioration in the global economic

environment has led to a reduced demand for our products.

Significant events in petrochemicals were as follows:

• The second PTA plant at the BP Zhuhai Chemical Company Limited

site in Guangdong province (China) successfully completed

commissioning in the first quarter of 2008. This 900+ ktepa plant is

the single largest PTA manufacturing train in the world and employs

BP’s latest, proprietary technology.

• Construction continued on the new 500ktepa acetic acid plant in

Jiangsu province (China) by BP YPC Acetyls Company (Nanjing)

Limited (BYACO). This is a BP joint venture with Yangzi Petrochemical

Co. Ltd (a subsidiary of Sinopec). Construction is scheduled to be

completed in June 2009 with commercial sales expected to begin in

the third quarter of 2009.

• Commissioning of our expanded Geel (Belgium) PTA facility

commenced at the end of 2008. The 350ktepa expansion improves

overall operating costs and increases the site’s PTA capacity to

1,425ktepa.

• In January 2008, BP and Sinopec signed a memorandum of

understanding to add a new acetic acid plant at their Yangtze River

Acetyls Co. (YARACO) joint venture site in Chongqing (China). This

world-scale (650ktepa) acetic acid plant will use BP’s leading Cativa™

technology. The expected plant start-up date, which was originally

anticipated to be during 2011, is under review due to the market

conditions. When complete, total production at the YARACO site is

expected to be well over one million tonnes per annum, making this

one of the largest acetic acid production locations in the world.

Aviation and marine fuels

Air BP is one of the world’s largest and best known aviation fuels

suppliers, serving all the major commercial airlines as well as the general

aviation and military sectors. During 2008, which was a tough year for the

aviation industry, we simplified our geographical footprint by exiting non-

core countries and now supply customers in approximately 70 countries.

We have annual marketing sales in excess of 27 billion litres and we have

relationships with many of the world’s major commercial airlines. Air BP’s

strategic aim is to grow its position in the core locations of Europe, the

US, Australasia and the Middle East, while focusing its portfolio towards

airports that offer long-term competitive advantage. BP’s marine fuels

business focuses on the distribution and sale of refined fuel oils to the

shipping industry at locations in more than 100 ports across the world.

During 2008, this business performed well, supported by strong growth

in the shipping market.

LPG

The LPG business sells bulk, bottled, automotive and wholesale LPG

products to a wide range of customers in 13 countries. During the past

few years, our LPG business has consolidated its position in established

markets, pursued opportunities in new and emerging markets such as

China and announced the exit from the Vietnam market in December

2008. LPG product sales in 2008 were approximately 68mbpd.

36