BP 2008 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

a

b

d

e

g

h

BP Annual Report and Accounts 2008

Performance review

%

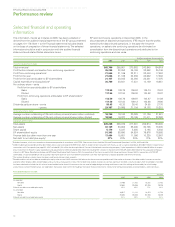

2008 2007 2006

Proved reserves replacement ratio, excluding

equity-accounted entities

Proved reserves replacement ratio, excluding

equity-accounted entities, including

sales and purchases of reserves-in-place

Proved reserves replacement ratio, for equity-

accounted entities

Proved reserves replacement ratio, for equity-

accounted entities, including sales and

purchases of reserves-in-place

116 44 34

98 38 11

132 248 272

172 248 239

million barrels of oil equivalent

Additions to proved developed reserves,

excluding equity-accounted entities,

including sales and purchases of

reserves-in-placea

Additions to proved developed reserves, for

equity-accounted entities, including sales

and purchases of reserves-in-placea

826

751

929

473

675

936

%

Proved developed reserves replacement ratio,

excluding equity-accounted entities,

including sales and purchases of

reserves-in-place

Proved developed reserves replacement ratio,

for equity-accounted entities, including

sales and purchases of reserves-in-place

88

153

99

101

70

195

aThis includes some reserves that were previously classified as proved undeveloped.

In 2008, net additions to the group’s proved reserves (excluding sales and

purchases of reserves-in-place and equity-accounted entities) amounted

to 1,085mmboe, principally through improved recovery from, and

extensions to, existing fields and discoveries of new fields. Of the

reserves additions through improved recovery from, and extensions to,

existing fields and discoveries of new fields, approximately half are

associated with new projects and are proved undeveloped reserves

additions. The remainder are in existing developments where they

represent a mixture of proved developed and proved undeveloped

reserves. The principal reserves additions were in the US (Arkoma,

Thunder Horse, Wamsutter), Trinidad (Mango), Asia-Pacific (Tangguh),

Angola (Plutão, Saturno, Vênus and Marte, and Angola LNG) and

Azerbaijan (ACG).

Production

Our total hydrocarbon production during 2008 averaged 2,517 thousand

barrels of oil equivalent per day (mboe/d) for subsidiaries and

1,321mboe/d for equity-accounted entities, a decrease of 1.2% and an

increase of 4.0% respectively compared with 2007. For subsidiaries,

36% of our production was in the US and 12% in the UK. For equity-

accounted entities, 70% of production was from TNK-BP.

Total production is expected to be somewhat higher in 2009. The

actual growth rate will depend on a number of factors, including our pace

of capital spending, the efficiency of that spend (in turn depending on

industry cost deflation), the oil price and its impact on PSAs as well as

OPEC quota restrictions.

The following tables show BP’s estimated net proved reserves as

at 31 December 2008.

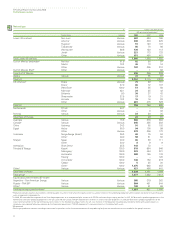

Estimated net proved reserves of liquids at 31 December 2008a b c

million barrels

Developed Undeveloped Total

UK

Rest of Europe

US

Rest of Americas

Asia Pacific

Africa

Russia

Other

410

81

1,717

58

77

464

–

174

119

194

1,273

56

69

496

–

477

529

275

2,990d

114e

146

960

–

651

Group 2,981 2,684 5,665

Equity-accounted entities 3,125 1,563 4,688f

Estimated net proved reserves of natural gas at 31 December 2008a b c

billion cubic feet

Developed Undeveloped Total

UK

Rest of Europe

US

Rest of Americas

Asia Pacific

Africa

Russia

Other

1,822

61

9,059

3,975

2,482

1,050

–

507

582

402

5,473

7,902

4,275

1,382

–

1,033

2,404

463

14,532

11,877g

6,757

2,432

–

1,540

Group 18,956 21,049 40,005

Equity-accounted entities 3,234 1,969 5,203h

Net proved reserves on an oil equivalent basis

mmboe

Developed Undeveloped Total

Group

Equity-accounted entities

6,249

3,683

6,313

1,902

12,562

5,585

Proved reserves exclude royalties due to others, whether payable in cash or in kind, where the

royalty owner has a direct interest in the underlying production and the option and ability to make

lifting and sales arrangements independently, and include minority interests in consolidated

operations. We disclose our share of reserves held in joint ventures and associates that are

accounted for by the equity method although we do not control these entities or the assets held by

such entities.

In certain deepwater fields, such as fields in the Gulf of Mexico, BP has claimed proved reserves

before production flow tests are conducted, in part because of the significant safety, cost and

environmental implications of conducting these tests. The industry has made substantial

technological improvements in understanding, measuring and delineating reservoir properties

without the need for flow tests. The general method of reserves assessment to determine

reasonable certainty of commercial recovery which BP employs relies on the integration of three

types of data: (1) well data used to assess the local characteristics and conditions of reservoirs and

fluids; (2) field scale seismic data to allow the interpolation and extrapolation of these characteristics

outside the immediate area of the local well control; and (3) data from relevant analogous fields.

Well data includes appraisal wells or sidetrack holes, full logging suites, core data and fluid samples.

BP considers the integration of this data in certain cases to be superior to a flow test in providing a

better understanding of the overall reservoir performance. The collection of data from logs, cores,

wireline formation testers, pressures and fluid samples calibrated to each other and to the seismic

data can allow reservoir properties to be determined over a greater volume than the localized

volume of investigation associated with a short-term flow test. Historically, proved reserves

recorded using these methods have been validated by actual production levels. As at the end of

2008, BP had proved reserves in 20 fields in the deepwater Gulf of Mexico that had been initially

booked prior to production flow testing. Of these fields, 18 are in production and two, Dorado and

Great White, are expected to begin production in 2009. Six other fields are in the early stages of

appraisal and development.

cThe 2008 year-end marker prices used were Brent $36.55/bbl (2007 $96.02/bbl and 2006

$58.93/bbl) and Henry Hub $5.63/mmBtu (2007 $7.10/mmBtu and 2006 $5.52/mmBtu).

Proved reserves in the Prudhoe Bay field in Alaska include an estimated 54 million barrels on which

a net profits royalty will be payable over the life of the field under the terms of the BP Prudhoe Bay

Royalty Trust.

Includes 21 million barrels of crude oil in respect of the 30% minority interest in BP Trinidad and

Tobago LLC.

fIncludes 216 million barrels of crude oil in respect of the 6.80% minority interest in TNK-BP.

Includes 3,108 billion cubic feet of natural gas in respect of the 30% minority interest in BP Trinidad

and Tobago LLC.

Includes 131 billion cubic feet of natural gas in respect of the 5.92% minority interest in TNK-BP.

20