BP 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2008

Performance review

Financial and operating performance

Group operating results

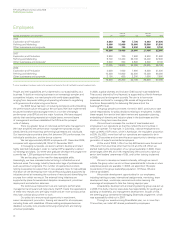

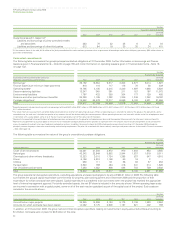

The following summarizes the group’s operating results.

$ million except per share amounts

2008 2007 2006

Total revenuesa 365,700 288,951 270,602

Profit from continuing operationsa 21,666 21,169 22,311

Profit for the year 21,666 21,169 22,286

Profit for the year attributable to BP shareholders 21,157 20,845 22,000

Profit attributable to BP shareholders per ordinary share – cents 112.59 108.76 109.84

Dividends paid per ordinary share – cents 55.05 42.30 38.40

aExcludes Innovene, which was treated as a discontinued operation in accordance with IFRS 5 ‘Non-current Assets Held for Sale and Discontinued Operations’ in 2004, 2005 and 2006.

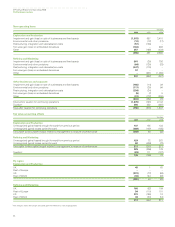

Business environment

Crude oil prices reached new record highs in 2008, in nominal terms.

The average dated Brent price for the year rose to $97.26 per barrel, an

increase of 34% over the $72.39 per barrel average seen in 2007. Daily

prices began the year at $96.02 per barrel, peaked at $144.22 per barrel

on 3 July 2008, and fell to $36.55 per barrel at year-end. The sharp drop in

prices was due to falling demand in the second half of the year, caused

by the OECD falling into recession and the lagged effect on demand of

high prices in the first half of the year. OPEC had increased production

significantly through the first three quarters; and, as a result of falling

consumption and rising OPEC production, inventories rose. As prices

continued to decline, OPEC responded with successive announcements

of production cuts in September, October, and December.

Natural gas prices in the US and the UK increased in 2008. The

Henry Hub First of Month Index averaged $9.04/mmBtu, 32% higher

than the 2007 average of $6.86/mmBtu. Prices peaked at $13.11/mmBtu

in July amid robust demand and falling US gas imports, but fell to

$6.90/mmBtu in December as demand weakened and production

remained strong. Average UK gas prices rose to 58.12 pence per therm

at the National Balancing Point in 2008, 94% above the 2007 average of

29.95 pence per therm.

Refining margins fell back in 2008, with the BP Global Indicator

Margin (GIM) averaging $6.50 per barrel. The premium for light products

above fuel oils remained high, reflecting a continuing shortage of

upgrading capacity and the favouring of fully upgraded refineries over

less complex sites.

The retail environment continued to be extremely competitive in

2008 with market volatility, high absolute prices, as well as large price

shifts in the crude market.

In 2007, the average dated Brent price rose to $72.39 per barrel,

an increase of 11% over the $65.14 per barrel average seen in 2006.

Daily prices began the year at $58.62 per barrel and rose to $96.02 per

barrel at year-end due to OPEC production cuts in early 2007, sustained

consumption growth and a resulting drop in commercial inventories after

the summer.

Natural gas prices in the US and the UK declined in 2007. The

Henry Hub First of Month Index averaged $6.86/mmBtu, 5% lower than

the 2006 average of $7.24/mmBtu. Prices were pressured by strong LNG

imports in summer, continued domestic production growth and high

inventories. Average UK gas prices fell to 29.95 pence per therm at

the National Balancing Point in 2007, 29% below the 2006 average of

42.19 pence per therm.

Refining margins had reached a new record high in 2007, with

the BP Global Indicator Margin (GIM) averaging $9.94 per barrel. The

premium for light products above fuel oils remained exceptionally high,

reflecting a shortage of upgrading capacity and the favouring of fully

upgraded refineries over less complex sites.

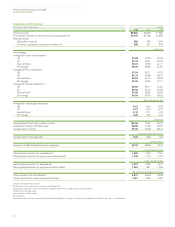

Hydrocarbon production

Our total hydrocarbon production during 2008 averaged 2,517mboe/d for

subsidiaries and 1,321mboe/d for equity accounted-entities, a decrease

of 1.2% (a decrease of 3.1% for liquids and an increase of 0.7% for gas)

and an increase of 4.0% (an increase of 2.5% for liquids and an increase

of 14.8% for gas) respectively compared with 2007. In aggregate, after

adjusting for the effect of lower entitlement in our PSAs, production was

5% higher than 2007. This reflected strong performance from our

existing assets, the continued ramp-up of production following the start-

up of major projects in late-2007 and a further nine major project start-

ups in 2008. Our total hydrocarbon production during 2007 averaged

2,549mboe/d for subsidiaries and 1,269mboe/d for equity-accounted

entities, a decrease of 3% (3.5% for liquids and 2.6% for gas) and 2%

(1.3% for liquids and 8.4% for gas) respectively compared with 2006. In

aggregate, the decrease primarily reflected the effect of disposals and

net entitlement reductions in our PSAs.

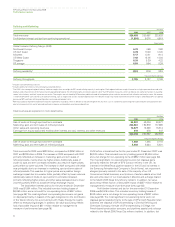

Profit attributable to BP shareholders

Profit attributable to BP shareholders for the year ended 31 December

2008 was $21,157 million, including inventory holding losses, net of tax,

of $4,436 million and a net charge for non-operating items, after tax, of

$796 million. In addition, fair value accounting effects had a favourable

impact, net of tax, of $146 million relative to management’s measure of

performance. Inventory holdings gains or losses, net of tax, are described

in footnote (a) on the following page. Further information on non-

operating items and fair value accounting effects can be found on

page 55.

Profit attributable to BP shareholders for the year ended

31 December 2007 was $20,845 million, including inventory holding

gains, net of tax, of $2,475 million and a net charge for non-operating

items, after tax, of $373 million (see page 56). In addition, fair value

accounting effects had an unfavourable impact, net of tax, of $198 million

(see page 56) relative to management’s measure of performance.

Profit attributable to BP shareholders for the year ended

31 December 2006 was $22,000 million, including inventory holding

losses, net of tax, of $222 million and a net credit for non-operating

items, after tax, of $1,237 million (see page 56). In addition, fair value

accounting effects had a favourable impact, net of tax, of $72 million (see

page 56) relative to management’s measure of performance. The profit

attributable to BP shareholders for the year ended 31 December 2006

included a loss from Innovene operations of $25 million.

50