BP 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2008

Performance review

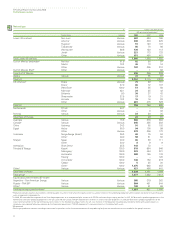

Russia

TNK-BP

• TNK-BP, a joint venture between BP (50%) and Alfa Group and

Access-Renova (AAR) (50%), is an integrated oil company operating

in Russia and the Ukraine. The TNK-BP group’s major assets are held

in OAO TNK-BP Holding. Other assets include the BP-branded retail

sites in Moscow and the Moscow region and interests in OAO Rusia

Petroleum and the OAO Slavneft group. The workforce comprises

more than 60,000 people.

• BP’s investment in TNK-BP is held by the Exploration and Production

segment and the results of TNK-BP are accounted for under the

equity method in this segment.

• TNK-BP has proved reserves of 7.1 billion barrels of oil equivalent

(including its 49.9% equity share of Slavneft), of which 5 billion are

developed. In 2008, TNK-BP’s average liquids production was

1.65mmb/d, a decrease of just under 1% compared with 2007. The

production base is largely centred in West Siberia (Samotlor, Nyagan

and Megion), which contributes about 1.2mmboe/d, together with

Volga Urals (Orenburg) contributing some 0.4mmboe/d. About 40%

of total oil production is currently exported as crude oil and 20% as

refined product.

• Downstream, TNK-BP has interests in six refineries in Russia and the

Ukraine (including Ryazan and Lisichansk and Slavneft’s Yaroslavl

refinery), with throughput of approximately 34 million tonnes per

year. During 2008, TNK-BP purchased additional retail and other

downstream assets in Russia and the Ukraine from a number of

small companies. TNK-BP supplies approximately 1,400 branded

filling stations in Russia and the Ukraine and, with the additional sites,

is expected to have more than 20% market share of the Moscow

retail market.

• On 9 January 2009, BP reached final agreement on amendments to

the shareholder agreement with its Russian partners in TNK-BP. The

revised agreement is aimed at improving the balance of interests

between the company's 50:50 owners, BP and Alfa Access-Renova

(AAR), and focusing the business more explicitly on value growth.

• The former evenly-balanced main board structure has been replaced

by one with four representatives each from BP and AAR, plus three

independent directors. Unanimous board support is required for

certain matters including substantial acquisitions, divestments and

contracts, and projects outside the business plan, together with

approval of key changes to the TNK-BP group’s financial framework

and of related party transactions. A number of other matters will be

decided by approval of a majority of the board, so that the

independent directors will have the ability to decide in the event of

disagreement between the shareholder representatives on the board.

BP will continue to nominate the chief executive, subject to main

board approval, and AAR will continue to appoint the chairman. The

three independent directors appointed to the restructured main board

are Gerhard Schroeder, former chancellor of the Federal Republic

of Germany, James Leng, former chairman of Corus Steel and

Alexander Shokhin, president of the Russian Union of Industrialists

and Entrepreneurs. In addition, significant TNK-BP subsidiaries will

have directors appointed by BP and AAR on their boards. Our

investment in TNK-BP will be reclassified from a jointly controlled

entity to an associate with effect from 9 January 2009.

• The parties have confirmed their agreement to a potential future sale

of up to 20% of a subsidiary of TNK-BP through an initial public

offering (IPO) at an appropriate future point, subject to certain

conditions and the consent of the Russian authorities.

• In 2007, BP and TNK-BP signed heads of terms to create strategic

business alliances with OAO Gazprom. Under the terms of this

agreement, TNK-BP agreed to sell to Gazprom its stake in OAO Rusia

Petroleum, the company that owns the licence for the Kovykta gas

condensate field in East Siberia and its interest in East Siberia Gas

Company. Discussions to conclude this disposal continue.

Sakhalin

• BP and its Russian partner Rosneft agreed two Shareholder and

Operating Agreements (SOAs) on 28 April 2008, recognizing BP as

a 49% equity interest holder with Rosneft holding the remaining

51% interest in the two newly formed joint venture companies,

Vostok Shmidt Neftegaz and Zapad Shmidt Neftegaz. BP also

continues to hold a 49% equity interest in its third joint venture

company at Sakhalin, Elvary Neftegaz, with Rosneft holding the

remaining 51%. During the year, each of the three joint ventures

held Geological and Geophysical Studies licences with the Russian

Ministry of Natural Resources (MNR) to perform exploration seismic

and drilling operations in these licence areas off the east coast of

Russia. To date, 3D seismic data has been acquired in relation to all

three licences. In the Elvary Neftegaz licence additional commitment

2D seismic data was acquired during 2008 in preparation for future

drilling commitments. Exploration wells have been drilled in the

Zapad-Shmidt Neftegaz and Elvary Neftegaz licences. In 2008, it was

agreed by both shareholders to allow the Zapad-Shmidt Neftegaz

licence to lapse at the end of its normal term.

Other

Azerbaijan

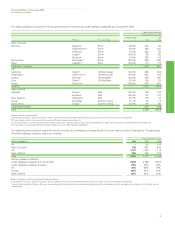

• In Azerbaijan, BP’s net production in 2008 was 130mboe/d, a net

decrease of 40% from 2007. The primary elements of this were the

effects of significantly higher prices resulting in a change in profit oil

entitlement in line with the terms of the PSA and reduced cost oil

entitlement, partially offset by an increase following the start-up of

the Deepwater Gunashli (DWG) platform, the ramping up of three

Azeri oil-producing platforms and the Shah Deniz condensate gas

platform commencing production in 2007.

• The DWG platform complex successfully started oil production

on schedule on 20 April 2008. DWG completes the third phase of

development of the Azeri-Chirag-Gunashli (ACG) field (BP 34.1%

and operator) in the Azerbaijan sector of the Caspian Sea. The DWG

complex is located in a water depth of 175 metres on the east side of

the Gunashli field. The complex comprises two platforms – a drilling

and production platform linked by a bridge to a water injection and

gas compression platform.

• On 17 September 2008, a subsurface gas release occurred below the

Central Azeri platform. As a precautionary measure, all personnel on

the platform were safely transferred onshore. The Central Azeri

platform was shut down until 19 December 2008, when following

comprehensive investigation and recovery work, BP began to resume

oil and gas production. Central Azeri processes oil and gas from West

Azeri, and West Azeri was also temporarily shut down and then

restored to normal operations on 9 October 2008. Operations of the

Compressor and Water Injection Platform (CWP), which is linked

by a bridge to Central Azeri, and the provision of power and injection

water across three Azeri field platforms were re-established on

12 October 2008.

Middle East and South Asia

• Production in the Middle East consists principally of the production

entitlement of associates in Abu Dhabi, where we have equity

interests of 9.5% and 14.7% in onshore and offshore concessions

respectively. In 2008, BP’s share of production in Abu Dhabi was

210mb/d, up 9% from 2007 as a result of higher overall OPEC

demand despite cuts implemented in the fourth quarter of 2008.

• In July 2008, BP Sharjah signed a farm-out agreement with RAK

Petroleum for the East Sajaa concession. Drilling of the first

exploration well is expected in 2009.

• In Block 61 in Oman, the challenges posed by the world’s largest

onshore azimuth 3D seismic survey led the BP Oman team to use

a ground-breaking new technique known as Distance Separated

Simultaneous Sweeping (DS3). This technique allows the acquisition

Performance review

27