BP 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

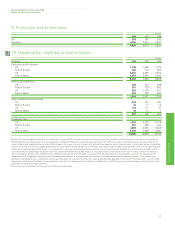

Financial statements

BP Annual Report and Accounts 2008

Notes on financial statements

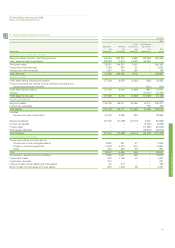

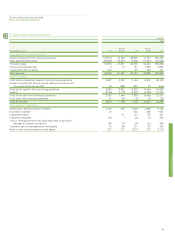

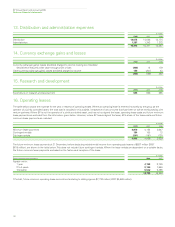

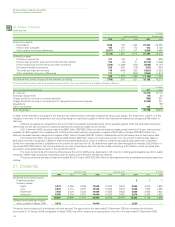

11. Impairment and losses on sale of businesses and fixed assets continued

Refining and Marketing

During 2008, the Refining and Marketing segment recognized impairment losses on a number of assets which in total amounted to $159 million.

The main component of the 2007 impairment charge of $1,186 million arose because of a decision to sell our company-owned and company-

operated sites in the US resulting in a $610 million write-down of the carrying amount of the sites to fair value less costs to sell. Following a decision

to sell certain assets at our Acetyls plant in Hull, UK, we wrote down the carrying amount of these assets to fair value less costs to sell leading to an

impairment charge of $186 million. Changing marketing conditions led to impairments in Samsung Petrochemical Company, to fair value less costs to

sell, and in China American Petrochemical Company amounting in total to $165 million. The balance relates principally to the write-downs of assets

elsewhere in the segment portfolio.

During 2006, certain assets in our Retail and Aromatics & Acetyls businesses were written down to fair value less costs to sell.

Other businesses and corporate

During 2008, Other businesses and corporate recognized impairment losses totalling $227 million primarily related to various assets in the Alternative

Energy business.

There were no significant impairments in 2007.

The impairment charge for 2006 relates to remaining chemical assets after the sale of Innovene.

Loss on sale of fixed assets

The principal transactions that give rise to the losses for each business segment are described below.

Exploration and Production

The group divested interests in a number of oil and natural gas properties in all three years. For 2006, the largest component of the loss is attributed

to the sale of properties in the Gulf of Mexico Shelf, which included increases in decommissioning liability estimates associated with the hurricane-

damaged fields that were divested during the year.

Refining and Marketing

For 2008, the principal transactions contributing to the loss were disposals of retail sites in the US and Europe.

For 2007, the principal transactions contributing to the loss were related to the decision to withdraw from the company-owned and company-

operated channel of trade in the US and retail churn. Retail churn is the overall process of acquiring and disposing of retail sites by which the group

aims to improve the quality and mix of its portfolio of service stations.

For 2006, the principal transactions contributing to the loss were retail churn.

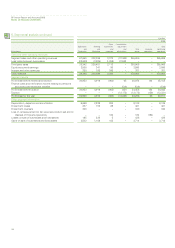

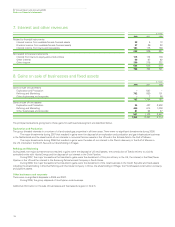

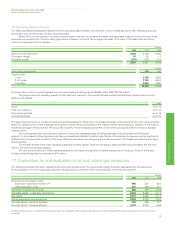

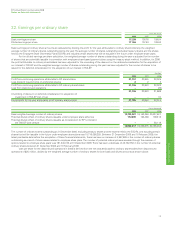

12. Impairment review of goodwill

$ million

Goodwill at 31 December 2008 2007

Exploration and Production 4,297 4,296

Refining and Marketing 5,462 6,626

Other businesses and corporate 119 84

9,878 11,006

Goodwill acquired through business combinations has been allocated to groups of cash-generating units (cash-generating units) that are expected to

benefit from the synergies of the acquisition. For Exploration and Production, goodwill has been allocated to each geographic region, that is UK, Rest

of Europe, US and Rest of World, and for Refining and Marketing, goodwill has been allocated to the Rhine Fuels Value Chain (FVC), US West Coast

FVC, Lubricants and Other.

In assessing whether goodwill has been impaired, the carrying amount of the cash-generating unit (including goodwill) is compared with the

recoverable amount of the cash-generating unit. The recoverable amount is the higher of fair value less costs to sell and value in use. In the absence

of any information about the fair value of a cash-generating unit, the recoverable amount is deemed to be the value in use.

The group calculates the recoverable amount as the value in use using a discounted cash flow model. The future cash flows are adjusted

for risks specific to the cash-generating unit and are discounted using a pre-tax discount rate. The discount rate is derived from the group’s post-tax

weighted average cost of capital and is adjusted where applicable to take into account any specific risks relating to the country where the

cash-generating unit is located. Typically rates of 11% or 13% are used (2007 11% or 13%). The rate to be applied to each country is reassessed

each year. A discount rate of 11% has been used for all goodwill impairment calculations performed in 2008 (2007 11%).

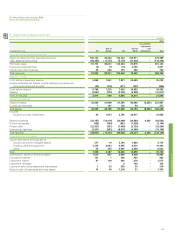

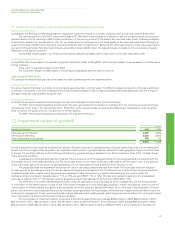

The three-year or four-year business segment plans, which are approved on an annual basis by senior management, are the primary source

of information for the determination of value in use. They contain forecasts for oil and natural gas production, refinery throughputs, sales volumes for

various types of refined products (e.g. gasoline and lubricants), revenues, costs and capital expenditure. As an initial step in the preparation of these

plans, various environmental assumptions, such as oil prices, natural gas prices, refining margins, refined product margins and cost inflation rates, are

set by senior management. These environmental assumptions take account of existing prices, global supply-demand equilibrium for oil and natural gas,

other macroeconomic factors and historical trends and variability.

For the purposes of impairment testing, the group’s Brent oil price assumption is an average $49 per barrel in 2009, $59 per barrel in 2010,

$65 per barrel in 2011, $68 per barrel in 2012, $70 per barrel in 2013 and $75 per barrel in 2014 and beyond (2007 average $90 per barrel in 2008,

$86 per barrel in 2009, $84 per barrel in 2010, $84 per barrel in 2011, $84 per barrel in 2012 and $60 per barrel in 2013 and beyond). Similarly, the

129