BP 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211

|

|

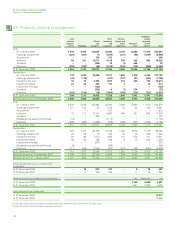

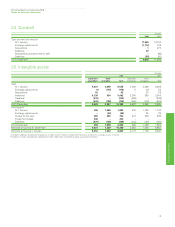

Financial statements

1

BP Annual Report and Accounts 2008

Notes on financial statements

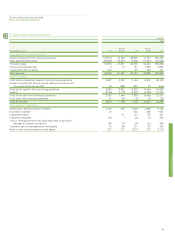

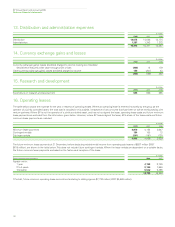

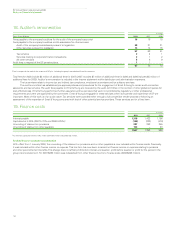

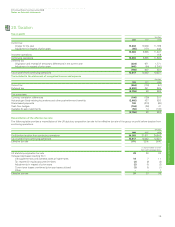

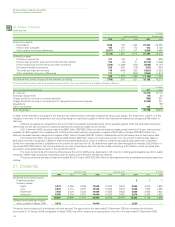

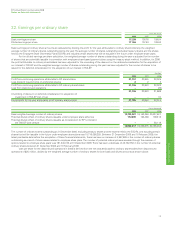

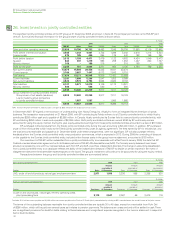

20. Taxation

Tax on profit

$ million

2008 2007 2006

Current tax

Charge for the year 13,468 10,006 11,199

Adjustment in respect of prior years (85) (171) 442

13,383 9,835 11,641

Innovene operations – – 159

Continuing operations 13,383 9,835 11,800

Deferred tax

Origination and reversal of temporary differences in the current year (324) 671 1,771

Adjustment in respect of prior years (442) (64) (1,240)

(766) 607 531

Tax on profit from continuing operations 12,617 10,442 12,331

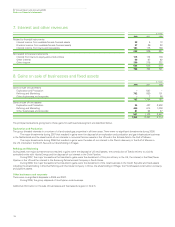

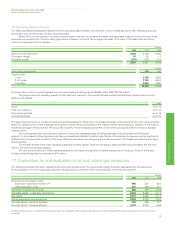

Tax included in the statement of recognized income and expense

$ million

2008 2007 2006

Current tax (264) (178) (51)

Deferred tax (2,492) 241 985

(2,756) 63 934

This comprises:

Currency translation differences (100) (139) 201

Actuarial gain (loss) relating to pensions and other post-retirement benefits (2,602) 427 820

Share-based payments 190 (213) (26)

Cash flow hedges (194) (26) 47

Available-for-sale investments (50) 14 (108)

(2,756) 63 934

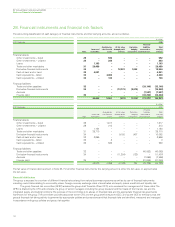

Reconciliation of the effective tax rate

The following table provides a reconciliation of the UK statutory corporation tax rate to the effective tax rate of the group on profit before taxation from

continuing operations.

$ million

2008 2007 2006

Profit before taxation from continuing operations 34,283 31,611 34,642

Tax on profit from continuing operations 12,617 10,442 12,331

Effective tax rate 37% 33% 36%

% of profit before taxation

from continuing operations

UK statutory corporation tax rate 28 30 30

Increase (decrease) resulting from

UK supplementary and overseas taxes at higher rates 14 7 11

Tax reported in equity-accounted entities (2) (2) (3)

Adjustments in respect of prior years (2) (1) (2)

Current year losses unrelieved (prior year losses utilized) (1) (1) (1)

Other ––

Effective tax rate 37 33 36

135