BP 2008 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2008

Notes on financial statements

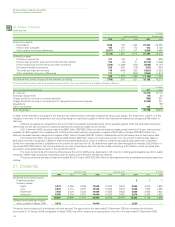

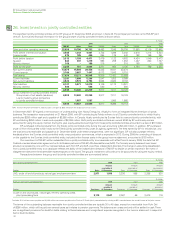

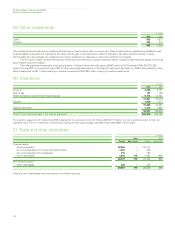

26. Investments in jointly controlled entities

The significant jointly controlled entities of the BP group at 31 December 2008 are shown in Note 46. The principal joint venture is the TNK-BP joint

venture. Summarized financial information for the group’s share of jointly controlled entities is shown below.

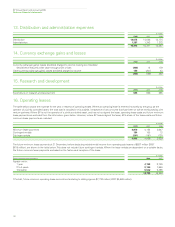

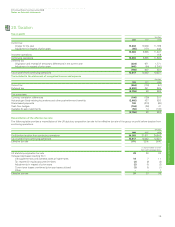

$ million

2008 2007 2006

TNK-BP Other Total TNK-BP Other Total TNK-BP Other Total

Sales and other operating revenues 25,936 10,796 36,732 19,463 7,245 26,708 17,863 6,119 23,982

Profit before interest and taxation 3,588 1,343 4,931 3,743 1,299 5,042 4,616 1,218 5,834

Finance costs 275 185 460 264 176 440 192 169 361

Profit before taxation 3,313 1,158 4,471 3,479 1,123 4,602 4,424 1,049 5,473

Taxation 882 397 1,279 993 259 1,252 1,467 260 1,727

Minority interest 169 – 169 215 – 215 193 – 193

Profit for the yeara2,262 761 3,023 2,271 864 3,135 2,764 789 3,553

Non-current assets 13,874 15,584 29,458 12,433 9,841 22,274

Current assets 3,760 3,687 7,447 6,073 2,642 8,715

Total assets 17,634 19,271 36,905 18,506 12,483 30,989

Current liabilities 3,287 1,998 5,285 3,547 1,552 5,099

Non-current liabilities 4,820 3,973 8,793 5,562 3,620 9,182

Total liabilities 8,107 5,971 14,078 9,109 5,172 14,281

Minority interest 588 – 588 580 – 580

8,939 13,300 22,239 8,817 7,311 16,128

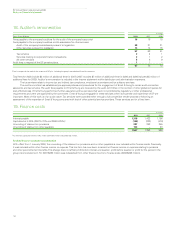

Group investment in jointly controlled entities

Group share of net assets (as above) 8,939 13,300 22,239 8,817 7,311 16,128

Loans made by group companies

to jointly controlled entities – 1,587 1,587 – 1,985 1,985

8,939 14,887 23,826 8,817 9,296 18,113

aBP’s share of the profit of TNK-BP in 2006 includes a net gain of $892 million on the disposal of certain assets.

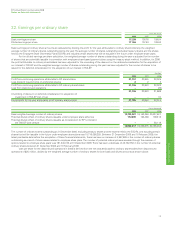

In December 2007, BP signed a memorandum of understanding with Husky Energy Inc. (Husky) to form an integrated North American oil sands

business. The transaction was completed on 31 March 2008, with BP contributing its Toledo refinery to a US jointly controlled entity to which Husky

contributed $250 million cash and a payable of $2,588 million. In Canada, Husky contributed its Sunrise field to a second jointly controlled entity, with

BP contributing $250 million in cash and a payable of $2,264 million. Both jointly controlled entities are owned 50:50 by BP and Husky and are

accounted for using the equity method. During the year, equity-accounted earnings from these jointly controlled entities amounted to a loss of $70 million.

BP purchased refined products from the Toledo jointly controlled entity during the year amounting to $3,440 million. In addition, BP purchased

crude oil from third parties which it sold to the Toledo jointly controlled entity under an agency agreement. The fees earned by BP for this service, and

the total amounts receivable and payable at 31 December 2008 under these arrangements, were not significant. BP will also purchase refinery

feedstocks from the Sunrise jointly controlled entity once production commences, which is expected in 2013. During 2008 the unwinding of discount

on the payable to the Sunrise jointly controlled entity, included within finance costs in the group income statement, amounted to $103 million.

Our investment in TNK-BP will be reclassified from a jointly controlled entity to an associate with effect from 9 January 2009, the date that BP

finalized a revised shareholder agreement with its Russian partners in TNK-BP, Alfa Access-Renova (AAR). The formerly evenly-balanced main board

structure is replaced by one with four representatives each from BP and AAR, plus three independent directors.The change in accounting classification

from a jointly controlled entity to an associate reflects the ability of the independent directors of TNK-BP to decide on certain matters in the event of

disagreement between the shareholder representatives on the board. The group's investment will continue to be accounted for using the equity method.

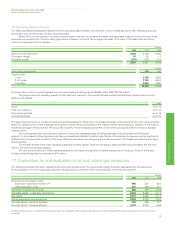

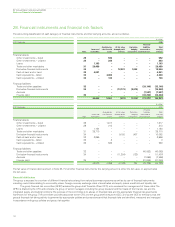

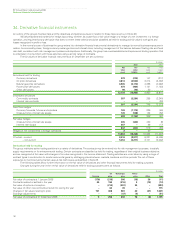

Transactions between the group and its jointly controlled entities are summarized below.

$ million

Sales to jointly controlled entities 2008 2007 2006

Amount Amount Amount

receivable at receivable at receivable at

Product Sales 31 December Sales 31 December Sales 31 December

LNG, crude oil and oil products, natural gas, employee services 2,971 1,036 2,336 888 2,258 830

$ million

Purchases from jointly controlled entities 2008 2007 2006

Amount Amount Amount

payable at payable at payable at

Product Purchases 31 DecemberaPurchases 31 December Purchases 31 December

Crude oil and oil products, natural gas, refinery operating costs,

plant processing fees 9,115 2,547 2,067 66 3,678 119

aIncludes $110 million current payable and $2,255 million non-current payable to the Sunrise Oil Sands jointly controlled entity relating to BP’s contribution on the establishment of the joint venture.

The terms of the outstanding balances receivable from jointly controlled entities are typically 30 to 45 days, except for a receivable from Ruhr Oel

of $386 million, which will be paid over several years as it relates to pension payments. The balances are unsecured and will be settled in cash. There

are no significant provisions for doubtful debts relating to these balances and no significant expense recognized in the income statement in respect of

bad or doubtful debts.

140