BP 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2008

Performance review

Refining and Marketing

Our Refining and Marketing business is responsible for the supply and

trading, refining, manufacturing, marketing and transportation of crude

oil, petroleum, chemicals products and related services to wholesale and

retail customers. BP markets its products in more than 100 countries. We

operate primarily in Europe and North America and also manufacture and

market our products across Australasia, in China and other parts of Asia,

Africa and Central and South America.

In 2008 we restructured the Refining and Marketing organization

into two main business groupings: fuels value chains (FVCs) and

international businesses (IBs). The FVCs integrate the activities of

refining, logistics, marketing, supply and trading, on a regional basis,

recognizing that the markets for our main fuels products operate

regionally. This shift to a more geographic and integrated model

represents a major simplification step and the opportunity to create

better value from our physical assets (refineries, terminals, pipelines and

retail stations). The IBs include the manufacturing, supply and marketing

of lubricants, petrochemicals, liquefied petroleum gas (LPG) and aviation

and marine fuels. We believe each of these IBs is competitively

advantaged in the markets in which we have chosen to participate. Such

advantage is derived from several factors, including location, proximity of

manufacturing assets to markets, physical asset quality, operational

efficiency, technology advantage and the strength of our brands. Each

business has a clear strategy focused on investing in its key assets and

market positions in order to deliver value to its customers and out-

perform its competitors.

During the past five years, our focus has been on process safety,

upgrading organizational capability and significant integrity management

investment. The construction of new production units at many of our

refineries as well as upgrades of existing conversion units at a number of

our facilities has positioned our assets to produce the high-quality fuels

needed to meet today's heightened product specifications.

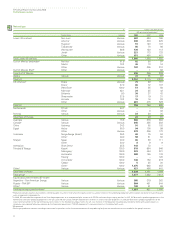

Our performance in 2008

The 2008 environment in which the segment operated was very

challenging, characterized by high and volatile crude and product prices,

which resulted in substantial margin volatility as well as higher energy

costs in manufacturing. Crude prices fell significantly in the second half of

the year and at the end of the year, prices were around $50/bbl lower

than the start of the year. Refining margins in the US were significantly

weaker than 2007 due to weaker gasoline demand. Conversely, in

Europe, where diesel accounts for a larger share of regional demand,

margins were stronger than a year ago. Demand for fuels has fallen,

initially due to high oil prices and subsequently due to the slowing of

global economies and the impact of the financial crisis. During the fourth

quarter, we saw a dramatic decline in the demand for our petrochemicals

products as a consequence of the economic slowdown. The year also

saw material swings in foreign exchange rates, particularly in the second

half, that affected our results.

Our 2008 performance reflects the benefits of the fundamental

improvements we are making across the business, including the

measures we have taken to restore the availability of our refining system,

reduce costs and simplify the organization. The loss before interest and

tax was $1.9 billion for 2008, compared with a profit before interest and

tax of $6.1 billion in 2007. The decrease was primarily driven by inventory-

holding losses. Our financial results are discussed in more detail on

pages 54-55.

Safety, both process and personal, remains our top priority. During 2008,

we started the migration to the new BP Operating Management System

(OMS) with an increased focus on process safety and continuous

improvement. The OMS is described in further detail on page 44. At the

end of the year, two of our petrochemicals plants in the US and two of

our refineries in Europe were operating on OMS. Within our US

refineries, we continue to implement the recommendations from the BP

US Refineries Independent Safety Review Panel. We have worked closely

with the independent expert, L Duane Wilson. The number of major

incidents associated with integrity management has decreased by 90%

since 2005. We have also reduced the number of oil spills by 60% and

the recordable injury rate by more than 57% since 1999. Regrettably, in

2008 there were four workforce fatalities associated with our operations,

one of which was a process safety incident.

In 2008, we saw the first substantial benefits of our operational

improvements. The Whiting refinery was restored to its full clean fuel

capability of 360mb/d in March 2008 following the compressor failure and

fire that took place during 2007. Texas City was also restored to full

economic capability by the end of the year. In Europe and Rest of World,

we commissioned new upgrading units at the Rotterdam and Kwinana

refineries, enhanced processing capability at the Gelsenkirchen refinery,

reconfigured the Bayernoil refinery for more efficient and competitive

operation, and completed construction of a new coker at the Castellón

refinery. During the next five years, we intend to continue the focus on

process safety, improve the competitive performance of our refineries

and complete the previously announced investment in the Whiting

refinery to increase its ability to process Canadian heavy crude.

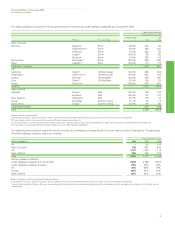

In total, our 17 refineries worldwide, including those partially

owned, achieved throughputs of 2,155mb/d on average, a 5% increase

on 2007 after adjusting for the net loss of throughput from previous

disposals and acquisitions. The performance of Texas City was impacted

by Hurricane Ike in September, which meant we had to shut down the

refinery in advance as a precautionary measure, along with other

refineries in the area. Operational disruption was minimized as crude

processing was restored in seven days and full operations restored within

three weeks. This was due to a terrific response from employees and

also reflected the improvements we have made to our assets at Texas

City over the last few years.

During 2008, we fully integrated our refining, logistics, marketing,

supply and trading activities, establishing six refining-to-marketing

integrated FVCs focused on refining and selling ground transportation

fuels in each region. This has enabled us to simplify internal interfaces,

optimize margins, reduce overhead costs and drive continuous

improvement. During the year, we continued the implementation of our

ampm convenience retail franchise model in the US, which we expect to

provide reliable long-term sales growth for our refinery systems, together

with reduced costs and lower levels of capital investment. In Europe,

where we are one of the largest forecourt convenience retailers, with

about 2,500 shops in 10 countries, we are growing our food-on-the-go

and fresh grocery services through BP-owned brands and partnerships

with leading retailers such as Marks & Spencer.

In relation to our IBs during 2008, in the lubricants business we

focused on enhancing our customer relationships and brand

distinctiveness, together with simplifying operations and improving

efficiency. Although 2008 was a difficult year for the aviation industry, in

Air BP, we simplified our footprint by exiting non-core countries resulting

in a reduction in working capital and improved returns on operating

capital employed. During the year, the environment in which our

petrochemicals businesses operate became more challenging as

deterioration in the global economic market led to reduced demand for

our products.

We are simplifying the structure of our organization, improving the

efficiency of our back office and reducing our headcount, including the

number of senior management positions.

Performance review

31