BP 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

a

b

BP Annual Report and Accounts 2008

Performance review

Excluding portfolio impacts, underlying refining throughputs in 2008

increased by 5% relative to 2007, driven principally by improved

operational performance in the US. Higher US throughputs were

attributable to the recoveries at the Texas City and Whiting refineries,

partially offset by the reduced equity interest in the Toledo refinery

stemming from the Husky joint venture (see below). The improvement

achieved in the US was lower than it would have been as crude runs

were reduced as a result of the low-margin environment as well as the

disruption at the Texas City refinery in September caused by Hurricane Ike.

The increase in Rest of Europe throughputs in 2008 is primarily

related to the purchase of Chevron’s 31% interest in the Rotterdam

refinery in 2007. The decrease in UK throughputs is due to the sale of the

Coryton refinery to Petroplus.

Significant events in Refining were as follows:

• On 21 March 2008, the Whiting refinery in the US was restored to its

full clean fuel capability of 360mb/d.

• BP completed recommissioning the Texas City refinery in the US.

With the successful return to service of Ultraformer No. 3 in the

fourth quarter, the site’s full economic capability was restored.

• On 31 March 2008, we completed a deal with Husky Energy Inc. to

create an integrated North American oil sands business by means of

two separate joint ventures, one of which entailed Husky taking a

50% interest in BP’s Toledo refinery. The Toledo refinery is intended to

be expanded to process approximately 170mb/d of heavy oil and

bitumen by 2015.

• In July, a final investment decision was taken to progress the

significant upgrade of the Whiting refinery. This project repositions

Whiting competitively by increasing its Canadian heavy crude

processing capability by 260mb/d and modernizing it with equipment

of significant size and scale.

• On 17 March 2008, BP and Irving Oil entered into a memorandum of

understanding to work together on evaluating the feasibility of the

proposed Eider Rock refinery in Saint John, New Brunswick, Canada.

Fuels marketing, supply and logistics

Our fuels marketing strategy focuses on optimizing the integrated value

of each fuels value chain that is responsible for the delivery of ground

fuels to the market. We do this by co-ordinating our marketing, refining

and trading activities to maximize synergies across the whole value chain.

Our priorities are to operate an advantaged infrastructure and logistics

network (which includes pipelines, storage terminals and road or rail

tankers), drive excellence in operating and transactional processes and

deliver compelling customer offers in the various markets where we

operate. The fuels business markets a comprehensive range of refined oil

products primarily focused on the ground fuels sector.

On 29 August 2008, BP announced an agreement with Enbridge

Inc. to build and reconfigure a pipeline system to transport Canadian

heavy crude oil from Flanagan, Illinois, to Houston and Texas City, Texas.

The system is expected to be in service by late 2012 with an initial

capacity of 250mb/d. The joint investment of the phased capacity

additions is expected to be in the range of $1-2 billion.

The ground fuels business supplies fuel and related

convenience services to retail consumers through company-owned

and franchised retail sites as well as other channels including wholesalers

and jobbers. It also supplies commercial customers within the road and

rail transport sectors.

BP’s value creation in ground fuels is obtained through the

integration of the value chain from the refinery gates or import hubs

across retail and commercial channels to market. Convenience retail

offers are focused on delivering appealing convenience offers across the

various markets in which we operate, through the BP Connect, ampm

and Aral brands.

Our retail network is largely concentrated in Europe and the US, and also

has established operations in Australasia and southern and eastern

Africa. We are developing networks in China in two separate joint

ventures, one with Petrochina and the other with China Petroleum and

Chemical Corporation (Sinopec).

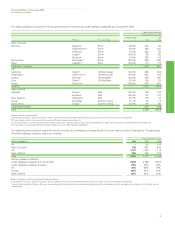

Number of retail sites operated under a BP brand

Retail sitesab 2008 2007 2006

UK 1,200 1,200 1,300

Rest of Europe 7,400 7,400 7,700

US (excluding jobbers) 2,500 2,500 2,700

US jobbers 9,200 9,700 9,600

Rest of World 2,300 2,500 2,600

Tot al 22,600 23,300 23,900

Changes in the number of retail sites over time are affected by, among other things, dealer/jobber-

owned sites that move to or from the BP brand as their fuel supply agreements expire and are

renegotiated in the normal course of business.

Excludes our interest in equity-accounted entities. Comparative information has been amended to

this basis.

At 31 December 2008, BP’s worldwide network consisted of some

22,600 locations branded BP, Amoco, ARCO and Aral, around the same

as in the previous year. We continue to improve the efficiency of our retail

network and increase the consistency of our site offer through a process

of regular review. In 2008, we sold 470 company-owned sites to dealers,

jobbers and franchisees who continue to operate these sites under the

BP brand. We also divested an additional 160 company-owned sites to

third parties.

At 31 December 2008, BP’s retail network in the US comprised

approximately 11,700 sites, of which approximately 9,200 were owned

by jobbers and 900 operated under a franchise agreement. In November

2007, BP announced that it would sell all of its company-owned and

company-operated convenience sites in the US. Despite the challenges

in the global credit market, we expect the sale of these sites to be

completed by the end of 2009. At the end of 2008, sales of 293 of sites

had been successfully completed. The sites will continue to market BP-

branded fuels in the eastern US and ARCO-branded fuels in the western

US. The franchise agreement has a term of 20 years and requires sites to

be supplied with BP- or ARCO-branded fuels for the term of the contract.

At the end of 2008, our European retail network consisted of

approximately 8,600 sites and we had approximately 2,300 sites in the

Rest of World.

Our retail convenience operations offer consumers a range of

food, drink and other consumables and services on the fuel forecourt in a

safe, convenient and innovative manner. With operations in both Europe

and the US, using recognized and distinctive brands, BP is working to

maximize the efficiency and effectiveness of its retail network in each of

its chosen market areas. By the end of 2008, we completed the roll-out

of more than 100 Marks & Spencer Simply Food sites as an integral part

of the convenience network in the UK, while a refresh of the Petit Bistro

brand in Germany and the Wild Bean Café brand in other European

locations has re-energized consumers’ convenience shopping choices. In

the US, BP has embarked on a roll-out of its successful ampm brand

across all targeted national markets as its single convenience flagship;

this programme roll-out is intended to be completed by the end of 2009.

34