BP 2008 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2008

Notes on financial statements

35. Finance debt continued

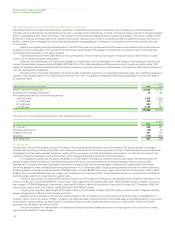

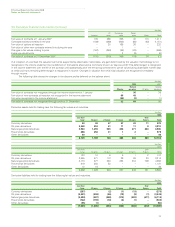

The following table shows, by major currency, the group’s finance debt at 31 December and the weighted average interest rates achieved at those

dates through a combination of borrowings and derivative financial instruments entered into to manage interest rate and currency exposures.

Fixed rate debt Floating rate debt

Weighted

Weighted average Weighted

average time for average

interest which rate interest

rate is fixed Amount rate Amount Total

% Years $ million % $ million $ million

2008

US dollar 5 3 9,005 2 22,116 31,121

Sterling – – – 6 21 21

Euro 4 3 74 4 1,330 1,404

Other currencies 7 10 216 7 442 658

9,295 23,909 33,204

2007

US dollar 5 2 9,541 5 20,460 30,001

Sterling – – – 6 35 35

Euro 4 4 81 5 107 188

Other currencies 7 13 268 7 553 821

9,890 21,155 31,045

Finance leases

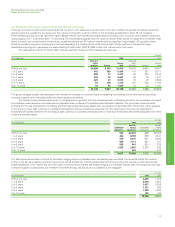

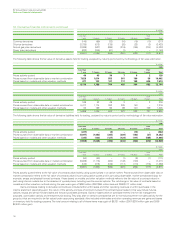

The group uses finance leases to acquire property, plant and equipment. These leases have terms of renewal but no purchase options and escalation

clauses. Renewals are at the option of the lessee. Future minimum lease payments under finance leases are set out below.

$ million

2008 2007

Future minimum lease payments payable within

1 year 116 268

2 to 5 years 361 393

Thereafter 439 630

916 1,291

Less finance charges 296 399

Net obligations 620 892

Of which – payable within 1 year 93 245

– payable within 2 to 5 years 234 217

– payable thereafter 293 430

Fair values

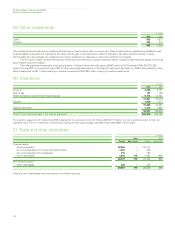

The estimated fair value of finance debt is shown in the table below together with the carrying amount as reflected in the balance sheet.

Long-term borrowings in the table below include the portion of debt that matures in the year from 31 December 2008, whereas in the balance

sheet the amount would be reported within current liabilities.

The carrying amount of the group’s short-term borrowings, comprising mainly commercial paper, bank loans, overdrafts and US Industrial

Revenue/Municipal Bonds, approximates their fair value. The fair value of the group’s long-term borrowings and finance lease obligations is estimated

using quoted prices or, where these are not available, discounted cash flow analyses based on the group’s current incremental borrowing rates for

similar types and maturities of borrowing.

$ million

2008 2007

Carrying Carrying

Fair value amount Fair value amount

Short-term borrowings 9,913 9,913 11,212 11,212

Long-term borrowings 23,239 22,671 19,094 18,941

Net obligations under finance leases 638 620 908 892

Total finance debt 33,790 33,204 31,214 31,045

156