BP 2008 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements

BP Annual Report and Accounts 2008

Notes on financial statements

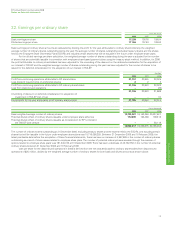

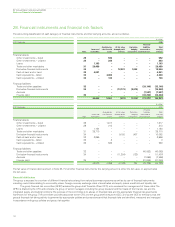

28. Financial instruments and financial risk factors continued

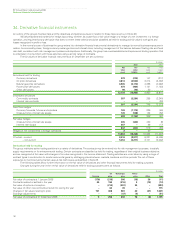

There are amounts included within finance debt that we show in the table below as due within one year to reflect the earliest contractual repayment

dates but that are expected to be repaid over the maximum long-term maturity profiles of the contracts as described in Note 35. US Industrial

Revenue/Municipal Bonds of $3,166 million (2007 $2,880 million) with earliest contractual repayment dates within one year have expected repayment

dates ranging from 1 to 40 years (2007 1 to 35 years). The bondholders typically have the option to tender these bonds for repayment on interest reset

dates; however, any bonds that are tendered are usually remarketed and BP has not experienced any significant repurchases. BP considers these

bonds to represent long-term funding when internally assessing the maturity profile of its finance debt. Similar treatment is applied for loans

associated with long-term gas supply contracts totalling $1,806 million (2007 $1,899 million) that mature within nine years.

The table also shows the timing of cash outflows relating to trade and other payables and accruals.

$ million

At 31 December 2008 2007

Trade and Trade and

other Finance other Finance

payables Accruals debt payables Accruals debt

Within one year 30,598 6,743 16,670 39,576 6,640 16,561

1 to 2 years 402 359 5,934 147 351 8,011

2 to 3 years 898 77 3,419 62 245 3,515

3 to 4 years 902 72 2,647 26 78 1,447

4 to 5 years 223 67 5,072 30 49 2,352

5 to 10 years 53 164 1,316 197 200 1,100

Over 10 years 64 45 1,050 24 36 1,447

33,140 7,527 36,108 40,062 7,599 34,433

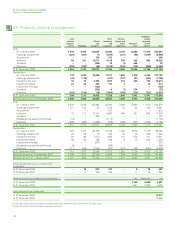

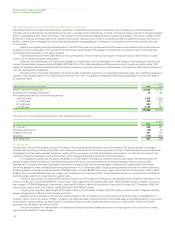

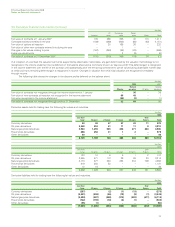

The group manages liquidity risk associated with derivative contracts on a portfolio basis, considering both physical commodity sale and purchase

contracts together with financially-settled derivative assets and liabilities.

The held-for-trading derivatives amounts in the table below represent the total contractual cash outflows by period for the purchases of physical

commodities under derivative contracts and the estimated cash outflows of financially-settled derivative liabilities. The group also holds derivative

contracts for the sale of physical commodities and financially-settled derivative assets that are expected to generate cash inflows that will be available

to the group to meet cash outflows on purchases and liabilities. These contracts are excluded from the table below. The amounts disclosed for

embedded derivatives represent the contractual cash outflows of purchase contracts some of which have embedded derivatives associated with them

which are financial assets.

$ million

At 31 December 2008 2007

Held-for- Held-for-

Embedded trading Embedded trading

derivatives derivatives derivatives derivatives

Within one year 562 60,270 699 82,465

1 to 2 years 403 8,189 659 8,541

2 to 3 years 470 2,437 641 2,906

3 to 4 years 509 1,111 627 707

4 to 5 years 535 841 624 338

5 to 10 years 1,538 2,087 2,342 592

Over 10 years – 553 – 447

4,017 75,488 5,592 95,996

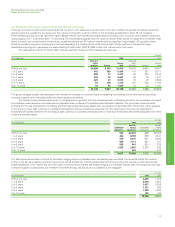

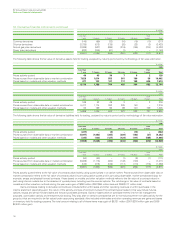

The table below shows cash outflows for derivative hedging instruments based upon contractual payment dates. The amounts reflect the maturity

profile of the fair value liability where the instruments will be settled net, and the gross settlement amount where the pay leg of a derivative will be

settled separately to the receive leg, as in the case of cross-currency interest rate swaps hedging non-US dollar finance debt. The swaps are with high

investment-grade counterparties and therefore the settlement day risk exposure is considered to be negligible.

$ million

At 31 December 2008 2007

Within one year 3,426 1,708

1 to 2 years 3,024 1,220

2 to 3 years 1,037 3,759

3 to 4 years 1,731 365

4 to 5 years 1,389 1,650

5 to 10 years 129 105

10,736 8,807

147