BP 2008 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2008 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements

BP Annual Report and Accounts 2008

Notes on financial statements

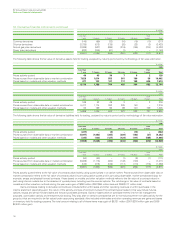

36. Capital disclosures and analysis of changes in net debt

The group defines capital as the total equity of the group. The group’s objective for managing capital is to deliver competitive, secure and sustainable

returns to maximize long-term shareholder value. BP is not subject to any externally-imposed capital requirements.

The group’s approach to managing capital is set out in its financial framework. The group aims to balance returns to shareholders between

long-term growth and current returns via the dividend whilst maintaining capital discipline in relation to investing activities and taking action on costs

to respond to the current environment. At the beginning of 2008, the group rebalanced returns to shareholders by increasing the dividend component.

As a result, the share buyback programme was curtailed and then suspended in September in light of the uncertain environment.

The group monitors capital on the basis of the net debt ratio, that is, the ratio of net debt to net debt plus equity. Net debt is calculated as gross

finance debt, as shown in the balance sheet, plus the fair value of associated derivative financial instruments that are used to hedge foreign exchange

and interest rate risks relating to finance debt, for which hedge accounting is claimed, less cash and cash equivalents. Net debt and net debt ratio are

non-GAAP measures. BP uses these measures to provide useful information to investors. Net debt enables investors to see the economic effect of

gross debt, related hedges and cash and cash equivalents in total. The net debt ratio enables investors to see how significant net debt is relative to

equity from shareholders. The derivatives are reported on the balance sheet within the headings ‘Derivative financial instruments’. All components of

equity are included in the denominator of the calculation. We believe that a net debt ratio in the range 20-30% provides an efficient capital structure

and an appropriate level of financial flexibility.

At 31 December 2008 the net debt ratio was 21% (2007 22%).

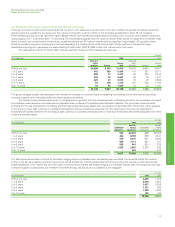

$ million

At 31 December 2008 2007

Gross debt 33,204 31,045

Less: Cash and cash equivalents 8,197 3,562

Less: Fair value (liability) asset of hedges related to finance debt (34) 666

Net debt 25,041 26,817

Equity 92,109 94,652

Net debt ratio 21% 22%

An analysis of changes in net debt is provided below.

$ million

2008 2007

Cash and Cash and

Finance cash Net Finance cash Net

Movement in net debt debt aequivalents debt debtaequivalents debt

At 1 January (30,379) 3,562 (26,817) (23,712) 2,590 (21,122)

Exchange adjustments 102 (184) (82) (122) 135 13

Net cash flow (2,825) 4,819 1,994 (6,411) 837 (5,574)

Other movements (136) – (136) (134) – (134)

At 31 December (33,238) 8,197 (25,041) (30,379) 3,562 (26,817)

aIncluding fair value of associated derivative financial instruments.

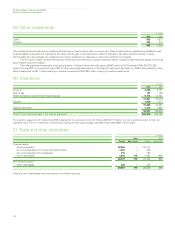

Revised definition of net debt

Net debt has been redefined to include the fair value of associated derivative financial instruments that are used to hedge foreign exchange and

interest rate risks relating to finance debt, for which hedge accounting is claimed. The derivatives are reported on the balance sheet within the

headings ‘Derivative financial instruments’. Amounts for comparative periods are presented on a consistent basis.

$ million

2007

As amended As reported

Net debt 26,817 27,483

Equity 94,652 94,652

Ratio of net debt to net debt plus equity 22% 23%

157