Abercrombie & Fitch 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Committee established by the Board to investigate and act with respect to claims asserted in the derivative cases, which concluded that

there was no evidence to support the asserted claims and directed the Company to seek dismissal of the derivative cases. On

September 10, 2007, the Company moved to dismiss the federal derivative cases on the authority of the Special Litigation Committee

Report. On March 12, 2009, the Company's motion was granted and, on April 10, 2009, plaintiffs filed an appeal from the order of

dismissal in the United States Court of Appeals for the Sixth Circuit. Plaintiff's appeal has been fully briefed and argued and is

awaiting decision. The state court has stayed further proceedings in the state-court derivative action until resolution of the

consolidated federal derivative cases.

On December 21, 2007 Spencer de la Cruz, a former employee, filed an action against Abercrombie & Fitch Co. and

Abercrombie & Fitch Stores, Inc. (collectively, the "Defendants") in the Superior Court of Orange County, California. He sought to

allege, on behalf of himself and a putative class of past and present employees in the period beginning on December 19, 2003, claims

for failure to provide meal breaks, for waiting time penalties, for failure to keep accurate employment records, and for unfair business

practices. By successive amendments, plaintiff added 10 additional plaintiffs and additional claims seeking injunctive relief, unpaid

wages, penalties, interest, and attorney's fees and costs. Defendants have denied the material allegations of plaintiffs' complaints

throughout the litigation and have asserted numerous affirmative defenses. On July 23, 2010, plaintiffs moved for class certification in

the action. On December 9, 2010, after briefing and argument, the trial court granted in part and denied in part plaintiffs' motion,

certifying sub-classes to pursue meal break claims, meal premium pay claims, work related travel claims, travel expense claims,

termination pay claims, reporting time claims, bag check claims, pay record claims, and minimum wage claims. The parties are

continuing to litigate questions relating to the Court's certification order and to the merits of plaintiffs' claims.

The Company intends to defend the aforesaid pending matters vigorously, as appropriate. The Company is unable to quantify the

potential exposure of the aforesaid pending matters. However, the Company's assessment of the current exposure could change in the

event of the discovery of additional facts with respect to legal matters pending against the Company or determinations by judges,

juries, administrative agencies or other finders of fact that are not in accordance with the Company's evaluation of the claims.

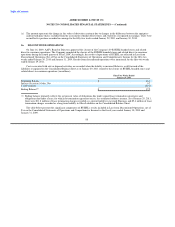

19. PREFERRED STOCK PURCHASE RIGHTS

On July 16, 1998, A&F's Board of Directors declared a dividend of one Series A Participating Cumulative Preferred Stock

Purchase Right (the "Rights") for each outstanding share of Class A Common Stock (the "Common Stock"), par value $.01 per share,

of A&F. The dividend was paid on July 28, 1998 to stockholders of record on that date. Shares of Common Stock issued after July 28,

1998 and prior to May 25, 1999 were issued with one Right attached. A&F's Board of Directors declared a two-for-one stock split (the

"Stock Split") on the Common Stock, payable on June 15, 1999 to the holders of record at the close of business on May 25, 1999. In

connection with the Stock Split, the number of Rights associated with each share of Common Stock outstanding as of the close of

business on May 25, 1999, or issued or delivered after May 25, 1999 and prior to the "Distribution Date" (as defined below), was

proportionately adjusted from one Right to 0.50 Right. Each share of Common Stock issued after May 25, 1999 and prior to the

Distribution Date has been, and will be issued, with 0.50 Right attached so that all shares of Common Stock outstanding prior to the

Distribution Date will have 0.50 Right attached.

91