Abercrombie & Fitch 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

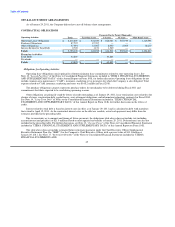

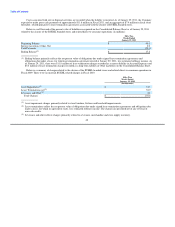

As of January 29, 2011, approximately 73% of the Company's ARS were "AAA" rated, approximately 12% of the Company's

ARS were "AA" rated, and approximately 15% were "A−" rated, in each case as rated by one or more of the major credit rating

agencies. The ratings take into account insurance policies guaranteeing both the principal and accrued interest. Each investment in

student loans is insured by (1) the U.S. government under the Federal Family Education Loan Program, (2) a private insurer or (3) a

combination of both. The percentage coverage of the outstanding principal and interest of the ARS varies by security. The credit

ratings may change over time and would be an indicator of the default risk associated with the ARS and could have a material effect

on the value of the ARS. If the Company expects that it will not recover the entire cost basis of the available-for-sale ARS, intends to

sell the available-for-sale ARS, or it becomes more than likely that the Company will be required to sell the available-for-sale ARS

before recovery of their cost basis, which may be at maturity, the Company may be required to record an other-than-temporary

impairment or additional temporary impairment to write down the assets' fair value. The Company has not incurred any credit losses

on available-for-sale ARS, and furthermore, the issuers continued to perform under the obligations, including making scheduled

interest payments, and the Company expects that this will continue in the future.

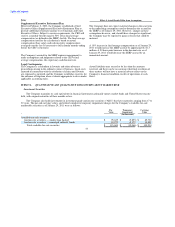

The irrevocable rabbi trust (the "Rabbi Trust") is intended to be used as a source of funds to match respective funding obligations

to participants in the Abercrombie & Fitch Co. Nonqualified Savings and Supplemental Retirement Plan I, the Abercrombie & Fitch

Co. Nonqualified Savings and Supplemental Retirement Plan II and the Chief Executive Officer Supplemental Executive Retirement

Plan. As of January 29, 2011, total assets held in the Rabbi Trust were $82.5 million, which included $11.9 million of municipal notes

and bonds with maturities that ranged from 11 months to three years, trust-owned life insurance policies with a cash surrender value of

$70.3 million and $0.3 million held in money market funds. The Rabbi Trust assets are consolidated and recorded at fair value, with

the exception of the trust-owned life insurance policies which are recorded at cash surrender value in Other Assets on the Consolidated

Balance Sheet and are restricted as to their use as noted above. Net unrealized gains or losses related to the municipal notes and bonds

held in the Rabbi Trust were not material for the fifty-two weeks ended January 29, 2011 and January 30, 2010. The change in cash

surrender value of the trust-owned life insurance policies held in the Rabbi Trust resulted in realized gains of $2.3 million and

$5.3 million for the fifty-two weeks ended January 29, 2011 and January 30, 2010, respectively.

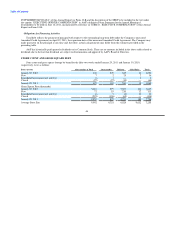

Interest Rate Risks

As of January 29, 2011, the Company had $43.8 million in long-term debt outstanding under the unsecured Amended Credit

Agreement. This borrowing and any future borrowings will bear interest at negotiated rates and would be subject to interest rate risk.

The unsecured Amended Credit Agreement has several borrowing options, including interest rates that are based on: (i) a defined Base

Rate, plus a margin based on a defined Leverage Ratio, payable quarterly; (ii) an Adjusted Eurodollar Rate (as defined in the

unsecured Amended Credit Agreement) plus a margin based on the Leverage Ratio, payable at the end of the applicable interest period

for the borrowing and, for interest periods in excess of three months, on the date that is three months after the commencement of the

interest period; or (iii) an Adjusted Foreign Currency Rate (as defined in the Amended Credit Agreement) plus a margin based on the

Leverage Ratio, payable at the end of the applicable interest period for the borrowing and, for interest periods in excess of three

months, on the date that is three months after the commencement of the interest period. The Base Rate represents a rate per annum

equal to the higher of (a) PNC Bank's then publicly announced prime rate or (b) the Federal Funds Effective Rate (as defined in the

unsecured Amended Credit Agreement) as then in effect plus 1/2 of 1.0%. The average interest rate was 2.7% for the fifty-two weeks

ended January 29, 2011. Additionally, as of January 29, 2011,

54