Abercrombie & Fitch 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

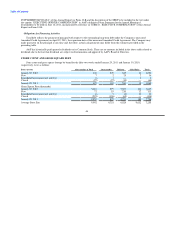

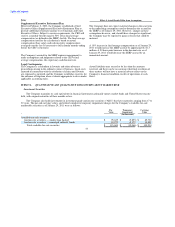

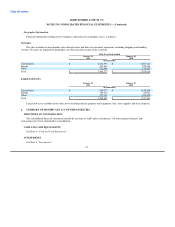

Policy Effect if Actual Results Differ from Assumptions

Inventory Valuation

Inventories are principally valued at the lower of average cost or

market utilizing the retail method.

The Company reduces inventory value by recording a valuation

reserve that represents estimated future permanent markdowns

necessary to sell-through the inventory.

Additionally, as part of inventory valuation, an inventory shrink

estimate is made each period that reduces the value of inventory

for lost or stolen items.

The Company has not made any material changes in the

accounting methodology used to determine the shrink reserve or

the valuation reserve over the past three fiscal years.

The Company does not expect material changes in the near term

to the underlying assumptions used to determine the shrink

reserve or valuation reserve as of January 29, 2011. However,

changes in these assumptions do occur, and, should those

changes be significant, they could significantly impact the

ending inventory valuation at cost, as well as the resulting gross

margin(s).

An increase or decrease in the valuation reserve of 10% would

have affected pre-tax income by approximately $2.4 million for

Fiscal 2010.

An increase or decrease in the inventory shrink accrual of 10%

would have been immaterial to pre-tax income for Fiscal 2010.

Property and Equipment

Long-lived assets, primarily comprised of property and equipment,

are reviewed periodically for impairment or whenever events or

changes in circumstances indicate that full recoverability of net

asset balances through future cash flows is in question.

The Company's impairment calculation requires management to

make assumptions and judgments related to factors used in the

evaluation for impairment, including, but not limited to,

management's expectations for future operations and projected

cash flows.

The Company has not made any material changes in the

accounting methodology used to determine impairment loss

over the past three fiscal years.

The Company does not expect material changes in the near term

to the assumptions underlying its impairment calculations as of

January 29, 2011. However, changes in these assumptions do

occur, and, should those changes be significant, they could have

a material impact on the Company's determination of whether or

not there has been an impairment.

51