Abercrombie & Fitch 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

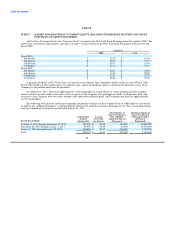

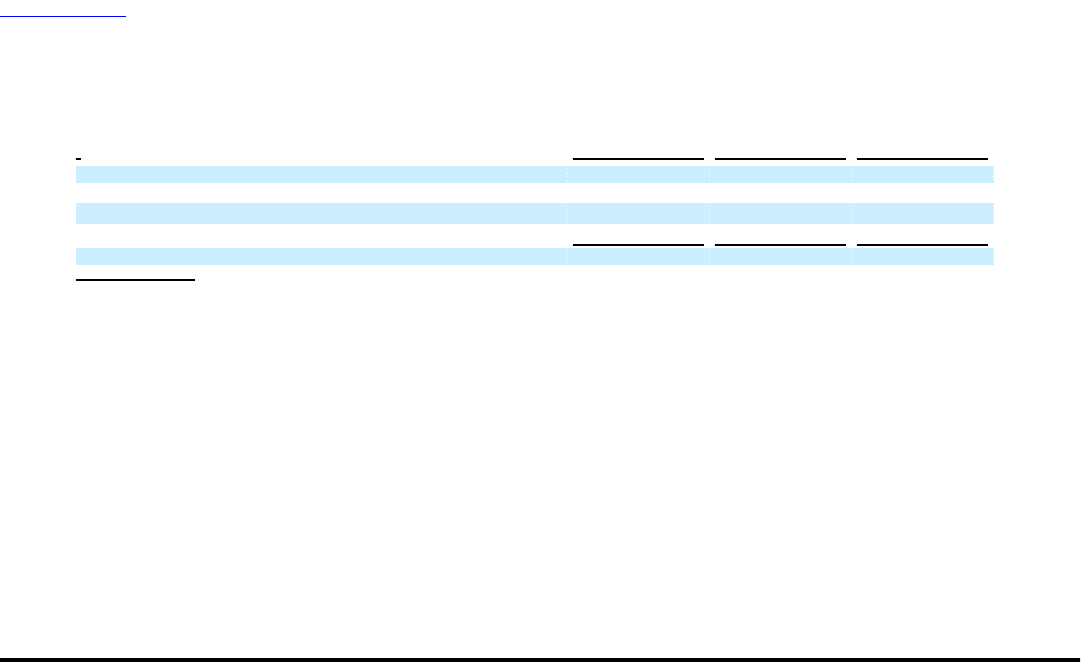

store-related asset impairment charges, exit charges associated with domestic store closures and the loss from discontinued operations,

net of tax. These non-GAAP financial measures should not be used as alternatives to net income per diluted share or as indicators of

the ongoing operating performance of the Company and are also not intended to supersede or replace the Company's GAAP financial

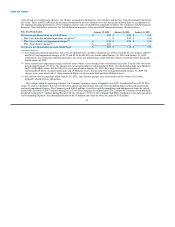

measures. The table below reconciles the GAAP financial measures to the non-GAAP financial measures discussed above.

Fifty-Two Weeks Ended January 29, 2011 January 30, 2010 January 31, 2009

Net income per diluted share on a GAAP basis $ 1.67 $ 0.00 $ 3.05

Plus: Loss from discontinued operations, net of tax(1) — $ 0.89 $ 0.40

Plus: Store-related asset impairment charges(2) $ 0.34 $ 0.23 $ 0.06

Plus: Store closure charges(3) $ 0.03 — —

Net income per diluted share on a non-GAAP basis $ 2.05 $ 1.12 $ 3.51

(1) Loss from discontinued operations, net of tax, per diluted share, includes operating loss of $0.12 and $0.24, exit charges of $0.40

and $0.00, and impairment charges of $0.37 and $0.16 for the fifty-two weeks ended January 30, 2010 and January 31, 2009,

respectively. Loss from discontinued operations, net of tax, per diluted share relate to Ruehl, which ceased operations during the

fourth quarter of 2009.

(2) Store-related asset impairment charges relate to stores whose asset carrying value exceeded the fair value. For the fifty-two week

period ended January 29, 2011, the charges were associated with two Abercrombie & Fitch, two abercrombie kids, nine Hollister

and 13 Gilly Hicks stores. For the fifty-two week period ended January 30, 2010, the charges were associated with 34

Abercrombie & Fitch, 46 abercrombie kids and 19 Hollister stores. For the fifty-two week period ended January 31, 2009, the

charges were associated with 11 Abercrombie & Fitch, six abercrombie kids and three Hollister stores.

(3) For the fifty-two week period ended January 29, 2011, store closure charges were associated with the closure of 64 stores,

primarily related to lease obligations.

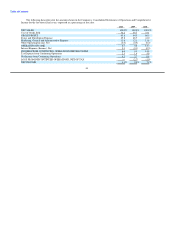

Net cash provided by operating activities, the Company's primary source of liquidity, was $391.8 million for Fiscal 2010. This

source of cash was primarily driven by results from operations adjusted for non-cash items including depreciation and amortization

and asset impairment charges. The Company used $160.9 million of cash for capital expenditures and had proceeds from the sale of

marketable securities of $84.5 million during Fiscal 2010. The Company also repurchased $76.2 million of Common Stock and paid

dividends totaling $61.7 million during Fiscal 2010. As of January 29, 2011, the Company had $826.4 million in cash and equivalents,

and outstanding Japanese Yen-denominated debt of $43.8 million and stand-by letters of credit of $3.0 million.

33