Abercrombie & Fitch 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

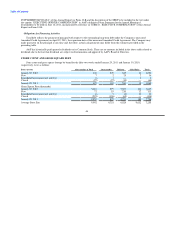

CURRENT TRENDS AND OUTLOOK

During Fiscal 2010, we exceeded our objectives in terms of sales, operating income and net income per share, and did this while

continuing to focus on the long-term drivers of the business.

We have a stated objective of increasing our operating margin back to historical levels of around 15% by Fiscal 2012, and have

identified previously a number of factors comprising our "roadmap" to achieving this goal.

First, as one of these factors, we had an original objective of returning our gross margin to our peak level of around 67% by

2012. Due to significant sourcing cost pressures, we no longer believe this objective is realistic. The Company expects to offset an

element of the sourcing cost pressure through increased ticket prices, and the gross margin rate should also benefit from continued

international growth; however, there is significant uncertainty about consumer reaction to price increases, and ongoing cost increases

are likely to continue to put downward pressure on the Company's gross margin rate. As we manage through this issue, the Company

will continue to take a long-term approach, and will not sacrifice quality to achieve cost reductions.

Second, improving average domestic store productivity levels, both through same store sales growth and as a result of the closure

of underperforming stores. During 2010, we achieved same store sales growth of 7%, and the Company is targeting same store sales

increases at this level or greater in each of 2011 and 2012. In addition, during 2010, we closed 64 domestic stores, predominantly at

the end of the year, and expect approximately a further 50 closings during 2011, predominantly at the end of the year.

Third, achieving significantly profitable international growth. In Fiscal 2011, we are seeking to accelerate international growth.

We expect to open up to 40 international mall-based Hollister stores, including our first stores in mainland China and Hong Kong. We

also plan to open five Abercrombie & Fitch flagship stores in Paris, Madrid, Dusseldorf, Brussels and Singapore. The Company's

flagship store in Dublin is now expected to open in 2012.

Fourth, sustaining strong growth rates in our direct-to-consumer business, which should benefit from multiple investments we

are making in the business and from our growing international presence.

Fifth, improving the productivity of the Gilly Hicks brand, which the Company believes is a necessary precursor to expanding

the store count for the brand and having a path to profitability.

Finally, maintaining tight control over expenses and seeking greater efficiencies, an example of which is our plan to consolidate

our two domestic distribution centers. The consolidation is expected to be completed by mid-2012 and is expected to facilitate the sale

of the second distribution center and result in reduced operational costs.

All of these factors interplay, so that over-achievement with respect to one or more factors may offset or counterbalance a

shortfall or under-achievement on other objectives. However, in the event of a significant shortfall against one objective, such as gross

margin, it is unlikely that the overall roadmap objective will be achieved.

During Fiscal 2011, based on new store opening plans and other capital expenditures, the Company expects total capital

expenditures to be approximately $300 million to $350 million, with the upper end of the range being subject to the Company

achieving the higher end of its range of potential new store openings, including commitments for 2012 openings.

36