Abercrombie & Fitch 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ABERCROMBIE & FITCH CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

DESIGN AND DEVELOPMENT COSTS

Costs to design and develop the Company's merchandise are expensed as incurred and are reflected as a component of

"Marketing, General and Administrative Expense."

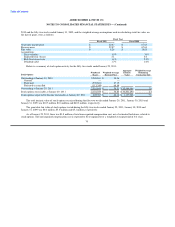

NET INCOME PER SHARE

Net income per basic share is computed based on the weighted-average number of outstanding shares of Class A Common Stock

("Common Stock"). Net income per diluted share includes the weighted-average effect of dilutive stock options, stock appreciation

rights and restricted stock units.

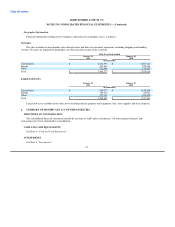

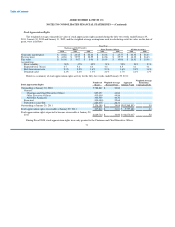

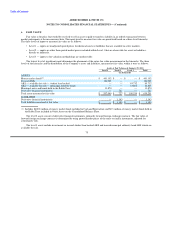

Weighted-Average Shares Outstanding and Anti-Dilutive Shares (in thousands):

2010 2009 2008

Shares of Common Stock issued 103,300 103,300 103,300

Treasury shares (15,239) (15,426) (16,484)

Weighted-Average — basic shares 88,061 87,874 86,816

Dilutive effect of stock options, stock appreciation rights and restricted stock units 1,790 735 2,475

Weighted-Average — diluted shares 89,851 88,609 89,291

Anti-Dilutive shares 6,019(1) 6,698(1) 3,746(1)

(1) Reflects the number of stock options, stock appreciation rights and restricted stock units outstanding, but excluded from the

computation of net income per diluted share because the impact would be anti-dilutive.

SHARE-BASED COMPENSATION

See Note 3, "Share-Based Compensation."

USE OF ESTIMATES IN THE PREPARATION OF FINANCIAL STATEMENTS

The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities as of the date of the financial statements and the reported amounts of revenues and

expenses during the reporting period. Since actual results may differ from those estimates, the Company revises its estimates and

assumptions as new information becomes available.

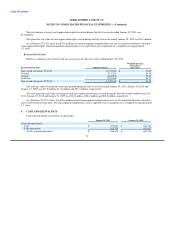

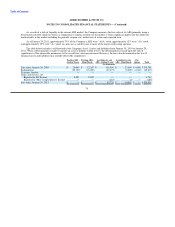

3. SHARE-BASED COMPENSATION

Financial Statement Impact

The Company recognized share-based compensation expense of $40.6 million, $36.1 million and $42.0 million for the fifty-two

week periods ended January 29, 2011, January 30, 2010 and January 31, 2009, respectively. The Company also recognized

$14.7 million, $12.8 million and $15.4 million in tax benefits

67