Abercrombie & Fitch 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Abercrombie & Fitch annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

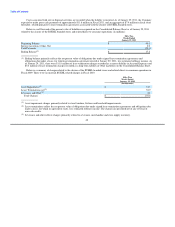

of (i) Consolidated EBITDAR for the trailing four-consecutive-fiscal-quarter period to (ii) the sum of, without duplication, (x) net

interest expense for such period, (y) scheduled payments of long-term debt due within twelve months of the date of determination and

(z) the sum of minimum rent and contingent store rent, not be less than 1.75 to 1.00 at January 29, 2011. The minimum Coverage

Ratio varies over time based on the terms set forth in the Amended Credit Agreement. The Amended Credit Agreement provides an

add back to Consolidated EBITDAR for the following items, among others, (a) recognized losses arising from investments in certain

auction rate securities to the extent such losses do not exceed a defined level of impairments for those investments, (b) non-cash

charges in an amount not to exceed $50 million related to the closure of RUEHL branded stores and related direct-to-consumer

operations, (c) non-recurring cash charges in an aggregate amount not to exceed $61 million related to the closure of RUEHL branded

stores and related direct-to-consumer operations, (d) additional non-recurring non-cash charges in an amount not to exceed

$20 million in the aggregate over the trailing four-consecutive-fiscal-quarter period and (e) other non-recurring cash charges in an

amount not to exceed $10 million in the aggregate over the trailing four-consecutive-fiscal-quarter periods. The Company's Coverage

Ratio was 2.51 as of January 29, 2011. The Amended Credit Agreement also limited the Company's consolidated capital expenditures

to $325 million in Fiscal 2010 plus $99.5 million representing the unused portion of the allowable capital expenditures from Fiscal

2009. There is no limit for capital expenditures in Fiscal 2011. The Company was in compliance with the applicable ratio

requirements and other covenants at January 29, 2011.

The unsecured Amended Credit Agreement is described in Note 14, "Long-Term Debt" of the Notes to Consolidated Financial

Statements included in "ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA" of this Annual Report on

Form 10-K.

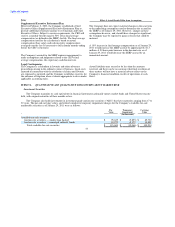

As a result of adjustments to vendor payment terms, there were no trade letters of credit outstanding at January 29, 2011. Trade

letters of credit totaling approximately $35.9 million were outstanding on January 30, 2010. Stand-by letters of credit totaling

approximately $3.0 million and $14.1 million were outstanding on January 29, 2011 and January 30, 2010, respectively. The stand-by

letters of credit are set to expire primarily during the third quarter of Fiscal 2011. To date, no beneficiary has drawn upon the stand-by

letters of credit.

If circumstances occur that would lead to the Company failing to meet the covenants under the Amended Credit Agreement and

the Company is unable to obtain a waiver or amendment, an event of default would result and the lenders could declare outstanding

borrowings immediately due and payable. The Company believes it is likely that it would either obtain a waiver or amendment in

advance of a default, or would have sufficient cash available to repay borrowings in the event a waiver was not obtained.

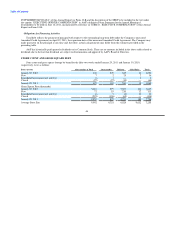

Operating Activities

Net cash provided by operating activities, the Company's primary source of liquidity, was $391.8 million for Fiscal 2010

compared to $395.5 million for Fiscal 2009. In Fiscal 2010, an increase in net income was off-set by an increase in inventory to

support increased sales in Fiscal 2010 as compared to a reduction in inventory in Fiscal 2009 in response to declining sales. The

timing of income tax payments and Ruehl exit payments in 2010 also contributed to the decrease in cash provided by operating

activities.

Net cash provided by operating activities was $395.5 million for Fiscal 2009 compared to $491.0 million for Fiscal 2008. The

decrease in cash provided by operating activities was primarily driven by a reduction in net income for Fiscal 2009 compared to Fiscal

2008, adjusted for non-cash impairment charges. Operating cash flows for Fiscal 2009 included payments of approximately

$22.6 million related primarily to lease termination agreements associated with the closure of RUEHL branded stores and related

direct-to-consumer

43